Theresa May’s plan is the right one – The UK must seize the day

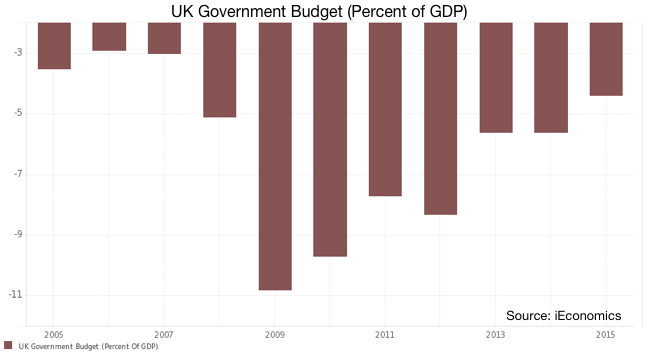

The IMF has just accepted it was wrong about the post-Brexit Armageddon predictions. After all, since the Brexit-vote the FTSE 100 is up 11%, the services sector has expanded at a faster rate, and the ONS ended up revising its estimates for GDP growth higher in the second quarter, to 0.7% from 0.6% previously. In the end, it was not an Armageddon, not even a small downturn. On the contrary, the economy seems to be in better shape than before and the IMF was even forced to revise its growth estimates for the UK to 1.8% this year, a figure that places the country at the top of the G7 leading industrial countries. However, the upgrade comes wrapped with a warning, as the IMF predicts postponed difficulties, which will likely materialise into lower growth in 2017. But, keeping that in mind, apart from the U.S., the IMF is predicting a decline in growth for all other G7 members – i.e. the UK is not alone. Contrary to the first predictions, there may be life outside the EU, in particular away from its austere view and eccentric monetary policy. The new UK Prime Minister, Theresa May, is determined to advance with the Brexit process, promising to trigger the Union’s Article 50 by March 2017. But she is also determined to put an end to the massive over-reliance on monetary policy as an adjustment tool and revert to fiscal spending instead. Infrastructure spending is likely to rise, as Osborne’s plan to balance the budget by 2020 has been completely scrapped.

In her speech to the Conservative Party conference on Wednesday, Theresa May showed her concern for the lack of efficacy of current policies and their long-term effects on wealth. She believes that the policy of keeping ultra-low interest rates, along with purchasing massive amounts of assets, “provided the necessary emergency medicine after the financial crisis” but, through being extended for many years, it also created significant economic distortions. “People with assets have got richer. People without them have suffered. People with mortgages have found their debts cheaper. People with savings have found themselves poorer.” There’s a rising concern that fiscal austerity mixed with low rates is unable to boost growth and doesn’t serve the interests of the nation as a whole. May believes the Brexit vote is the result of a widening division in Britain – London and the South East versus ‘the rest’ – and promises that “a change has got to come, and we are going to deliver it”. This signals a clear change in direction in terms of policy.

