Get off the line, there’s a train coming

That was a joke we used to say on the phone. “Get off the line, there’s a train coming!” For us as school kids it ranked up there with shouting to cyclists “your back wheel’s going round” and that thing where you stuff your tongue behind your bottom lip while making an unintelligible sound when someone does or says something stupid.

Talking to your friends was just as important as it is today, just a lot less practical. Phones were usually somewhere fairly public, like the hall, often somewhere with no creature comforts, such as a chair. Well either that or, less convenient, a phone box! And it all cost a fortune because BT still had everyone in their tight little grip.

Well to an extent they still do. I can’t get Virgin where I am (apparently they can’t extend the existing cables 3 metres to reach my property so I’m stuck with going through a BT (BT.A) line to get any kind of decent broadband speed. I really hate having to do business with BT. The scumbags that took us for every penny they could for decades. I’m not going to tell you the whole Jackanory about why I now face 10 days without broadband, but it’s their fault.

So I thought I’d have a look at the Fixed Line Telecom sector. Thankfully ShareScope is designed so that you don’t actually need a live internet connection to look at your historical data.

There are six companies in the sector. Obviously BT is one, and I can definitely say I am dismayed that they are still doing well. It feels like doing business with an abusive step-dad, or faux pas as I prefer to say. But people do willingly, or, as in my case, are forced to.

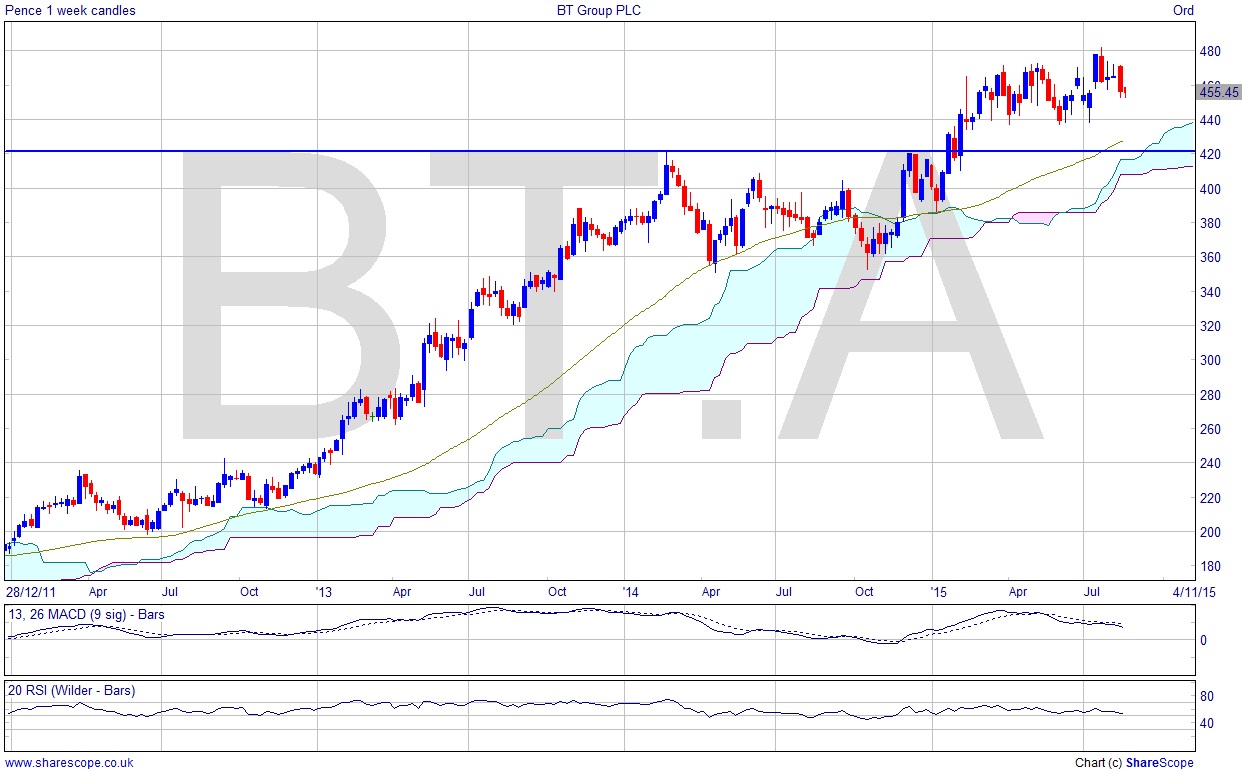

BT’s chart looks pretty decent actually. Maybe this is a chance to get back all those years of super-profit from them! Actually, I found karma trades don’t really work. Not surprising because there is no such thing as karma, so it really doesn’t work. Clearly we’re nowhere near the £11 high of 2000, but in recent terms there’s an intact trend with higher lows supporting, well above the Ichimoku cloud. And unlike many stocks it’s not one of those auguring a FTSE failure. Whilst they don’t have a monopoly, it’s still not quite fair competition.

