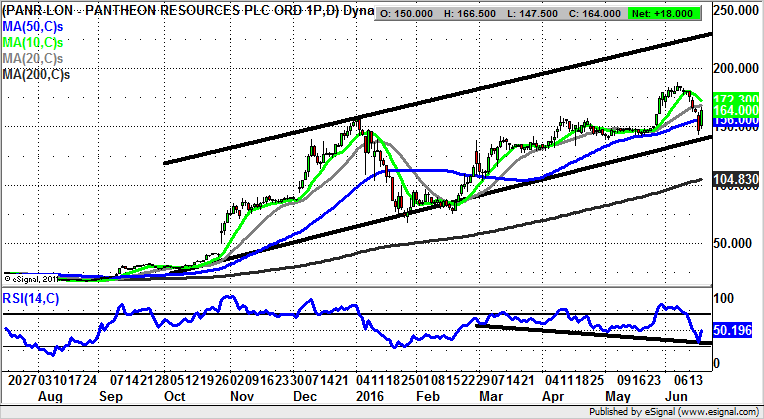

Chart of the Day: Pantheon Resources

Given the way that Pantheon Resources has been something of a “hero” play for private investors, it seems churlish not to take a look at the charting position in the wake of what appears to be a rebound from the floor of the recent trading range.

Pantheon Resources (PANR): Price Channel Target at 230p

Pantheon Resources has been something of a casebook study of a company which has matched or exceeded expectations, even the traditionally very high ones of private investors. Indeed, what can be said is that very few plays manage to deliver in terms of the strict timeframe (today) and the potential upside (ten bagger) that the punters tend to demand. What is evident on the daily chart here is not only the progression within a rising trend channel which can be drawn in from as long ago as October last year, but also the way that since September last year the shares have remained above or very much above the 200 day moving average, now at 104p. In such circumstances one can normally get away with projecting the most optimistic upside on the price action, with the hope here being that the top of last year’s trend channel at 230p should be delivered over the next 1-2 months. At this stage only cautious traders would wait on a clearance of the 10 day moving average at 172p before pressing the buy button. The stop loss on the buy argument is a weekly close back below the present June intraday low at 143p.

Comments (0)