Are these some of the most exotic ETFs around?

In the last few years, passive index investing has grown significantly, as those involved in the investment business try to capitalise on the growing demand for alternative ways of building investment portfolios that bypass both the high fees incurred in active fund management and the knowledge (and money) required to build a well-diversified portfolio.

At the end of 2016, the assets under management of exchange-trade funds (ETFs) amounted to $571bn and $2.54tn in Europe and the US respectively. According to data released by the consultancy firm ETFGI, 90 per cent of net fund flows in the US in the past three years have been into passive funds. Many believe the industry will grow to $5tn in the US by 2020, which would see the ETF sector surpass the hedge fund industry.

Modern investors are like modern consumers: they do their homework before shopping. Informed individuals now have access to all the data they need in a centralised place: the internet. They are no longer willing to pay for full service. For this reason, and also because most hedge funds are unable to consistently beat the market, the ETF industry proliferated and expanded its offer of index investing.

A few years ago, ETFs were a niche market which began life by offering the small investor a way of building a diversified portfolio. Instead of buying each of the 500 stocks that are part of the S&P 500, an investor could buy a single share of the SPDR S&P 500 ETF (NYSEARCA:SPY), which closely mirrors the S&P 500 performance for a small 0.10% fee.

The offer expanded into international indices, indices differentiating between small and large capitalisations, and indices differentiating between asset classes. An investor can buy a whole portfolio of commodities through the iShares S&P GSCI Commodity-Indexed ETF (NYSEARCA:GSG), or just invest in gold through the SPDR Gold Trust ETF (NYSEARCA:GLD). The offer later expanded to allow investors to be able to short gold and leverage gold performance with inverse and leveraged ETFs respectively. The current ETF offer is pretty much unlimited, and investors can get exposure to some rather quirky investment themes.

The current ETF offer is pretty much unlimited, and investors can get exposure to some rather quirky investment themes.

A few months ago, I wrote about factor ETFs. These ETFs decompose market returns in an alternative way to traditional asset classes. Instead of commodities, equities, and bonds, we get value, momentum, quality and size as investing themes. These factors offer a very refined way of managing risk, which is not easily achieved without using such ETFs.

The opportunities unlocked by ETFs are huge and I myself usually refer my readers to some ETF investments in each of my blogs. The main reason for this is because ETFs make it easier to play an investment theme, in particular when the theme stems from macro events. If I think the oil market is going down, it’s easier to pick an oil ETF than to select some particular stocks from the industry. Most retail investors just don’t have the tools and resources (data, time, patience, knowledge) to select individual stocks to build a position around some macro theme.

In today’s article I’m going to look into three exotic investment themes that make a lot of sense and that many investors don’t know about. The first one is obesity.

Invest in the fight against obesity

Janus Capital offers such an exotic opportunity, allowing investors to benefit from obesity. Well, to be precise it is not about benefiting from obesity but rather benefiting from the fight against it, by building a portfolio of companies that dedicate their time to fighting the global obesity epidemic.

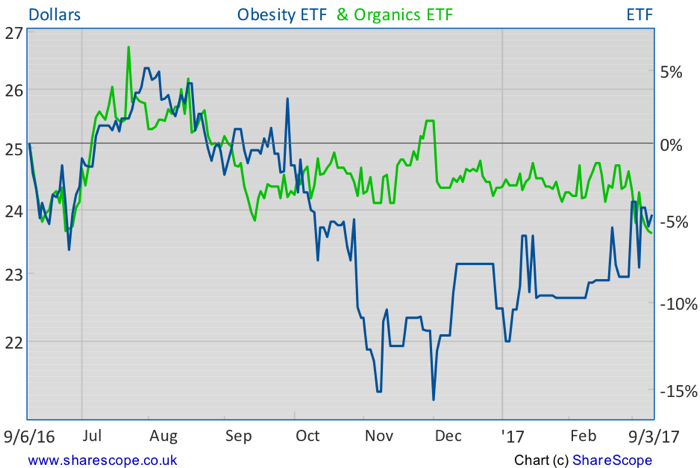

The Obesity ETF (NASDAQ:SLIM) was created in mid-2016 and has total net assets around $2.4m. Its main goal is to track the performance of the Solactive Obesity Index. This ETF purchases equity in companies that provide treatment and care for obesity and that are focused on either fighting obesity or on fighting obesity-induced diseases. This includes companies not only providing weight loss programmes and supplements but also dedicated to the treatment and cure of diabetes, high blood pressure, cholesterol, and heart disease.

