Finally Some Bad News

If you’ve watched Wimbledon (or any sporting event on TV) in recent years you’ll know they have all manner of statistics at hand. Why? Well it’s quite simple really. If you have enough data and enough different permutations then records are getting broken every other shot/game/match, etc. People love things like that, even though, or perhaps because, they don’t really understand how monumentally insignificant they are. We are hooked, for the most-part, on meaningless hues of the unimportant. This is trivia masquerading as education.

Often these stats are as unimpressive as SEO (Search Engine Optimization). I think SEO is a massive scam. SEO companies are trying to guess how to get round the ever changing secret algorithms that drive Google and the other main search engines. Armed with the clarion call “we can get your website to the top of a search” they head off to your office to impress you with statistics that were (possibly) true yesterday, statistics so peculiar that they are of no value to anyone, except, whilst also not including, you. “Oh look, we’ve got you to the top of your search results”. “Yes, but that’s ‘my own name’.com, surely I would be at the top of that unless I’m called John Smith?”

So we’re bombarded with meaningless information. Guess what else is the same? The news. They have column inches or story minutes to fill and anything will do. When it comes to top financial numbers, saying things are the biggest ever is a great way to catch people’s attention. However, in a world with an interest based system of capital with a growing global population most amounts will be bigger than those that went before. Osborne has been accused by morons of selling off more in absolute value terms than Thatcher did. Well duh! It’s over 30 years later so no surprise there.

