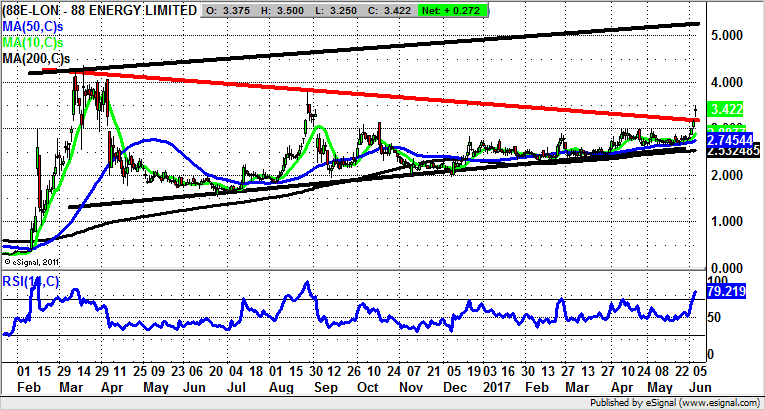

88 Energy: Long-awaited triangle breakout targets 5p

We have been treated to a decent few weeks of newsflow for 88 Energy (LON:88E), with the technical position also backing up the positive move.

One of the most important aspects as far as small cap companies are concerned is the need for a regular flow of significant positive news in order to drive liquidity. This is especially to instil loyalty amongst the existing shareholders. Unfortunately, even with the best will in the world, newsflow is not something which can be turned on or off like a tap.

But at least in the case of 88 Energy it has clearly been making significant progress with regard to its latest Alaska well. Indeed, over the past few weeks the company has said that it is making significant progress and that the Icewine-2 well is on schedule.

The company has been advancing to production testing over the past few weeks, and on the basis that it could proceed to target flow testing for late in June or going into July. As for what the company said today, this centres on preparing for Icewine-2 fracking after the completion of log analysis.

The additional good news is that this appears to have delivered a decent technical breakthrough, with the shares breaking out of their post 2016 triangle formation at 3.2p. The message now is that while there is no sustained price action below the broken line the upside here could be a 2016 resistance line projection as high as 5p over the next 3-4 months. Only back below the 50 day moving average zone at 2.73p would now be outright negative for 88 Energy.

Comments (0)