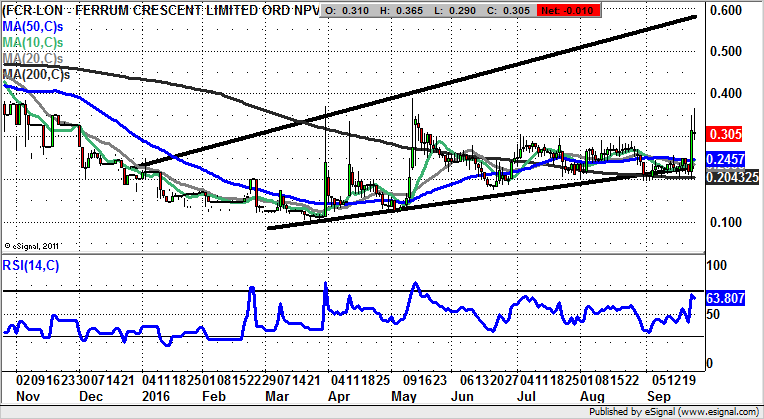

Ferrum Crescent targets 0.6p after extended bull flag

It is sometimes difficult not to be swayed by what the trading Twitterati are excited about. The current Stock Du Jour is Ferrum Crescent.

Ferrum Crescent (FCR): 0.6p Technical Target

It was the turn of the Executive Chairman of Ferrum Crescent Justin Tooth to be star of the show in the small cap market this week. The buzz surrounds the Goldquest Zinc assets and the speculation that a company which has a market capitalisation of less than £5m is sitting on an asset which is allegedly worth £25m. All of this allows armchair Warren Buffets to calculate that the stock should be worth well over 1p, rather than the 0.3p where we are now. As far as the technical position is concerned, it can be seen on the daily chart that recovery moves after an extended bear run have been afoot here since May, with the first attempt at clearing the 200 day moving average now at 0.2p. For this month we were treated to an extended bull flag above the 200 day line with the view now being that provided there is no sustained break back down below this feature we should see significant upside. Just how high the stock could stretch is suggested by the January resistance line projection currently heading as high as 0.6p. The time frame on such a move is seen as being as soon as the next 1-2 months.

Comments (0)