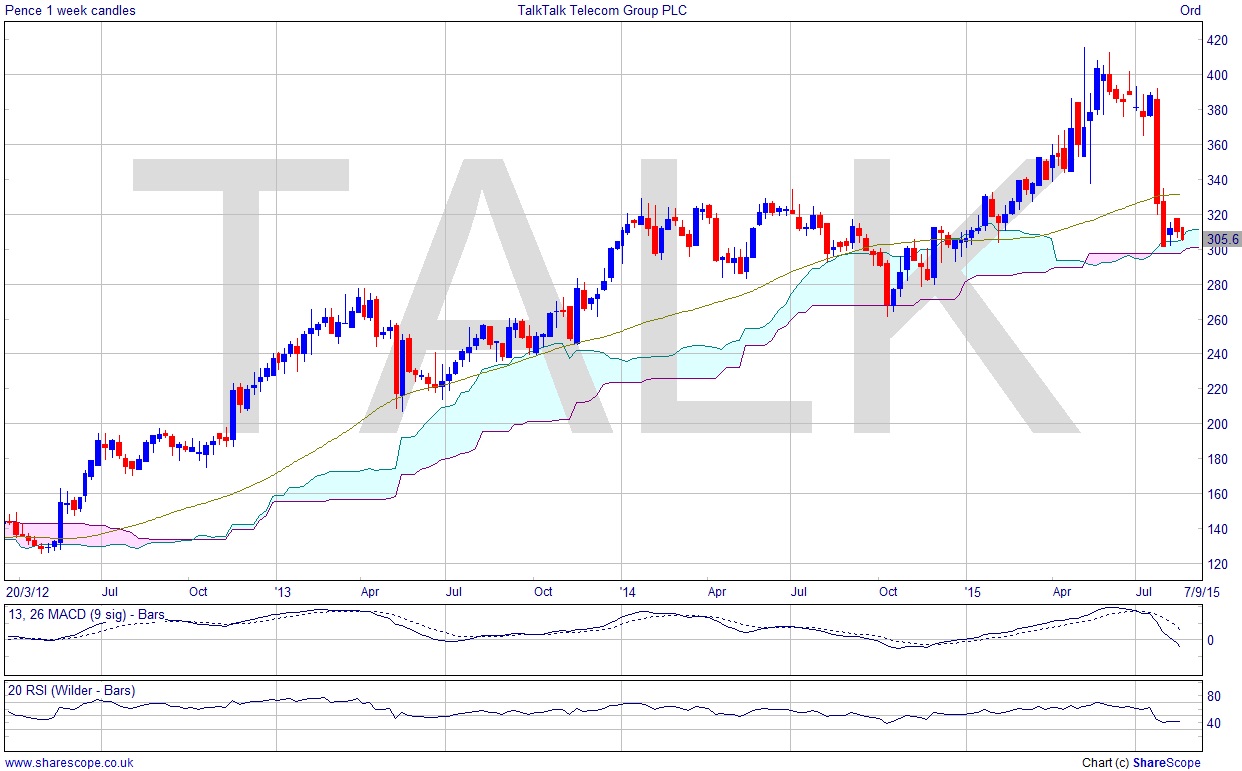

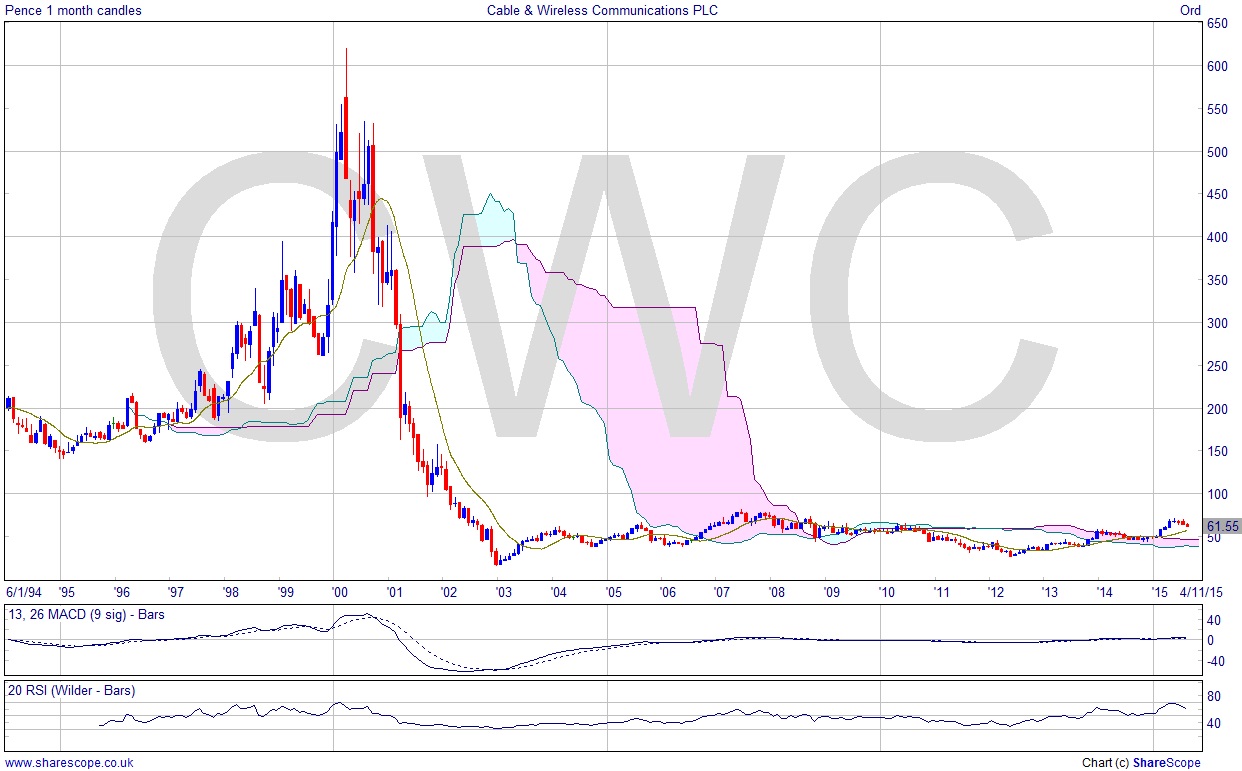

The rest of the sector looks either abysmal or turning sour. Talk Talk (TALK) has been doing well but a really sharp correction recently is jeopardising that. If it falls below the cloud they’re stuffed. And it’s already 25% down on just a few weeks ago (and following Telecom Plus in that direction). Cable & Wireless (CWC) is fairly representative of the other stocks. Peak in 2000 and since then nothing really. C&W was 600p in 2000, now it’s been hovering around 10% of that for over a decade.