While many readers may deem the industry not significant enough to be worthy of an investment, that couldn’t be further from reality. Data from the World Health Organisation show that globally 10% of men and 14% of women are classified as obese, with the numbers expected to climb to 18% and 21% respectively by 2025. In the US alone, 75% of men and 67% of women aged 25 or over are either overweight or obese.

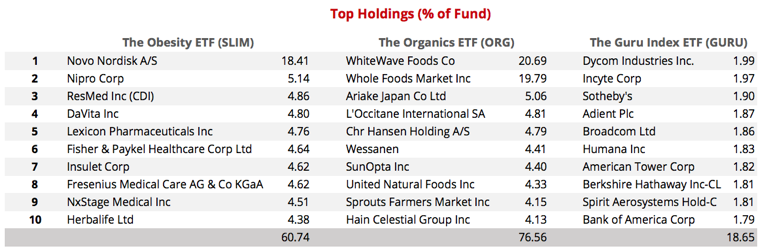

While the resources pledged to cancer research are huge, the same isn’t true of obesity. But health data show that there are more people dying of heart disease than of cancer, and obesity is the main cause of heart problems. Because the obesity problem is big and the resources pledged to the market are not of the same magnitude, investors may well reap more benefits from this industry than from other, bigger health themes. For those willing to gain exposure to the industry, the Obesity ETF from Janus Capital is a good option. The fund has 40 holdings as of today, with 61% of its assets concentrated in the top 10 holdings.

The second passive index I want to look at today is related to organic food and it is also provided by Janus Capital. The Organics ETF (NASDAQ:ORG) tracks the Solactive Organic Food Performance Index and invests in companies that are engaged in the business of producing, distributing, marketing, and/or selling organic products.

The extensive use of pesticides and toxins is a reason for concern today. The rapid expansion of some diseases is increasing people’s awareness of the health risks of modern agriculture and food processing, which is contributing to the rise in demand for organic products. This is not just about food and beverages; this is also about non-food products like cosmetics and personal care items. Many farms are reverting to organic, as global demand for organic products is expected to grow at an annual pace of 16% through to 2020, and possibly beyond. The Organics ETF offers exposure to 27 stocks, with its top 10 holdings accounting for 77% of total assets under management.

My last take is on a very different theme. It is about mirroring the performance of the smart money. The main idea behind it is that hedge funds are better informed than retail investors as they have larger resources available to help with decision making.

So, instead of trying to hand-pick equities or to mirror the market, why not imitate what the best hedge funds do? That is the main goal of the Global X Guru Index ETF (NYSEARCA:GURU), which tracks the performance of the Solactive Guru Index. Launched in June 2012, and now with over $500m in assets under management, the ETF was ranked as the “best niche ETF” in 2013 and is much larger than the ETFs mentioned above.

As suggested by its name, the Global X Guru ETF tracks the price movements of the top equity holdings of a select group of hedge fund managers – the gurus – based on their reported quarterly regulatory filings (the well-known 13F filings). At the end of a quarter, when the filings arrive at the SEC, the GURU ETF is recomposed. From a list of the top hedge funds, a filter is applied to seek out concentrated equity positions with lower turnover and long holding periods. The ETF then selects the top holdings from each of the selected hedge funds and gives them an equal weighting.

The idea behind this strategy is good in principle, but still relies in the premise that hedge funds consistently beat the market, which academic research has shown not to be the case. The truth is that the fund tries to select only the best hedge funds; but even were that to provide an edge, there is one serious shortcoming: the 13F filings are made public more than one month after the trades occurred, which may significantly reduce potential returns. In any case, the GURU ETF has been showing some good performance and is an option to keep handy.

In summary, for those not willing to pay a 2/20 fee structure there are very cheap ways of following macro trends or tracking very specific market niches. With the advent of ETF investing, retail investors can achieve something they couldn’t before – cheap diversification. Through buying a single share in the Obesity ETF, an investor needs less than $25 to get exposure to 40 different stocks. Without ETFs that wouldn’t be possible without a large sum of cash.

Comments (0)