A Review of the Indices

Time for a quick review of the main markets, I think, following recent falls. Are we in a new era? Is it just a blip?

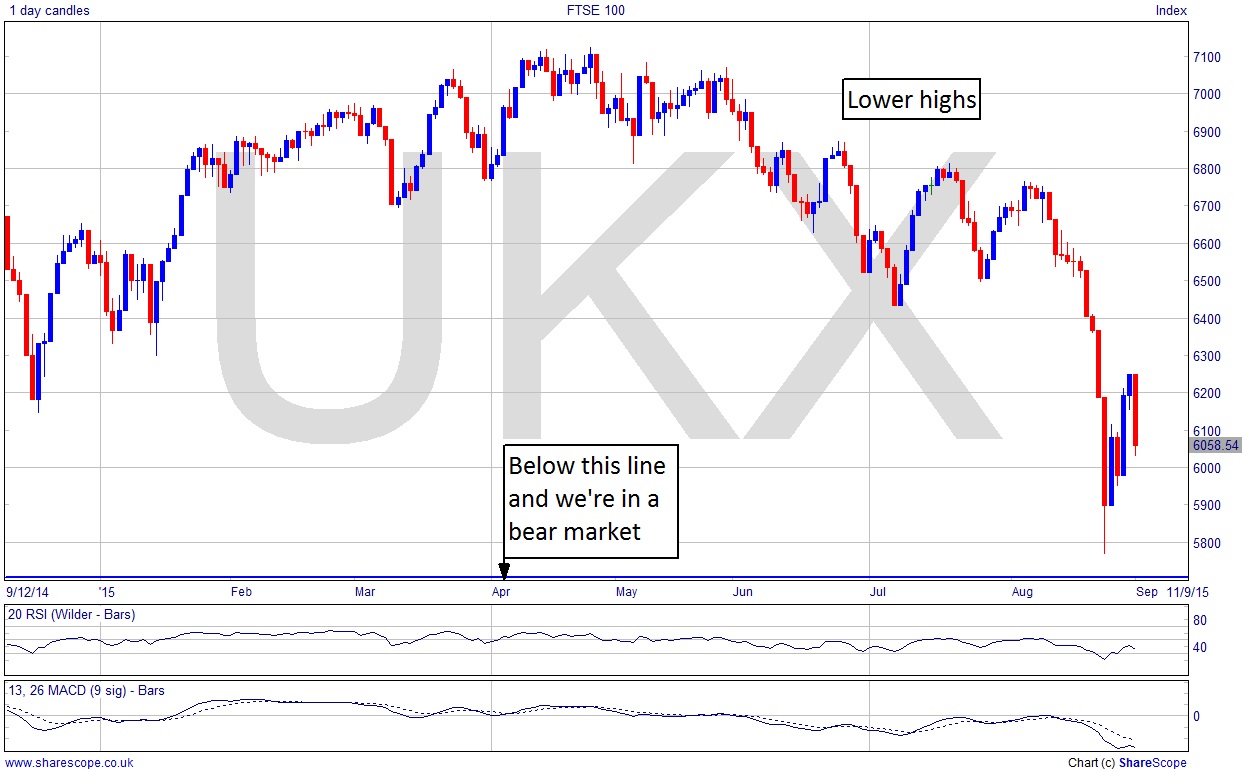

I wrote a blog piece last month called ‘Is the Dow Jones Rolling Over’ in which I said that 17,000 was the key level. It failed there and fell really quickly down to under 15,400. A Bear Market would require a fall to below 14,400, which is still some way below the low reached here. The FTSE 100 has no such luxury and was a few 10s of points from being in Bear territory, and is much weaker than the Dow.

