Binary Bet Of The Week: Hung Parliament Weighing Heavily On Pound

The final session of the UK Parliament took place on Thursday 26th March, marking a five week run-up to the general election.

At the time of writing, the outcome is almost impossible to predict, with bookmaker odds giving a Labour minority government a 29% implied probability and a Conservative minority government a 25% probability. A conservative majority has a current probability of 18.2%, and continuation of the current coalition is given a likelihood of 13.3%.

If this were a horse race, it would be one that punters and bookmakers would try to avoid like the plague. Financial markets are also unsure of what to do, with a hung parliament the most likely outcome and a market unfriendly Labour victory on the cards.

More than anything, financial markets despise uncertainty. Sometimes, uncertainty can have a more damaging effect than outright negative news: at least with the latter the markets know what they are facing.

GBP/USD Daily Chart

The GBP/USD has been declining steadily since Q4 2014, though most of this decrease has been down to the pervasive strength of the US dollar.

Against the euro, we can see the impact of the election uncertainty with a bit more clarity as the EUR/GBP has risen since the beginning of March.

EUR/GBP Daily Chart

Part of this recent upwards trend is down to the quietening of the Greek crisis. There have been various Greek reform proposals mooted since the Merkel/Tsipras summit, but these mostly appear to be window dressing and a repetition of ideas already put forward. Broad structural reform still seems like it is being kicked into the long grass, but for now markets appear placated.

The EUR/GBP did nip back on Thursday and Friday thanks to comments from Bank of England Governor Carney that the next moves in UK interest rates is likely to be higher. This is not exactly a revelation but nevertheless calmed some of the speculators putting outside bets on a rate cut or at least a delay in rate hikes.

This pullback could prove to be short lived though as election uncertainty seeps more into the nation’s (and traders’ consciousness). The Bank of England is unlikely to make any firm decisions until after the general election, so the chance of an upside shock for the pound has to be less than the chance of a downside shock.

With Europe still able throw up a good crisis, it is hard to bet on the EUR/GBP just yet though, even with the UK election uncertainty. A better vehicle could be the GBP/JPY.

GBP/JPY Daily Chart

The yen pairs have enjoyed the US dollar backing off recently, with the GBP/JPY selling off heavily since the beginning of March. Support does loom in the 176.00 region but should this break, there is much room for significant downside.

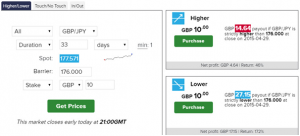

A good way to play this is a LOWER trade predicting that the GBP/JPY will close BELOW 176.00 in 33 days time, which could return 170% if successful. Alternatively, put another way, betting that the GBP/JPY will drop and close below 176.00 on April 29th could return £27.07 from every £10 put at risk.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)