Gold: The struggle for support risks another $100 drop

Given that 2016 was the year of the great mining sector revival, the worst case scenario would be that the latest fall in precious metals brings that revival to an end.

Ahead of the US Presidential Election it appeared that we had a good indicator of the result – better than the pollsters in fact! Below $1,300 gold suggested Clinton would win, and above it suggested Mr Trump could make it to the White House.

In the end we had a mix of the two. First, gold shot up towards $1,340 as it was revealed that Donald Trump had won Florida. But then as he began his acceptance speech without threatening to nuke the world, gold began to sell off. And it is still doing so. His policies are regarded as being good for the US Dollar, and hence bad for gold.

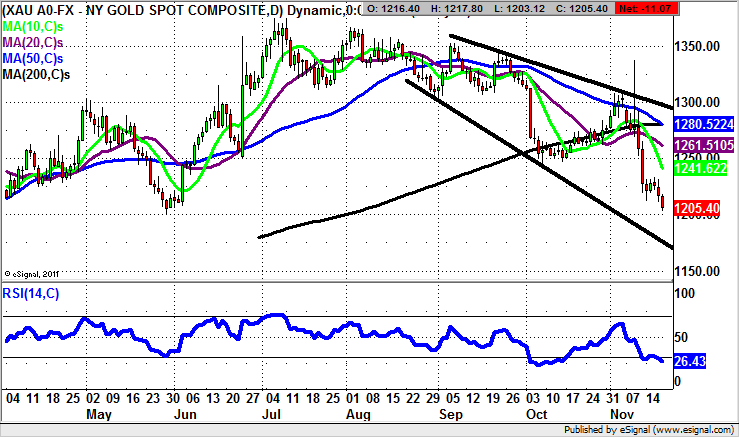

The daily chart shows the pain the bulls have been in, with the spike and retreat a quite dramatic one over the past 10 days. The problem evident now is that this decline has barely been arrested by the main 2016 support area down to $1,200, and it would appear that unless something special happens, this will give way too.

From a technical trading perspective the risk is that while there is no daily close back above recent $1,230 resistance, the downside here over the next 4-6 weeks could be towards the $1,113 area – the initial resistance of 2016.

Comments (0)