Defence and Retail – Lockheed Martin, BAE and Sports Direct

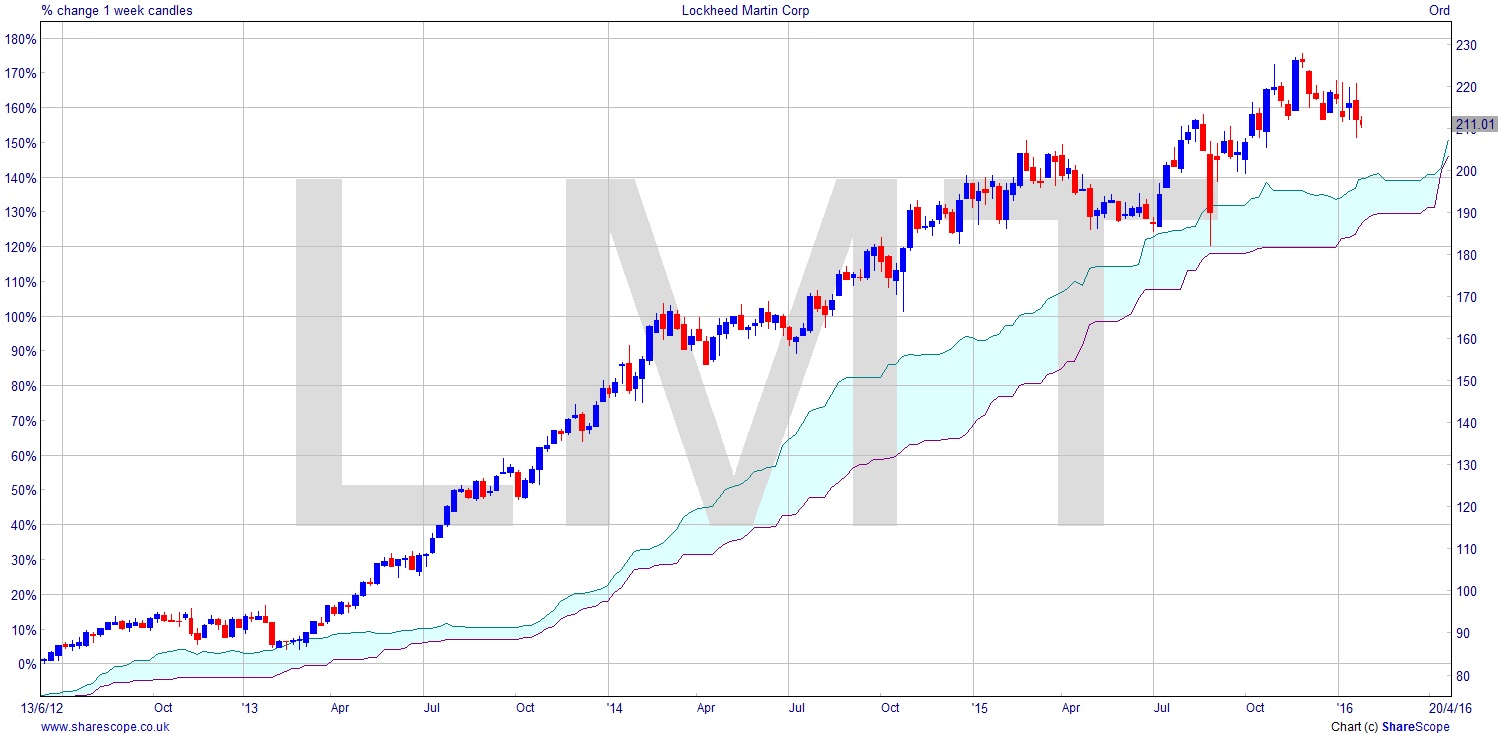

Last time I wrote about Lockheed Martin (NYSE:LMT) it was in my magazine article “War! What Is It Good For? Absolutely Your Pension” back in the early summer. My point being that if you don’t have a defence element to your portfolio, then you don’t really have a pension. The stock was $205.13 then and it’s still bullish as we enter 2016. They have decided to focus fully on aerospace and defence. Good news I say. Operating profit is up 21% in their Missile and Fire Control division – you could say that’s gone ballistic. They’ve bought Sikorsky Helicopters and are ditching some peripheral businesses from the group. Although it succumbed in August to the market down-blip, it has defied the market falls of January, meaning it’s still bullish, above the cloud and in the right business to continue to perform. Technically there is not much to say here. It’s a good looking chart for a pension component. At $211.01 as I write.

