FTSE 100 On Fire

On the face of it, the way that the FTSE 100 is finally looking comfortable at record highs in the run up to one of the most uncertain General Elections is puzzling. The pork barrel politics that is a feature of what is currently going on in the campaign may go some way to explaining why. This is especially in the aftermath of the latest bribe from the Conservatives to at least partly abolish inheritance tax on family homes. There are two components to this. The first is of course the way that it helps buy a decent amount of votes, with our money. The second is that it provides a further boost to the housing market, with everyone given a rather obvious incentive to bet the farm on bricks and mortar over and above the prospect of low interest rates for an extended period.

The assumption to make from the FTSE 100 at 7,000 plus is therefore that the current combination of Conservatives/LibDem, is set to continue, even if there may be some horse trading required with a few UKIP MPs to form a government. This is particularly the case given the way it is difficult to imagine that high net worth or institutional investors are likely to be rushing for blue chip stocks on the prospect of Labour/SNP killing off the Non Dom loophole or delivering Mansion Tax. But it should be added that if the electoral lottery which is being set up for 7th May throws up a truly hung parliament with the need for a second vote, or should Labour get in, it would be very interesting to see if the recent gains for the UK index will be sustained. One would expect at least a few hundred points to be lopped off within a matter of days under such a scenario.

That said, the reason that that FTSE 100 is on fire is not totally down to the politicians and their latest promises. A helping factor for UK equities which has been missing for much of the post financial crisis period is the boost which is offered by M&A. This has been conspicuously absent for several years, due to an initial cash crunch, then regulatory blocks, and finally CEOs apparently deciding that it is better to keep taking a 6 or 7 figure salary than act in the best interests of their shareholders.

Luckily, it would appear that courtesy of the oil price collapse we are now finally in a position where at least this part of the stock market will provide decent bid situations – even if the best of the bunch here in the UK via BG Group (BG.) has already been put to bed. The biggest plus point of oil & gas bid activity is the heavy weighting of this asset class in the FTSE 100 – something which has been underlined by the way that for April to date we have seen the UK index clear 7,000 so easily. Barring something exceptional (Labour/SNP), this could be a sustainable level.

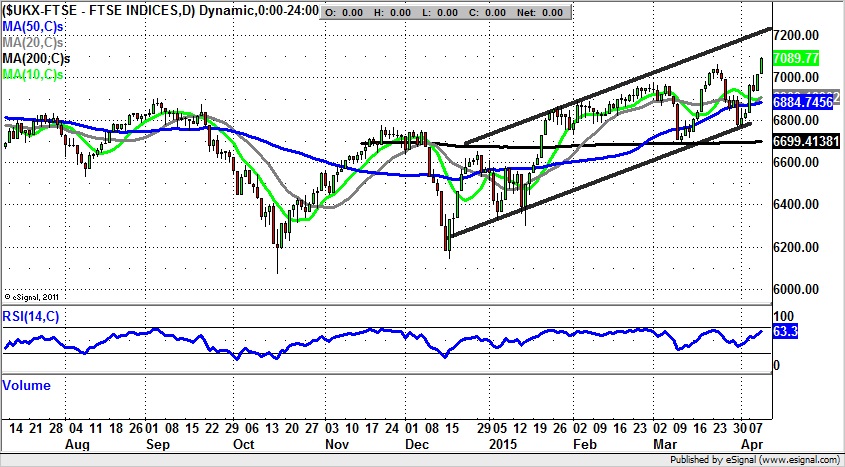

The technical angle at the moment shows how recent months have witnessed progress within a rising trend channel from December, with the last two daily candles particularly strong looking. This would suggest that the top of the channel at 7,200 is the “minimum” we shall see over the next couple of weeks. The only thing missing from a charting perspective to suggest a more extended breakout is on its way would be a higher low above the old March intraday low at 6,974.

Comments (0)