Breakouts Are For Dummies

The standard of training in the UK retail investment community is abysmal. Thousands upon thousands of people who think they are traders simply go long or short based on gut feeling with absolutely no analysis whatsoever. They deserve to be part of the 90:90:90, the mantra of the spread betting industry: 90% of punters lose 90% of their money in 90 days.

For the most part, training is pretty abysmal too, with a very few notable exceptions (I’ll write about that another day). Either it’s done by people who aren’t traders at all, but rather, excellent presenters with believability to the novice, charging thousands to teach you basic stuff that is freely available on the internet; or it’s done by companies with a particular product to sell and no breadth of training as a result.

The standard is usually one, perhaps two indicators and that’s your set-up. A favourite of the unsophisticated Brit-Retail Market, or as I’m going to say now, Bretail, is the breakout. It’s so simple anyone could do it. Can you already see a problem with it then?

It’s not a secret that markets are able to be, and are, manipulated. And I don’t even mean illegally. As a result the manipulation is most likely to occur around breakouts, because human behaviour is entirely predictable, and so are breakouts.

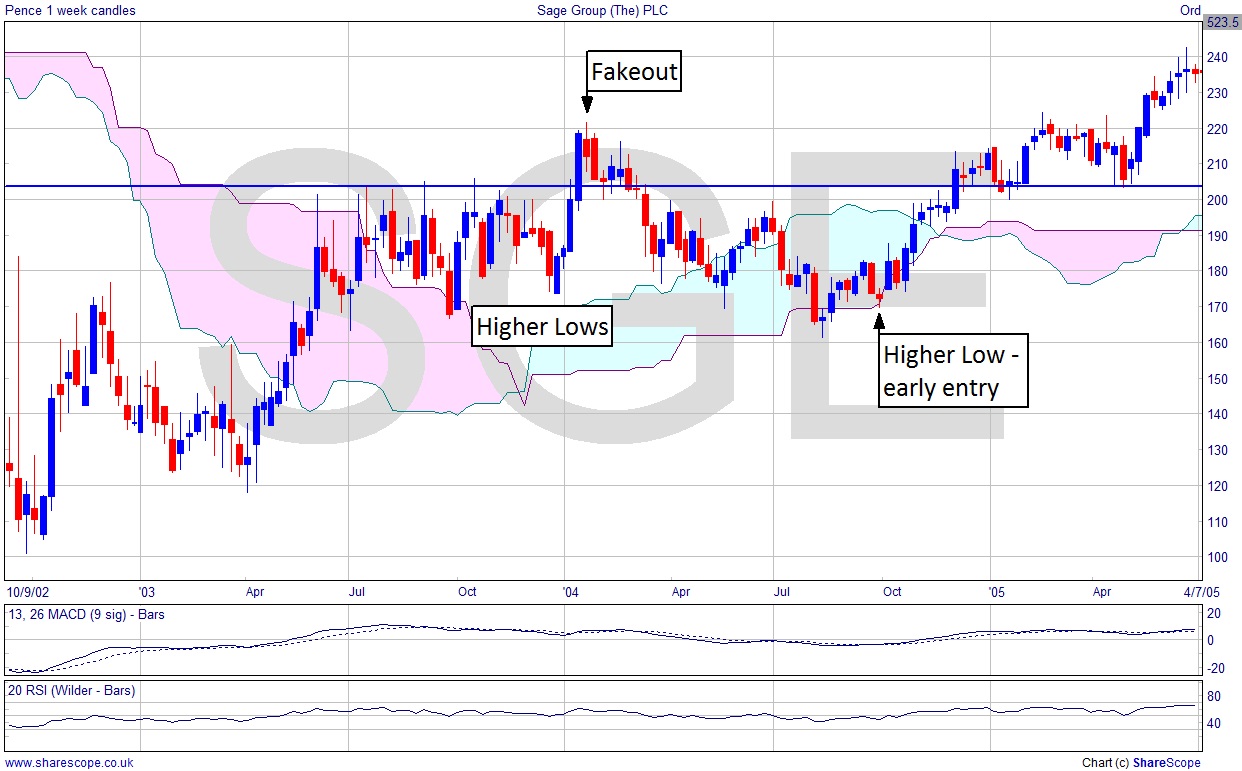

Breakouts occur when a level at support or resistance is broken, usually after a period of congestion but not necessarily. Head and shoulders are breakouts at the neck line, for example. The expectation is that once the breakout occurs then we’ll see a move strongly away from the starting point. The problem is the failed breakout, or fakeout as it’s often known.

Take a look at the Sage (SGE) chart I’ve used to illustrate the point. There’s resistance at just over 200p during the summer/autumn of 2003. It must have looked very tempting: a number of touches on the resistance level, plus it’s a big number (a hundred). But had you traded it when it broke out in early ’04 you’d have lost money. You would have been lucky to get in under 210p and you would have had to sell below 200p.

In fact, it’s almost a year before the price gets back up to that resistance level again. I imagine worry would then start to creep in for the private investor. Is the resistance level still valid? Won’t it just fail like last time? In early January they would probably feel smug as it looks like that’s exactly what’s going to happen. But wait! No, it’s succeeds. The price goes on up, to peak at over 300p over the next year. I’m saying most private investors would have talked themselves out of the second chance, and if they did enter it, would have played safe and sold at the retracement to 200p (remember bid offer spread means they’d be selling at under 200p).

So what should we do to trade what is obviously an opportunity?

Simple. There’s no doubt there is an important resistance level at just over 200p. What we need is a way to enter the trade lower, so that if it fails we can get out at breakeven, or even a small profit. There are higher lows in October and December ’03 which would have served the purpose quite well. Even when the trade fails you are still not testing your stop, presumably just below the higher low you entered on. So you could cash out after failure in early ’04 with a small profit.

In Oct ’04 there’s another higher low (at the bottom of the cloud, too, which is a nice support signal). You’re in around 175p and you can use a reasonably tight stop once it does break upwards, which certainly shouldn’t get hit in early ’05, and you’re in up to 300p, not from 210, but from 175p, a year later.

If you want to be really conservative then get in after the higher low bounces off the resistance level. Resistance becoming support is a very strong signal. You’d still be in around 210p and up to 300p but in just around nine months, and never have been in for the fakeout.

If you do the same as everyone else you will lose money. Don’t be a mug. Don’t trade breakouts!

Comments (0)