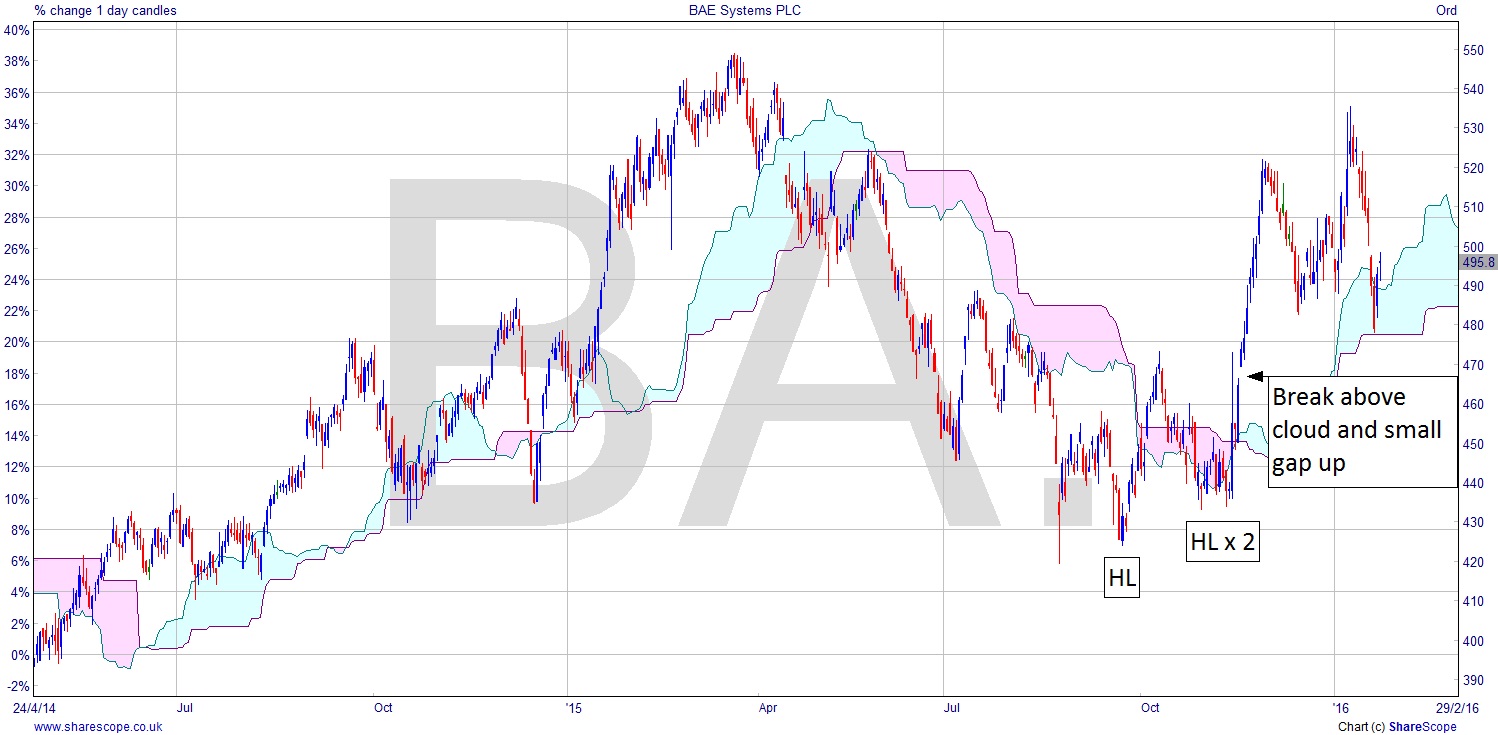

If you’re still flogging the dead horse of UK stocks then BAE Systems (BA.) is not quite so intact, but again is not in the doldrums after the falls earlier in January. There was a nice entry point as it created higher lows in the autumn, and began to move upwards. A beautiful move above the cloud on the daily chart would have been a great entry even for the most fainthearted –particularly with that small gap up consolidating the change in trend. This was a nice little recovery play that could conservatively have yielded 10% over the space of a couple of months.

Are defence stocks starting to be seen as a safe haven as markets flirt with correction? It would make sense. In most scenarios defence spending will continue as it has. It really is being seen as a safe haven at the moment.

As for retail, inflation through the backdoor – i.e. making contents smaller to sneak in price hikes under the radar – has perhaps given the impression of affordability to consumers. So how much, in that climate, can we rely on consumer confidence data? Not much I’d say. I didn’t think it looked busy in December out there, although I accept a lot of High Street business will have gone virtual. January was dead.