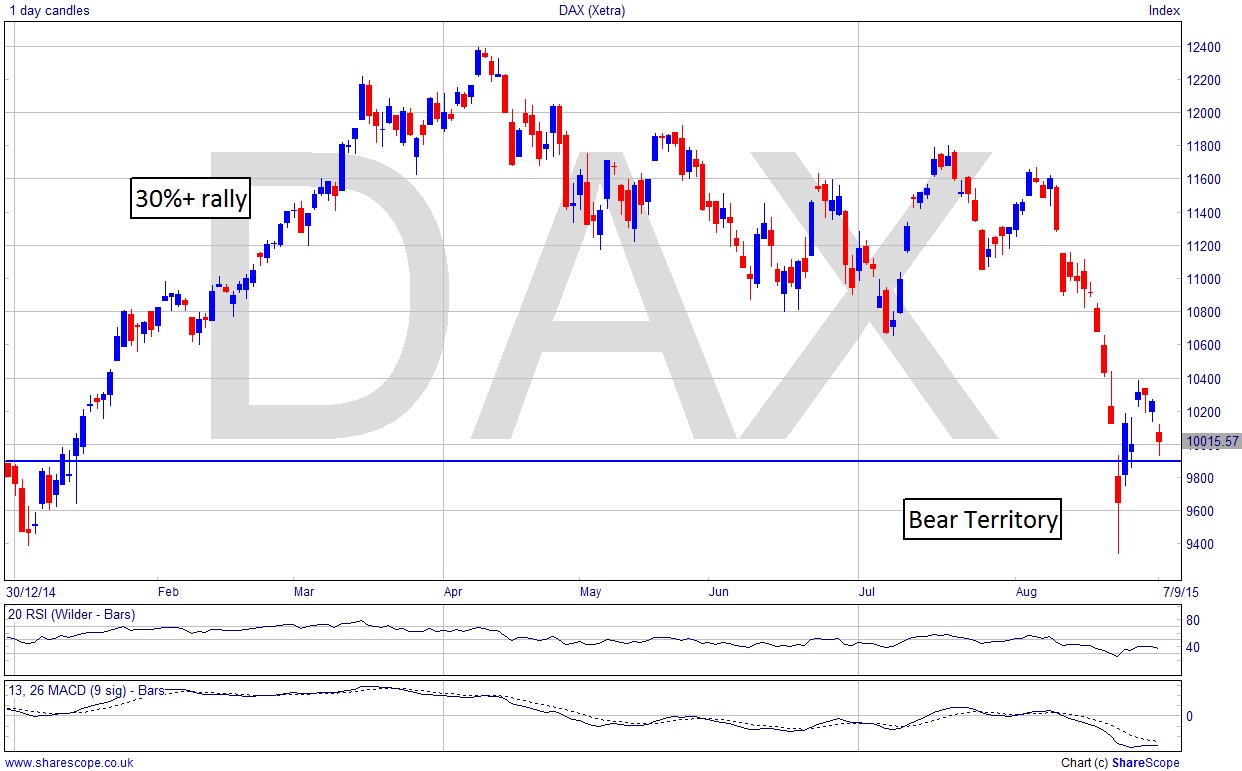

The DAX has already crossed the Bear Line gapping down but now rallied above it. Unlike the FTSE 100 though, the DAX did rally over 30% in the first few months of the year, and even at the recent low had simply lost this year’s gains.

