Breakout Time For the Euro

Skittish, would be one word to describe markets at the moment. Ugly, would be a more accurate description however.

The benchmark S&P 500 recovered from over-sold territory this week, to put the index back above the 100 period moving average that has acted as support for much of this bull rally. Equities remain within reach of their record highs, but traders are maintaining a careful balancing act.

Any sign of exuberance could be a signal to the Fed that the time has come to raise interest rates. At the same time, the FOMC has traditionally been sensitive to market movements, so a sell-off can sometimes be simply seen as a move in the game of playing the Fed.

S&P 500 daily chart

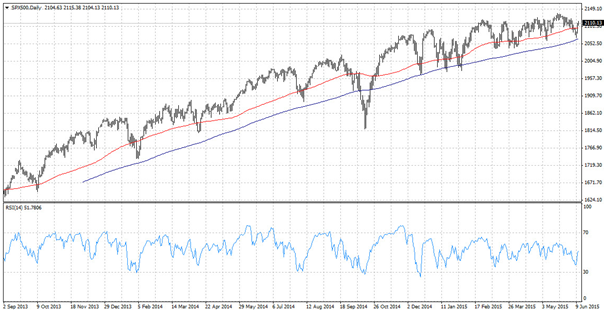

The longer term chart below shows the S&P 500 with the 14 period Relative Strength Index in the bottom pane.

S&P 500 daily chart

While both the 100 period average (red) and 200 period average (blue) continue to support the S&P 500, the 14 period RSI shows how the market has lost momentum.

Throughout 2015, there hasn’t been a single instance of the S&P 500’s 14 period RSI reaching extreme levels above 70 or below 30. While new record highs have been made in 2015, it’s hardly been a scintillating year so far.

Is this a sell signal?

Markets are still overbought by many valuation metrics from the PE/10 to a simple regression to the mean. Yet these valuation metrics have been poor market timing tools in the short term. They are best combined with a short term spike that typifies an exhaustion high.

While the Fed continues to accommodate a marketing friendly stance of extending the ZIRP (Zero Interest Rates Policy) it’s unlikely markets will fall too far.

Markets rarely stay coiled for long

This trading morass in equities is having a direct and indirect impact on currency markets, notably the euro.

For some time, the euro has been the primary counter point to the US dollar. The Greenback has been struck by the same curse afflicting stock markets – A lack of clear direction. Without the constant pressure from the dollar, the euro has been free to rally over the last few months.

The euro is likely to have enjoyed bigger gains were it not for the small matter of Greek debt.

History seems to be repeating itself daily in the battle between creditors and Greece. The creditors insist on Greece tightening its belt and pushing through cost saving reform. Greek officials push back against these ‘draconian’ changes while at the same time leaking details of progress being made in negotiations. Meanwhile cash is slowly leaking out of the Greek banking system.

Thursday typified the ongoing cycle with a Greek court ruling that the government should reverse prior cuts to private sector pensions made in 2012 as they deprive pensioners of quality of life. This was followed by European Council President Tusk cautioning that Greece has just about run out of time.

Similar to the S&P 500, the EUR/GBP has remained range bound since February.

EUR/GBP Daily

There really is no way of knowing in which direction markets might break-out, but there is the creeping feeling that some sort of end game is approaching.

The negotiators might pull through, or Germany might finally decide it’s had enough. Either way, the impasse is unlikely to continue past the erratic summer months.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)