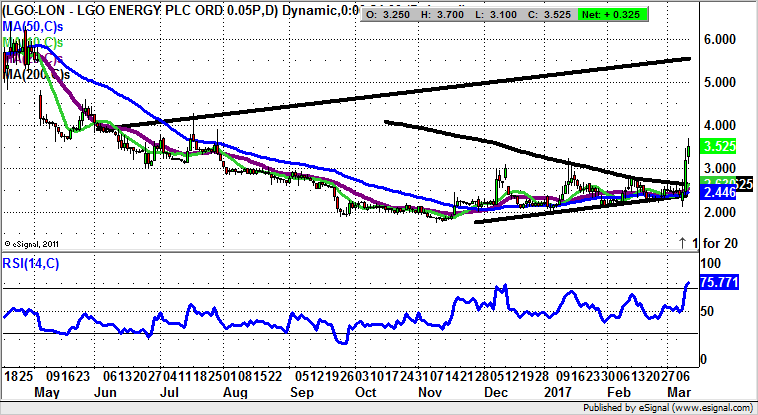

LGO Energy: Weekly clearance of 200 day line targets 5.5p

The old Lenigas & Oil was the stock that got me into the area of small caps charting. So it is appropriate to revisit its new manifestation at a time when the shares look to be ready to rebound.

Although we are now in a very healthy looking period for small caps shares – especially since the start of the year – one still shies away from delivering the most optimistic calls, if only on force of habit. In the case of LGO Energy (LON:LGO) we have a situation where those good people at VSA Capital have suggested that the share price here could rise as much as 800%. Presumably, given long enough, one could say this for many a company. However, from a charting perspective I like to limit such calls to between 50% and 100% at most.

The reason behind the big call from VSA is their suggestion of the financial restructuring of the company and developments at the key Goudron Field. This may be correct, but for our purposes all we would like as a takeaway is that the fundamentals here are stable, and the latest charting breakout could have legs.

What can be seen here is a decent weekly close above the 200 day moving average at 2.65p, with the message being that while there is no break back below this, and especially the former post December resistance at 3p, we should be treated to significant further upside. The favoured destination over the next 1-2 months is the top of a rising trend channel at June at 5.5p.

Comments (0)