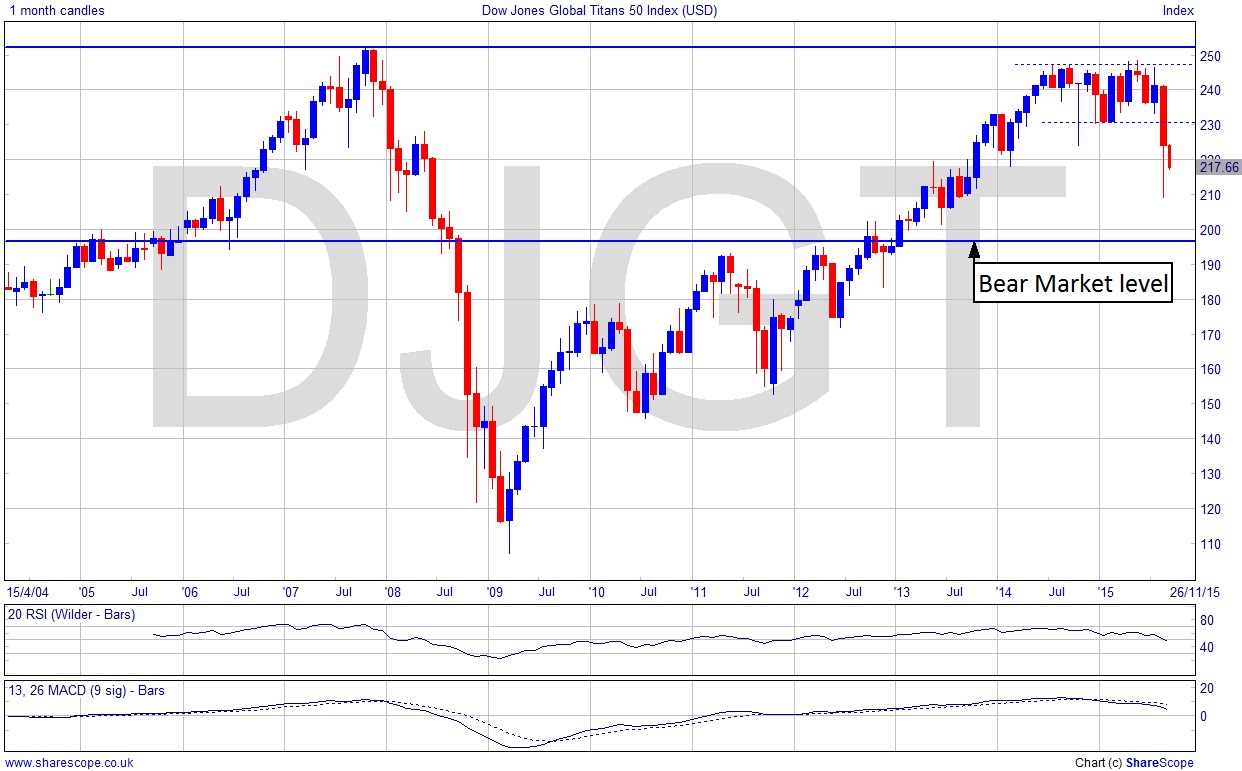

I wrote about the Dow Jones Global Titans 50 a month ago saying that it was most likely to go sideways or down and that there was little in the way of visible support below the congestion area, and of course it has now fallen out of that congestion. An index of 50 of the major companies in the world struggled and failed to beat its 2007 ATH, which is a sign perhaps that things haven’t been that rosy outside of the leading markets (US and Germany mainly in terms of stock market levels that really broke into new ground).

Then again, we can also identify a reason why even those leading markets haven’t really been as impressive as they appeared to be – QE. Printing loads of money, as the EU and especially the US did, means the resulting upward revaluation of markets makes at least part of the higher levels we’ve seen meaningless.

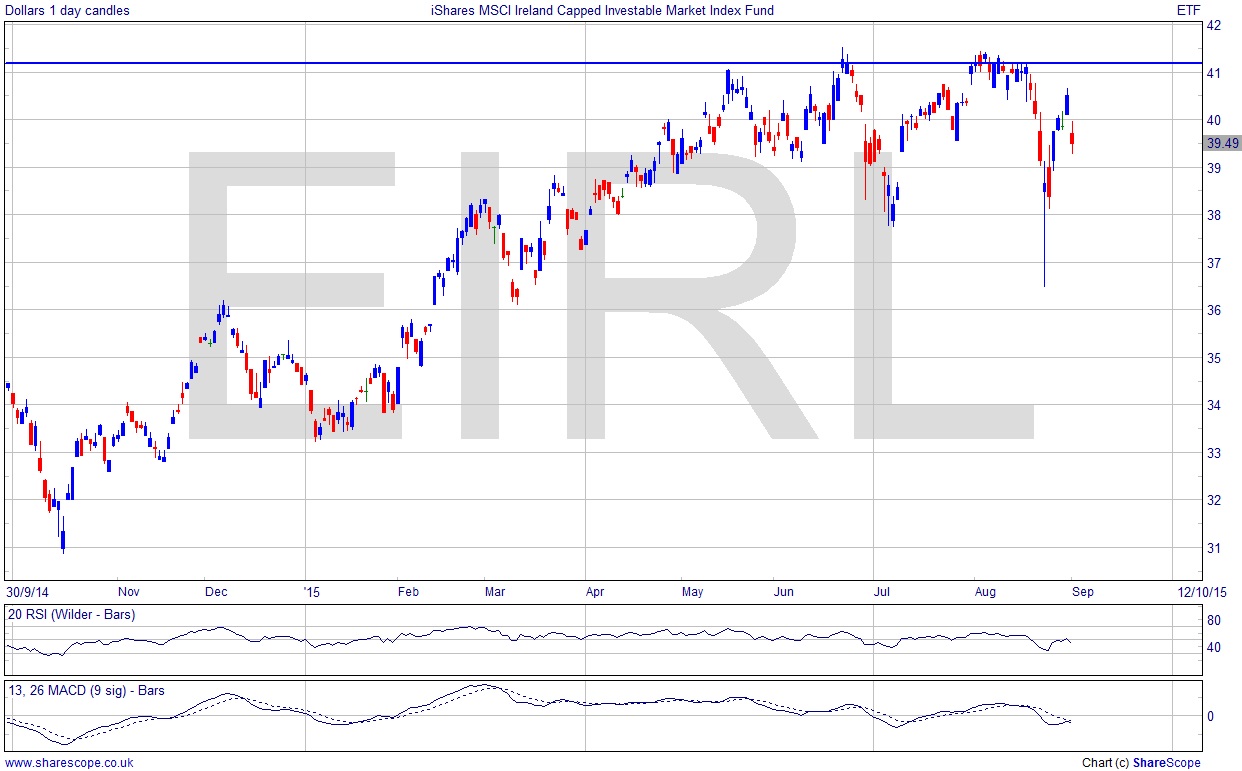

France’s CAC 40 almost hit bear market too. Interestingly though, the Irish ETF I picked out in my article about Ireland’s growing economy last month has barely been dented by the fall, even though it did take a bit of a hit. It’s now limbering up for another try at the ATH. Overall, the trend is still intact, although it wouldn’t take much for it to start rolling over.

So, in general we’re seeing weakness in the European main markets. The FTSE is dangerously close to a bear market, the DAX is technically already in one (unless it shows some real signs of strength), and the US is holding up under pressure. With all indications that the US will raise interest rates this autumn, it seems clear that funds will be moving westward and this is yet another reason why European markets will lose out while US markets gain.

Comments (0)