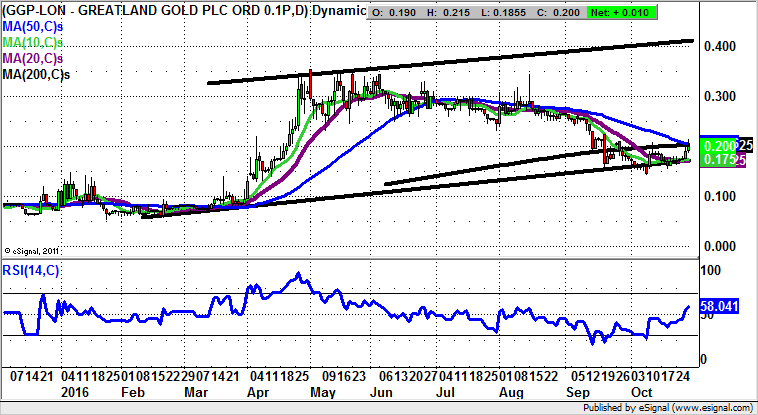

Greatland Gold: Above 200 day line targets 0.4p

It may be the case that with retail traders long up to the eyeballs of Gold and Silver, we are due a new leg to the downside. But at least the minnow stocks in the area such as Greatland Gold (LON:GGP) appear to be progressing well.

Greatland Gold is currently in focus following the announcement earlier this month that drilling had started at its Ernest Giles project in Western Australia. In fact, this news effectively ended the post May drift for the stock, with it consolidating the initial 2016 rally from 0.05p to 0.35p. This was clearly quite a significant move, and one that needed to be absorbed by the market. But it would now appear the process is complete, helped along by bullish divergence in the RSI window after a final brief probe for the stock below the former September support at 0.15p.

The view now is that provided there is no end of day close back below the floor of last month, we should see a fresh acceleration to the upside, through the 200 day moving average at 0.2p and beyond. It helps that the 200 day line is currently rising, with the message being that one would anticipate a 1-2 month journey up towards the top of a trend channel from February heading as high as 0.4p. The RSI at 59/100 with its latest clearance of the neutral 50 level is a leading indicator on the upside scenario.

Comments (0)