Get Your Head & Shoulders At Boots

Boots is now part of that huge American concern Walgreens. In fact our big High Street pharmacies are not British at all any more. Superdrug is part of Hutchison, the Hong Kong based company. Lloyds Pharmacy is owned by German company Celesio AG.

While researching this post I came across a study of dividends based on comparing the current yield to the historical norm. I’ve never really bought stocks for income, but certainly a lot of people do. So there will be people noticing that Walgreen Boots Alliance Inc (WBA) are overvalued using that metric. In fact they stand out in such analysis of US companies, specifically ones that have increased their dividends for at least 25 straight years (there’s a list of such stocks complied by Dave Fish apparently), suggesting they may be over-valued.

The problem with this kind of approach is always going to be determining what the cause is. This is the laborious thing with all fundamental analysis: you need to know what the story is.

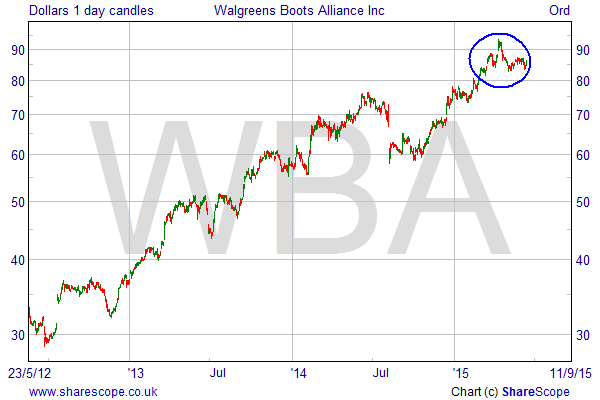

Well the thing that jumps out at me on the WBA chart is the head and shoulders pattern that is all but formed now over the last three or so months. It may not complete and could bounce and carry on up, but assuming it breaks downwards we could be in for a fairly swift move down.

You may have read that Boots are planning to shed 700 jobs in the UK. They must be feeling the pinch from online retailers, and it’s fair to say that if they’re struggling in what can only called favourable corporate conditions (i.e. very low interest rates, no significant pressure on markets to contract) then they could be a zombie company. Walgreen certainly seem to have paid a premium for them as the share price leapt from £8 to £11 when the bid was made in 2007. They may be highly leveraged as a consequence and smug that the base rate hasn’t gone up. Yet.

There are other worries with the UK pharmacy marketplace in that the rules governing places that can issue prescriptions may be relaxed, and that could somehow lead to pharmacies clustering around doctors’ surgeries and not catering to other areas. How much that is going to affect what is essentially a US stock is debatable.

So back to this head and shoulders. I quite like the fact that the right shoulder is lower than the left, which is often a sign of weakness in a stock. I don’t need to worry too much about the fundamentals if I get a really clear signal. If it is going down all I need to do is manage the trade. It could also be argued there is a second right shoulder. No probs. It’s just a confirmation of the signal which could represent denial among buyers, which in turn could make the fall sweeter still if it happens. It does, though, make it harder to determine just where the neck line is – so that’ll be a judgement call. I’d probably put on a smaller starter position and add more after it’s started to fall.

One word of warning is this is a stock that has gapped quite often. That said it has gapped generally in the direction of the trend, but it should be considered when putting a limit order on, as a gap could trigger a carefully placed limit order and bank some profits. Might want a guaranteed stop on the other hand. And don’t forget to hedge the currency risk if you’re not using a spread bet/CFD to trade a dollar denominated stock.

Comments (0)