Early Entry Trumpet Blowing

This is not a piece about how to interpret a fanfare, but a nice illustration of some of the articles I’ve written over the last few months coming together.

I wrote a piece called “Breakouts are for Dummies” back in August. The basic point being that even a trained monkey can see and trade breakouts. It’s an unsophisticated strategy. It means everyone is trying to pile in at the same time which leads to volatility, larger than normal spreads and poor fills. You’ll be chasing the price, which is something we should never do in trading.

I examined how to make an early entry and thus avoid volatility, resulting in being either in profit, or at breakeven when the breakout happens, or fails, as the case may be. Early entry gives you a buffer to have a ‘free look’ at the breakout. All very well in theory you might reasonably say. So here’s an actual example, then, which has appeared in my own blog piece from a couple of weeks ago. In my piece about Bitcoins on 22 October, when it stood at £266.68, I wrote, “Well I’d say looking good for a break upwards… it should move up to the £300 level whether it breaks out or not.” It’s been over £300 this week, just a fortnight later. The breakout is still very much in the offing. An early entry would mean you’d now be sitting pretty with a free look at the ‘public’ breakout, and a profit if it fails.

In other words, it actually works. And it works even net of costs – costs that many theoreticians fail to acknowledge. In fact you’ll find a lot of examples floating around which wilfully ignore costs and come out with the lame argument that “it depends on which instrument you’re using”. Well I’ll largely debunk that myth another day, but broadly, costs are fairly similar, or you’re using entirely the wrong instrument to trade.

So, early entry… It’s worth getting on top of. It makes your trade management a lot less stressful, and the last thing you need in trading is stress. Or put another way, exhilaration should come from getting it right, not from getting a fill in a volatile market!

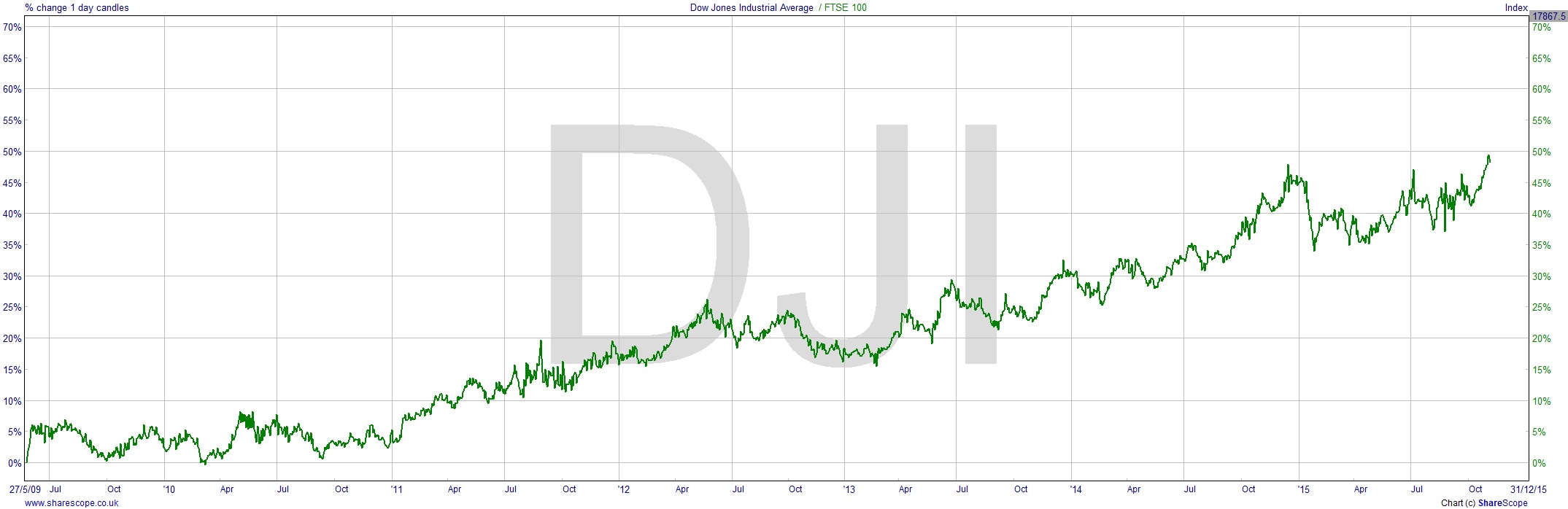

Meanwhile, the Dow once again continues to improve in relative terms to the FTSE100. It’s now at the largest differential since 2009’s bull market started as you can see on the chart. I’ve mentioned this would be the trend several times over recent months. Just because we live in the UK certainly doesn’t mean we have to invest in it. In fact most of the FTSE100 companies are multi-nationals that are more affected by events outside the UK than within. Certainly not by the actions of you and me! The FTSE100 and the UK are not football teams. You don’t have to continue to invest in them out of some sense of loyalty. If you have been doing that then there has been an idiot tax applied.

Comments (0)