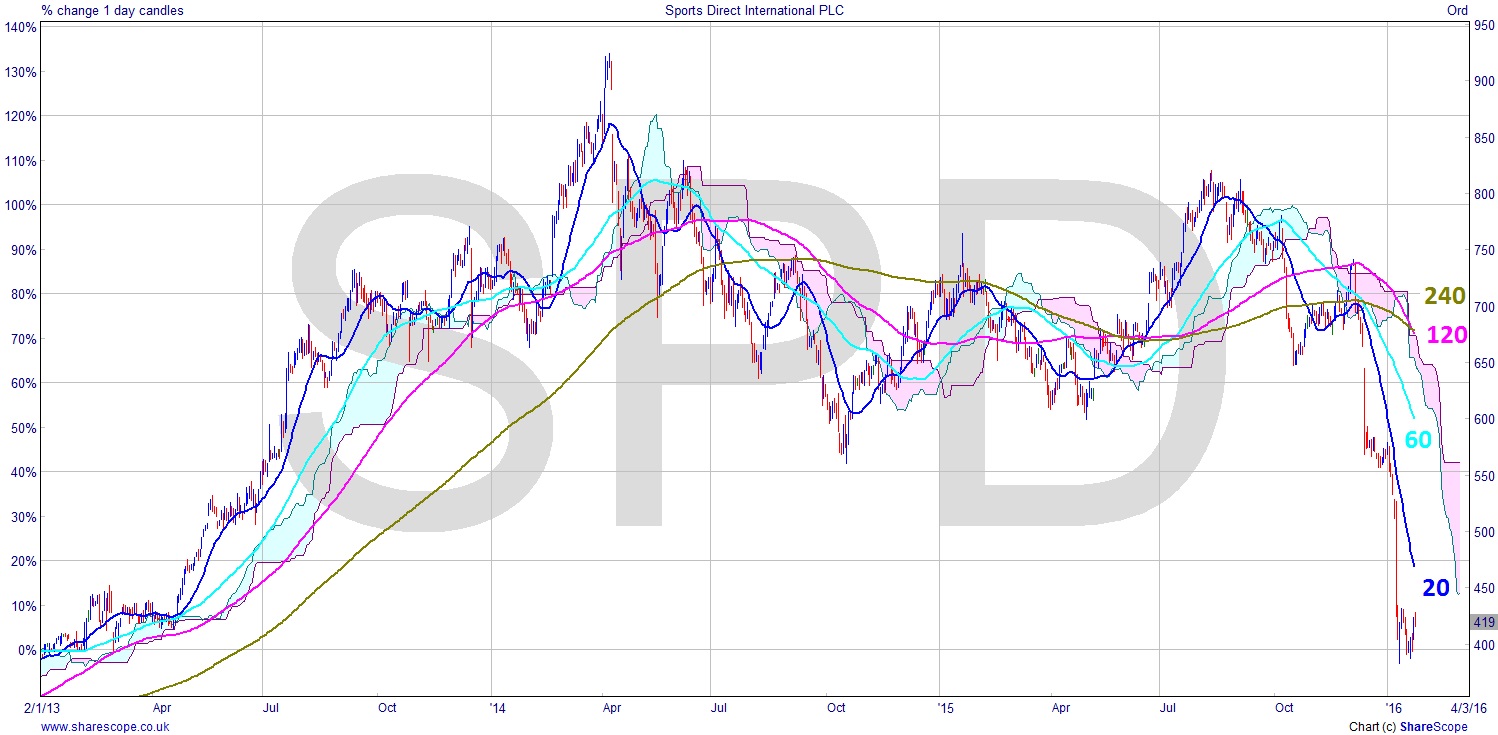

Sports Direct (SPD) is a relatively busy shop though, so how is their chart looking? Oh dear, oh dear, oh dear. A gap down price collapse. In less than two years they’ve had more than 50% wiped off their share price. I guess they know how their employees feel when they receive their pay packets now. Although how come paying peanuts hasn’t converted into earnings? This could be a recovery punt for a little retracement if the markets continue their upwards sleep-walking. There is a minor higher low there last week. It’s a stock that’s hugely divorced from its Moving Averages now, and that has to be reconciled. Of course it could reconcile by the price staying down and the Moving Averages falling – something you can’t really trade!

They are as follows: 20 day (blue), 60 day (cyan), 120 day (magenta) and 240 day (olive). By the way, these numbers relate far better to the actual trading calendar than the standard ones inexplicably used by many. Roughly my MAs equate to 1, 3, 6 and 12 months. Even a rise to the 20 day MA would produce a tradable move using a spread bet. The 60 day is almost 50% higher than the price action. Now I don’t care which way it goes in the end because right now it is plausible to expect the price to make up some of the ground here. If they meet halfway it’s a really good move up. Speculative, but with such a sharp fall it is common to see a 50% retracement.

Comments (0)