Jubilee Platinum (JLP): 4.5p target after the latest chromite news

Jubilee Platinum has been a private investor favourite for longer than most might have anticipated. However, it looks as though the waiting game may finally be over.

It may not be too much of a revelation that for a mining company to actually extract something out of the ground can very often be something of a transformational event from an investment perspective. This may sound like it is stating the obvious. But unfortunately in the small caps space a rather low proportion of companies actually make it to the promised land of investors being able to see the metal they are searching for.

In the case of Jubilee Platinum though, we have been treated to a doubling of chromite sales in the third quarter, which suggests that the momentum really is behind the bulls on a fundamental basis.

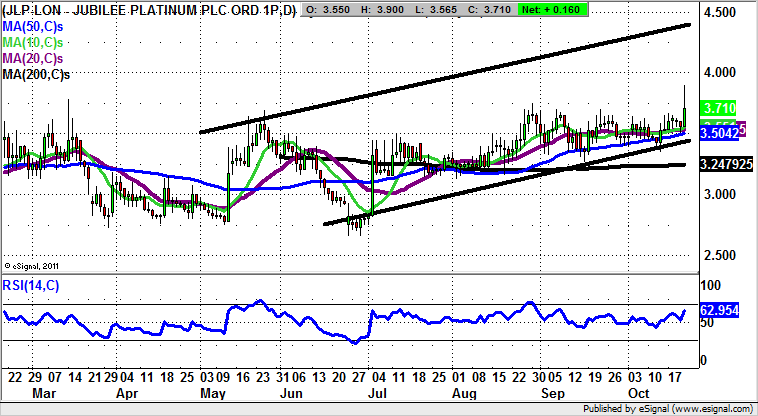

The good news in addition to this is that we can see from the daily chart how there is also momentum in terms of the price action. It is possible to draw a rising trend channel from as long ago as the end of May. The floor of the channel currently runs just below the 50 day moving average at 3.50p.

This leads us to believe that while above the 50 day line on a weekly close basis the shares should be heading as high as the 2016 resistance line projection at 4.5p as soon as the end of next month. Indeed, only back below the 200 day moving average at 3.24p would really delay the upside argument.

This is not a mining company. They are minerals processing and are doing something completely different from 18 months ago which was based on furnace smelting. Why should the graph link the two? its witchcraft? Jubilee are still in development and the platinum plant and its extraction rates are all important, as there has been no platinum revenues so far. If JBL own all the platinum concentrate extracted then sales will project to a much more valuable company