Burberry (BRBY): Technical target above 2,000p if M&A has legs

One of the big omissions in terms of the post-Referendum rally for the FTSE 100 has been the relative lack of decent M&A activity or even speculation to provide momentum. At least the latest regarding luxury goods group Burberry provides some cheer.

One of the many people I interview on a weekly basis is the editor of the Betaville website, business journalist Ben Harrington. Apparently, since the last time I spoke to him, Betaville has offered the rumour that British luxury goods group Burberry could be the subject of a takeover from US retailer Coach (COH).

While this sounds like one of those situations where one plus one equals three, the fall in the Pound and the recent struggles at Burberry do suggest that it needs a boost of this kind, or at least a change of direction. From a fundamental perspective we have seen the company hit by both fears of a Far East slowdown, and the aftermath of the Chris Bailey episode, where the former CEO went rather quickly from being a rather overpaid rising star, to a rather plain asteroid.

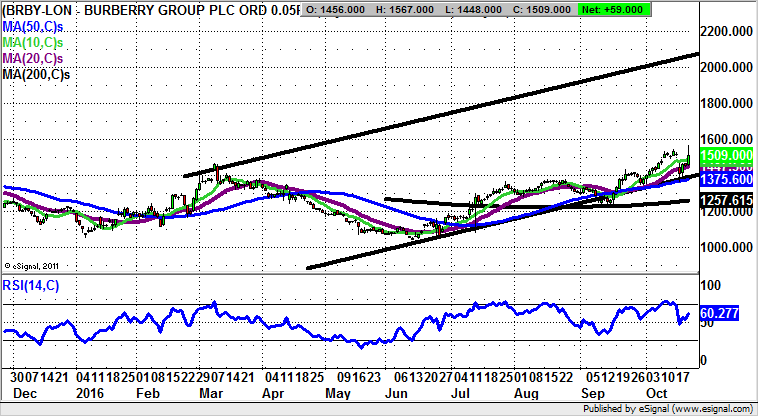

But at least with this period behind the company we can see on the daily chart how there has been a decent progression after the golden cross buy signal between the 50 day and 200 day moving averages in August. The top of a rising trend channel from March is heading for 2,000p plus and this is the 2-3 month target while the 50 day moving average at 1,375p is held.

Comments (0)