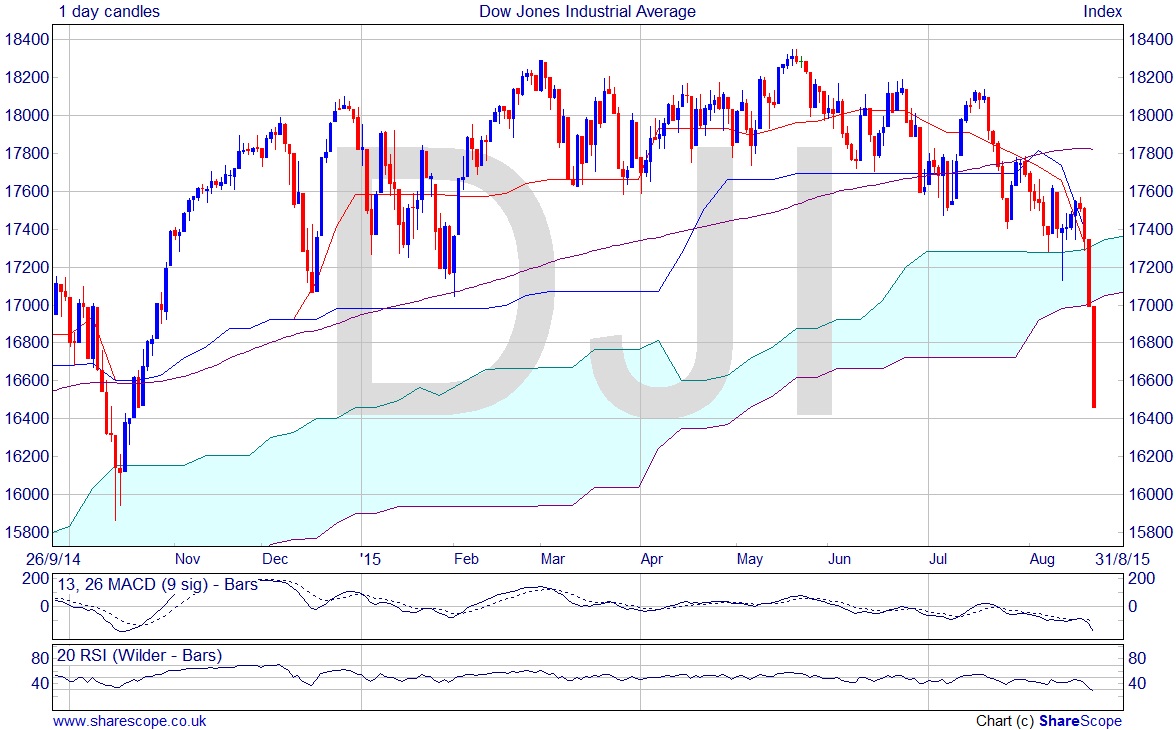

The reason I mention this is because I’ve already written about important levels in the main market indices over the last couple of months, that we were expecting there to be a correction. We are now below the 17,000 level intraday on the Dow which I said was a critical level (blog post ‘Is the Dow Jones Rolling Over?’ 6th Aug ’15). The newspapers will dream up some statistic that makes the story sensational. It’s not. A continued fall below this would be the beginnings of the story I, and others, have already been telling. What we’re seeing here is highly predictable and expected. It was predictable before China devalued their currency and that is incidental to the price level. If confidence is evaporating or people are profit taking and consolidating, then it could have been anything from a Chinese currency revaluation to Obama saying the ‘N’ word (‘nationalisation’ as regular readers will know).

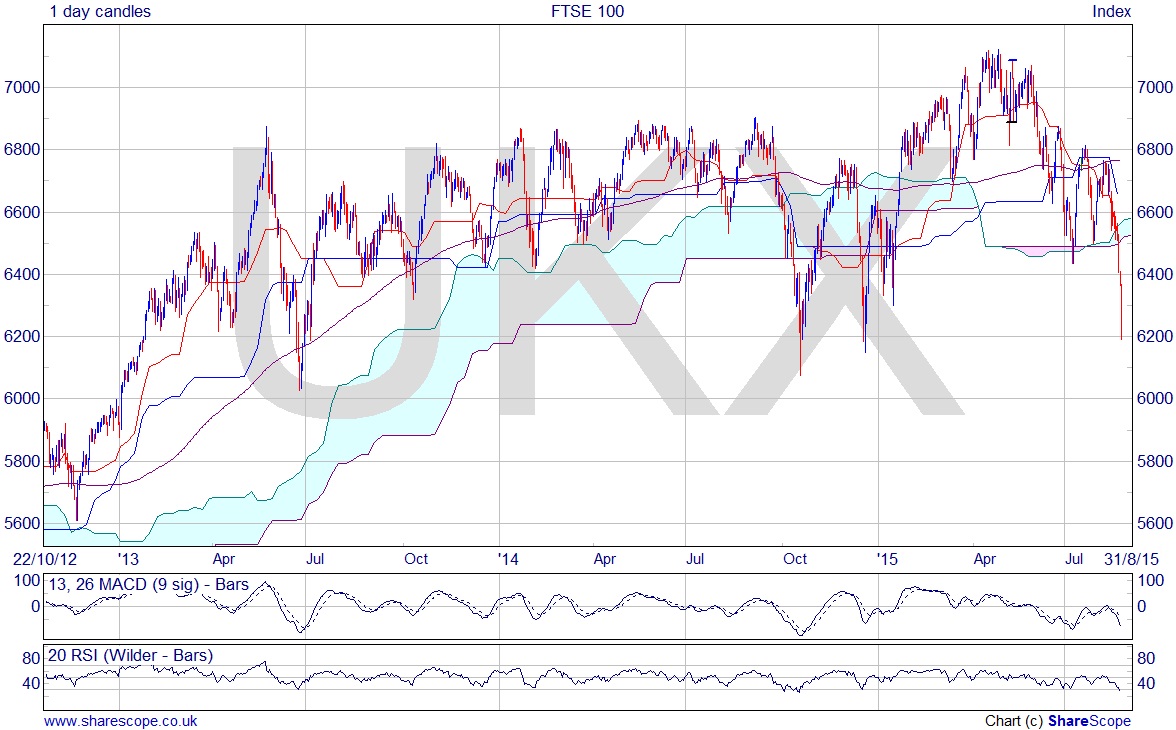

I’ve written plenty of posts about how the FTSE is an also-ran, so I’ve included the chart just for illustration really. It looks weaker than the Dow. Both charts are end of day. The FTSE closed at 6206.43 on Friday and the Dow is still open, presently trading at 16,459. I’d like to see the Dow close well below 17,000 to be interested.

Comments (0)