Zak’s Daily Round-Up: ITV, MERL, RR., SPD, FXPO and KEFI

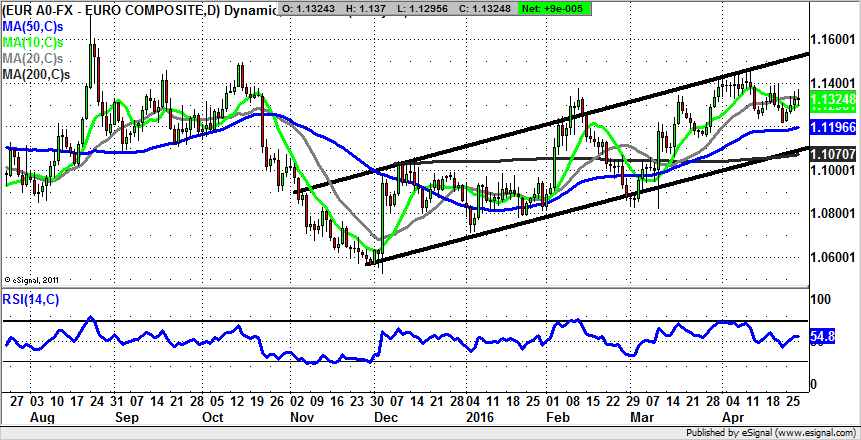

Market Direction: Euro/Dollar $1.15 Back In Focus

ITV (ITV): Initial Sub 220p Support

Shares of ITV have been both interesting and difficult to get a handle on from a technical perspective over the recent past, with the latest gap to the downside underlining the issues facing those attempting to make money out of the price action. That said, it has to be admitted that trying to be too clever with regard to anticipating the next move in the stock could be part of the reason for the problems here. This is said on the basis that it is possible to draw a falling trend channel on the daily chart from as long ago as the beginning of the year. The floor of the channel runs at 217p, which coincidentally is the low in the wake of the latest decline for the shares. The hope now would be that despite the gap to the downside we shall see at least an initial dead cat bounce that would cause the stock to partially or even fully fill the gap up to 233p. The nightmare scenario is that shares of ITV will top out at or below the initial April floor at 225p. If this is the case one would fear that a deeper dive, and indeed, a long term negative turnaround is on its way here – back towards 200p.

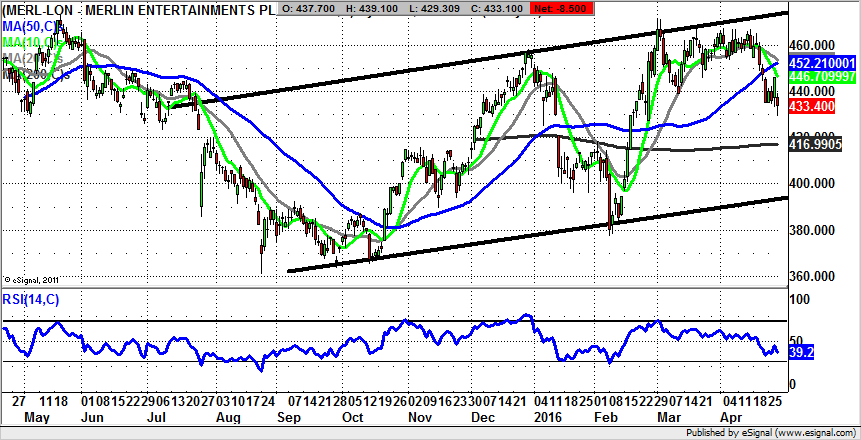

Merlin Entertainments (MERL): Extended Top through 460p

In terms of newsflow over the past year it has been a miserable time for Merlin Entertainments, after the issues with safety. This is mirrored to some extent by the present picture on the daily chart of the stock. Here we can see a rising trend channel in place since as long ago as July, with the floor of the channel way down at 395p. This is in theory the downside target for the shares on a technical basis, especially while there is no end of day close back above the 50 day moving average now at 452p. Even if this feature is broken it can be seen how there has been an extended top over 460p, so that the bulls have been struggling since at least the beginning of last month.

Rolls-Royce (RR.): Above 200 Day Line Targets 800p

While it may still be a little early to crack open the Champagne, what can be seen on the daily chart of Rolls-Royce is that the tentative recovery for the jet engine maker seems to be well on track. This is said especially in the wake of an extended recovery of the 200 day moving average now at 660p, and the rebound off an extended uptrend line in the RSI window at 50 yesterday. The feelings of positivity are completed by both a hammer candle yesterday off the 200 day moving average and the rebound off the floor of a rising trend channel which can be drawn in from as long ago as the end of November. The likelihood is that provided there is no end of day close back below the 200 day line we shall be treated to a best case scenario target here as high as the 2015 price channel top of 800p over the next 1-2 months.

Sports Direct (SPD): Above 50 Day Line Suggests 540p

It has not exactly been an easy few months for bulls of Sports Direct, especially given the way that the stock fell with the market to start 2016, adding to the woes of December. But it does appear that there are green shoots of recovery here. This is because we have an extended break back above the 50 day moving average now at 394p. Such moves are very often a leading indicator on sustained recovery, with the view at this stage being that while there is no end of day close back below the 50 day line the upside here could be as great as the top of a rising trend channel from January at 540p. Only cautious traders would wait on a clearance of the top of a March gap at 418p on an end of day close basis before taking the plunge on the upside.

Small Caps

Ferrexpo (FXPO): 50 Plus Seen While Above 200 Day Line

Of course, the year to date really has been the year of the mining stocks recovery, with not too much differentiation made between those companies focused on the industrial metals and those on the precious metals side. This may not be intuitive, but at least it can be implied that the market was so short of the whole sector that almost everything has been squeezed higher. This is especially the case with Ferrexpo, which was one of the stocks looking down the barrel, as recently as the end of January. Since then the shares recovered their 50 day moving average in the middle of February, with the big plus since then being the way that this feature has essentially been held ever since. Indeed, there have been a couple of major bounces off this feature last month and for April. The best that can be said currently is that we are looking at a bull flag consolidation which is located either side of the 200 day moving average now at 35p. What can be said in the wake of the latest price action is that one would expect to see a fresh leg to the upside within a rising trend channel from December. This is especially the case while there is no end of day close back below the 200 day line. The technical target as long as Ferrexpo holds the key moving average is as high as 55p – the December price channel top.

Kefi Minerals (KEFI): 1p Now On Tap

It would appear we can upgrade the latest on the technicals from Kefi given the vertical push through the 200 day moving average at 0.45p. This leads us to believe there is enough momentum to ensure that while there is no weekly close back below this feature the upside for the shares could be towards 1p – the top of a rising trend channel from August over the next 1-2 months.

Comments (0)