Bacanora Minerals: Gap through 200 day line could lead to 110p

Bacanora Minerals (LON:BCN) was one of my stocks for 2016, and at least as far as the first half of the year the call was decent. The question for the start of 2017 is whether the shares can deliver in a significant way.

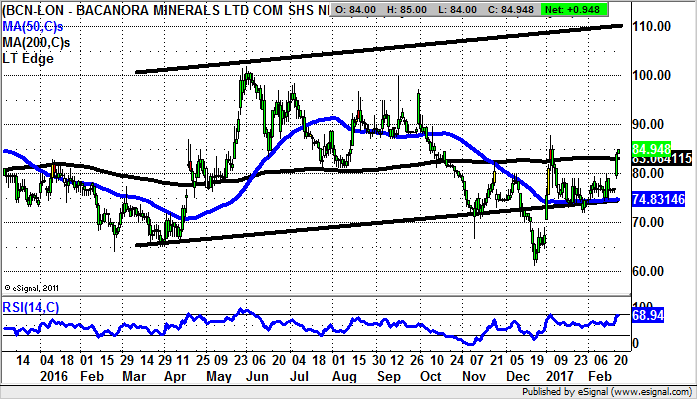

What can be seen on the daily chart of Bacanora Minerals is that even though we have some in the market in frenzy mode regarding the prospects for Lithium, so far the parabolic ascent for all things related to this concept has not really materialised.

What can be said currently is that the technical setup does appear to be on track. This is said in the wake of the as yet unfilled gap to the upside through the 200 day moving average, now at 83p. Ordinarily this would be a great signal in its own right. However, this comes in the aftermath of the December bear trap gap reversal, an event which may prove to have been a significant turning point.

The view now is that we should be treated to further progress which could lead towards the top of a rising trend channel which can be drawn in from as long ago as March last year. The implication is that we could see progress to as high as 110p, the top of last year’s trend channel.

The timeframe on such a move is regarded as being as soon as the next 2-3 months. At this stage only back below the floor of the channel / 50 day moving average at 74p would really delay the upside scenario.

Comments (0)