It’s Not A Long Way To Tipperary

For as long as anyone can remember Ireland’s biggest export has been its people. I don’t mean has-beens as in Terry Wogan, but real people. They’ve reached every corner of the globe. The Irish Bar is ubiquitous in all civilised cities. The question was once asked as to why the English pub hasn’t been so successful as an export, and the answer quickly comes: “because you can’t export warm beer and being ignored”.

The Irish pretty much invented marketing, encouraging everyone to visit a country they left, where it rains most of the time and where most of the people encouraging you to go there rarely visit. Ok, maybe that’s not quite true, but they are master marketers.

The economic and social history of our 5th biggest trading partner has been something of a roller coaster ride. Colonisation by the English (although it is generally thought that if it weren’t the English it would have been another nation, so ripe for colonisation Ireland was), the potato famine, the so-called ‘troubles’, or as I prefer to call it, the civil war. There was also suffering as a result of politicians looking the other way while they were getting re-elected as property prices soared, and as a result, a few families were basically given enough rope to hang themselves along with everyone else. These individuals ripped off the nation to such an extent that it was one of the worst hit by the sub-prime crisis. I saw a talk by a very eloquent Shane Ross (Independent Senator) at an Irish International Business Network (IIBN) event, where he gave an impassioned account of the extreme cronyism that had taken hold and would take Ireland years to pay for.

After the crisis, vast numbers left Ireland to seek work elsewhere, in particular, younger people under 25. A bail-out was negotiated and, as Eugene Forde (Counsellor, Economic, Commercial and Finance at the Irish Embassy at the time) told me, they would not yield over the very low Corporation Tax which he said underpinned the whole Irish economy. Yes, companies would relocate if they were forced to raise it by the ECB, and there was no question of that happening. He was right. And now Ireland is one of the fastest recovering, not to say growing, economies in Europe.

Against this backdrop, Ireland is now trying to woo the talent that went overseas to work, right back to the Emerald Isle. They are targeting emigrants in places as far afield as Australia and Canada. Check out pleaseleavecanada.com which sends you to an Irish ad agency keen to recruit. €1,500 in relocation expenses is being offered to nurses who will return to work in Ireland, something perhaps we should have thought of with the shortage of nurses here in the UK! In fact some of them may be nurses working here in the UK.

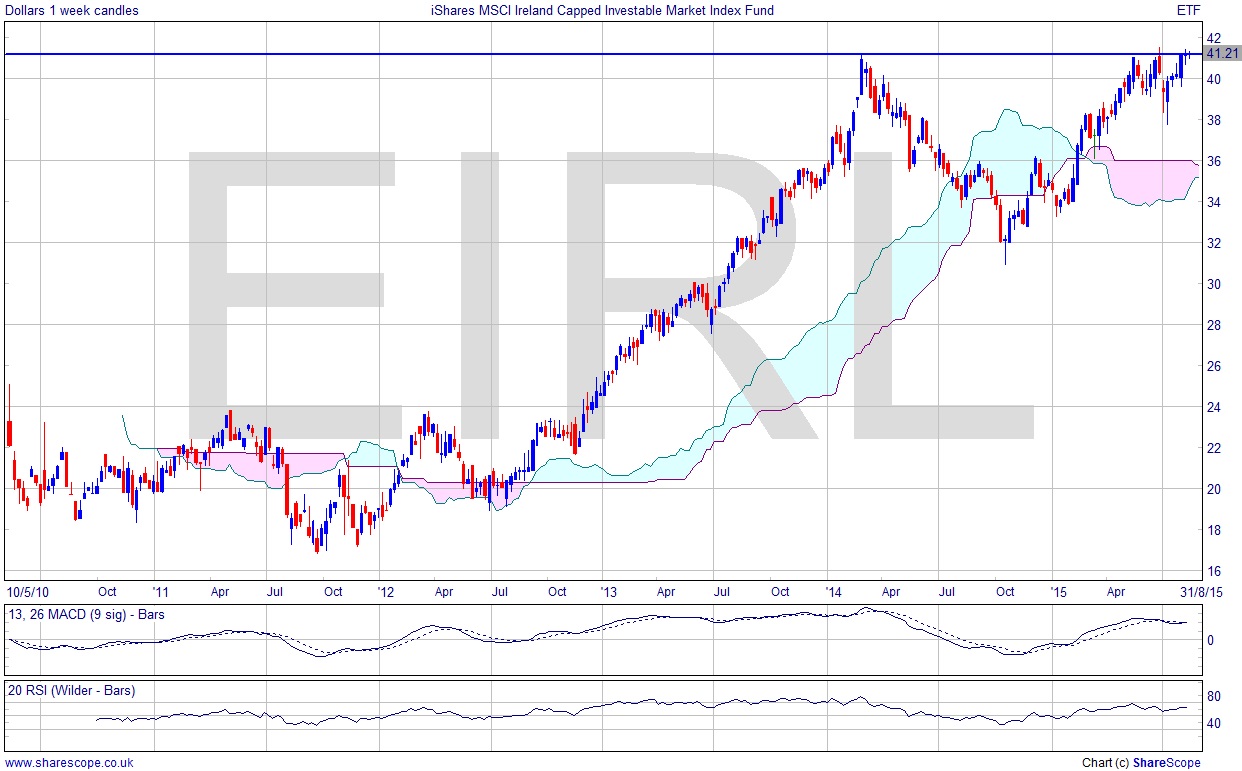

Improving economies with skill shortages are excellent places to look for investment opportunities. There’s only one Irish ETF so far as I know: the snappily titled iShares MSCI Ireland Capped Investible Market Index Fund [EIRL]. What a chart. If Ireland is poised to boom then this chart could go mental. There’s a list of the components and useful info on the iShares.com US site (the listing is in New York). Basically the ETF is taking a running jump at the ATH, and that’s 3 times now. A break upwards could easily see another $10 on the price, or around 20%, the momentum being about $10 per year.

Comments (0)