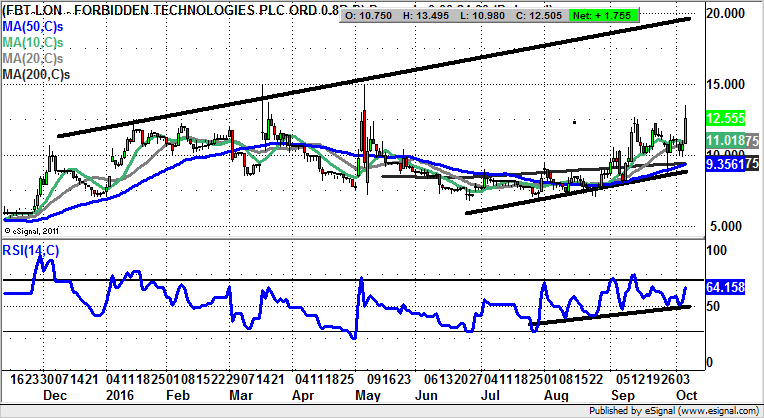

Forbidden Technologies nears ‘golden cross’ buy signal

As the cliché goes, timing is everything when it comes to the stock market. This is underlined by the present technical set up at Forbidden Technologies.

Forbidden Technologies (FBT): Run Up To Golden Cross

One of the problems with the small cap end of the stock market is the way liquidity issues can mean you are sitting on “dead” money for perhaps months or even years. This could of course eventually multi bag and end the misery within a relatively short space of time. However, most of us would like to be within a month or two of a decent move to the upside, a point which is currently illustrated on the daily chart of Forbidden Technologies. Here it can be seen how after more than 10 months of sideways consolidation we appear to be ready for a big break to the upside. This is said on the basis that we are in the run up to a 50 day / 200 day moving average golden cross. It is traditional that the run up to such signals is the most bullish in the technical cycle, and this looks as though it will be the case on this occasion. As far as what the upside could be we are looking at the top of a rising December price channel, with its resistance line projection heading as high as 20p. The timeframe on this scenario is the next 1-2 months, especially while initial October support at 10p remains unbroken.

Comments (0)