Blue Chip Breakout Stocks: HSBC, LSE, Rolls Royce

The cliché as far as the top market capitalisation stocks are concerned is that elephants do not gallop. This suggests that moves to both the upside and hopefully even the downside tend to be of a pedestrian nature. However, as anyone following an “elephant” such as Tesco (TSCO) will have discovered in the recent past, this is not necessarily something which pans out in either direction, especially in current volatile and confused markets. In fact the gallop aspect really referred to the way that you might conceivably double or triple you money relatively easily in a small cap/”growth” company which has a market cap of £10 million or £20 million over the course of a year or two. But for the blue chips the expectation would normally tend to be that a 10% gain or loss per annum is most likely to be on tap, with the move cushioned or enhanced by the dividend, amounting to say 3% – 5% at most.

But at least for the three stocks I have picked out today, it may be that we can assume some galloping to the upside, given the charting configurations on offer. First up is HSBC (HSBA), the world’s local bank, which is pretending to be in a sulk which will cause it to leave the UK. This could merely be a bluff, especially as the one thing that this country is not short of is High Street banks. The other issue is that few would shed a tear if all of the banks left the country…

However, what is interesting regarding the daily chart configuration of HSBC is the way that since the beginning of April we have been treated to no less than two unfilled gaps to the upside. The first was in the wake of last month’s sharp bear trap, while the second came in the wake of the clearance of the 200 day moving average now running at 617p. Indeed, the best way forward at this stage is probably to assume that the stock will move to deliver a higher low above the 200 day line, consolidating the ultra strong price action of this month. On this basis traders would probably be looking to buy any dips towards the floor of the latest gap at 635p, with an end of day close stop loss back below the 200 day line. The target over the next 4-6 weeks is seen as being as great as the August resistance line projection currently heading as high as 730p, something which if it materialises would be a great achievement for a FTSE 100 heavyweight.

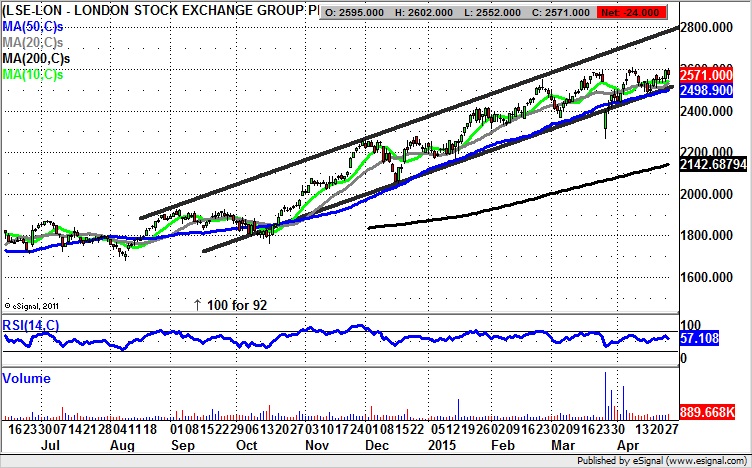

What is interesting about shares of London Stock Exchange (LSE) is the way that the breakout from October flagged very well the eventual breakout we have seen for the FTSE 100 through 7,000 after a long 15 years wait. The present position on the daily chart shows the way that we continue to have progress within a rising trend channel from August. The floor of the channel currently runs at 2,498p, with the implication being that while there is no end of day close back below this feature we could hit the price channel top as high as 2,800p over the next 1-2 months.

Finally, Rolls Royce (RR.) is a stock which has been in the wars, especially on a fundamental basis in the recent past. But it would appear that the bulls have managed to shake off the worst of the stock market’s doubts, at least over the near term. This point is underlined by the clearance of the 200 day moving average now at 938p in March. The present position is that one would expect a journey towards the main 2014 resistance at 1,100p plus over the next 2-4 weeks. The best stop loss at this stage is probably an end of day close back below the 10 day moving average at 1,015p.

Comments (0)