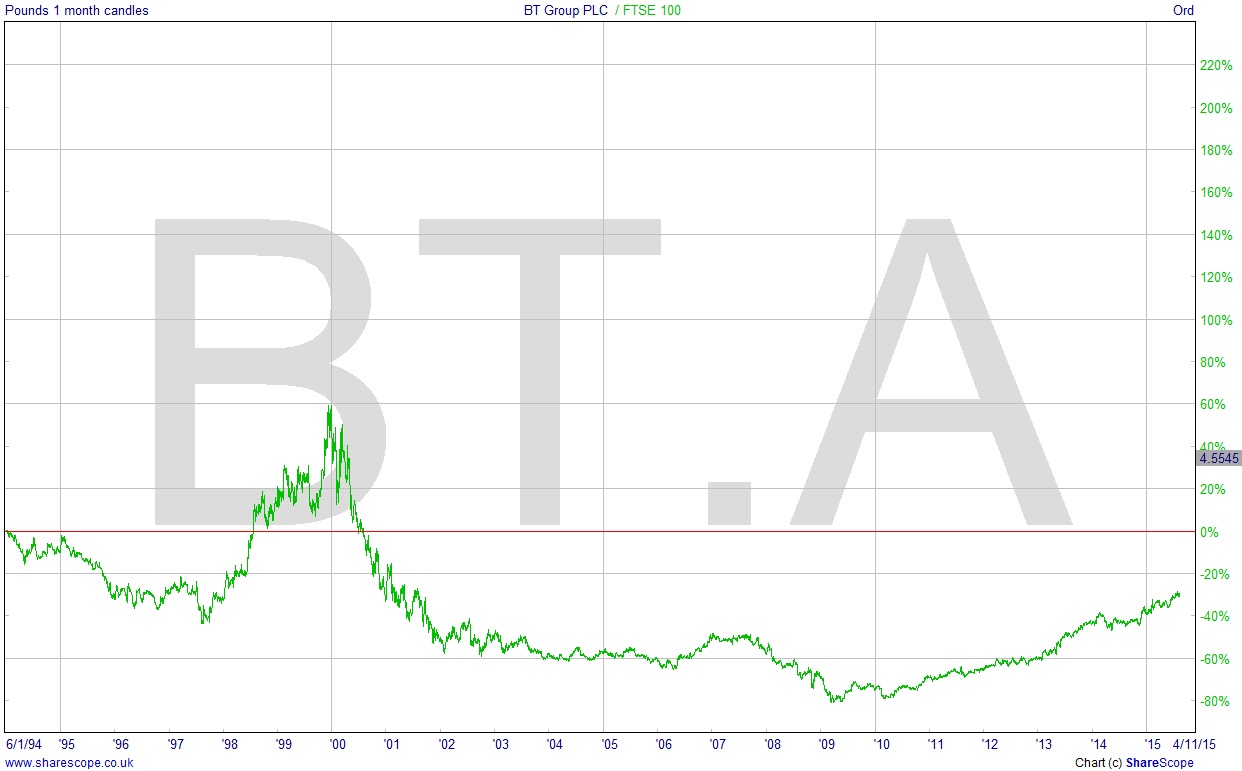

Of course these companies don’t just do landlines or they’d be totally stuffed one imagines. But they’ve not managed to compete. In fact, BT looks like a defensive stock since it’s not failing. If the FTSE 100 is going to fail, or even if it isn’t, long BT and short FTSE 100 is well worth a look. BT has been recovering ground against the market for quite some time now, which is a shame, because I was really hoping they were going to the dogs and might get taken over!

Comments (0)