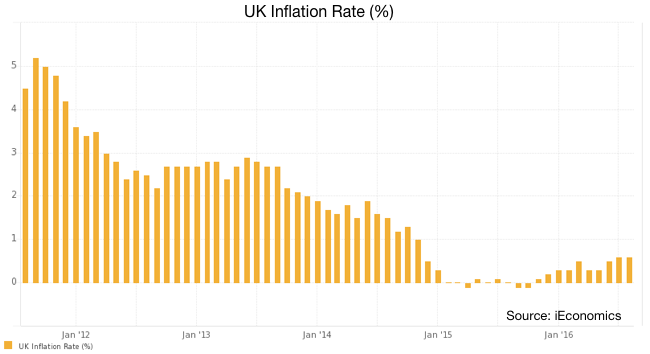

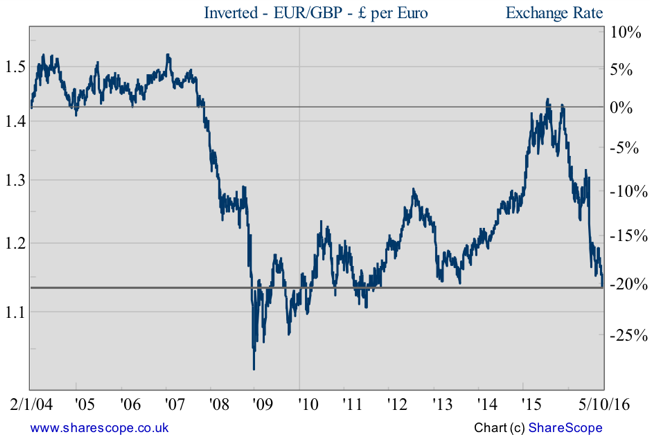

Many seem disappointed with May, as they foresee a hard Brexit and a potential unfavourable investment climate. But Brexit is Brexit. To respect the will expressed through the “No” vote win last June, the government has the responsibility to schedule the exit in a timely manner and not simply kick the can down the road. The country needs to adapt to a new environment, and the sooner the better. At the same time, it cannot live on central bank asset purchases forever. Monetary policy isn’t working anymore and is imparting collateral damage to the nation. The only good thing about it is the possibility it creates for the government to boost infrastructure spending at almost no cost. Investors are currently happy to lend money to the government at a 0.89% interest rate for 10 years. With inflation now at a 20-month high and the pound heavily depressed, the inflation rate will likely quickly surpass the nominal interest rate faced by the government on its borrowing activities, which creates an epic opportunity for the government to detach from Europe and boost the economy.

In the past edition of Master Investor magazine, I pointed out to investors that the global policy focus is moving from the central bank to the government again. The nascent cracks in Europe, the delayed growth in industrial countries – all contribute to a change in focus and to the end of austerity. Contrary to what many believe, the natural long-term interest rate is not negative or even zero and the world is not really experiencing an epic ageing problem. Allow interest rates to be set freely in the market without the intervention of a central bank and you will see how close to zero the natural interest rate really is. The only reason why rates are so low is because the fools who back them believe there will be another group of fools behind them doing the same, at an even lower rate – a Ponzi scheme, that is. Were central banks to announce the end of asset purchases today, negative yields would end overnight. But still, some still prefer to label cash as “sinister” with a view to abolishing it, such that central banks can ultimately confiscate their client’s money through negative interest rates in the hope that scared households would spend every penny earned instead of saving it.

Fortunately, the UK is going in a different direction from the prevailing madness that is willing to mix austerity with a cash ban. May’s speech unequivocally caps the BoE, making it harder for the bank to move on with additional easing. While being independent, the central bank relies on ministers’ permission to purchase assets under quantitative easing because it needs an indemnity against potential losses. Unless there is a massive problem of liquidity coming, the central bank is unlikely to find any further support from the government. Don’t expect rate cuts or more eccentric asset purchases at this point.

What you can expect is infrastructure spending. May believes in “making the market work for working people, because that’s what government can do”. Philip Hammond will soon announce a package of measures to stimulate the economy, which some believe may be as large as £50bn. I believe these measures will accelerate growth in the UK and make the exit much smoother than many predict (including the IMF). I also believe that the EU will make it increasingly easier for the UK to leave, in particular if the UK makes some concessions in immigration policy. After all, immigrants are not stealing any jobs from the British and to some extent the economy depends on them.

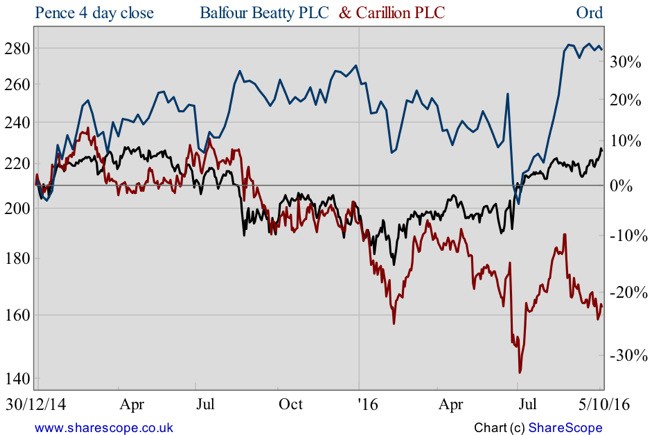

Construction companies, and others directly and indirectly related to infrastructure spending, will benefit from the shift in focus. While low interest rates certainly make it cheaper for these companies to finance their activities, government spending creates demand. Companies like Balfour Beatty (LON:BBY) and Carillion (CLLN) will directly benefit from an increase in government spending and are worth keeping in a portfolio. Other options include Kier Group (LON:KIE) and Babcock International (LON:BAB). All those companies regularly appear in the government pay check and are well placed to reap the benefits of government spending.

As a side note, let me just make a point about inflation. The latest CPI numbers pointed to consumer prices rising 0.6%, which marks a 20-month high. With the pound now at a 31-year low against the dollar and at a 5-year low against the euro, I suspect that inflation may well accelerate faster than anticipated, pressing bond prices down. For this reason, investors should rotate their portfolios toward equities or, at least, protect against the erosion in real income. Long-term debt should be avoided at all costs because this is the top loser in case inflation rises.

My last few words are reserved for the pound. The currency has been pressed down and it will probably continue following this downtrend for a while. But, as Brexit fears vanish, inflation picks up and the economy shows improvement, the trend will be inverted and the pound will recover. That will happen sooner rather than later…

Comments (0)