Zak’s Daily Round-Up: BA., BKG, ABDP, APH and ASC

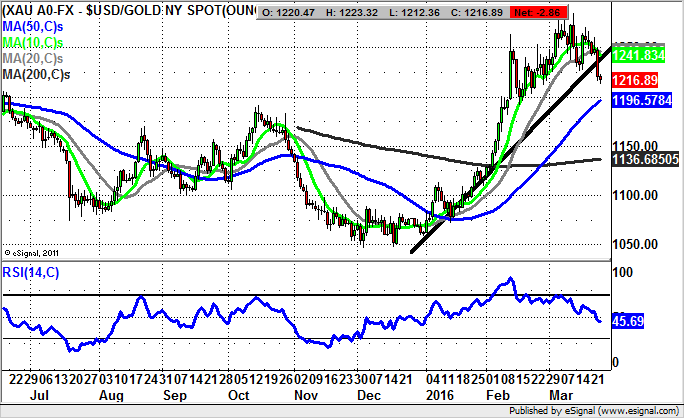

Market Direction: Gold below $1,230 Risks $1,190

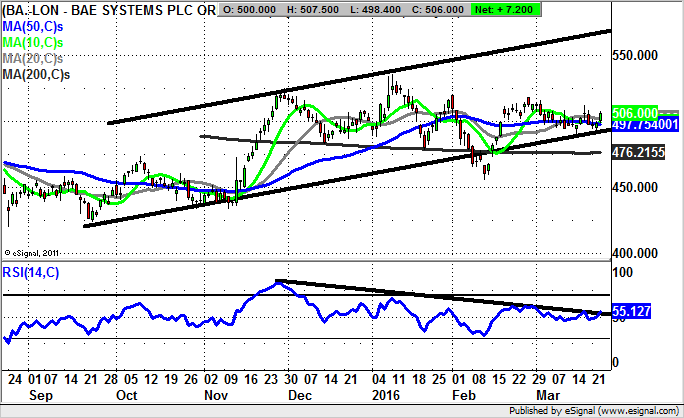

BAE Systems (BA.): Above 50 Day Line Targets 570p

BAE Systems is a stock which continues to be one of the most viewed by private investors – in terms of them wanting to check where the share price is. This places it above the likes of the High Street bank stocks and even miners, which have been soaring of late. Clearly, some people do take the view that something interesting in a positive way could be forthcoming. From a technical perspective it can be seen how there has been a rising trend channel in place on the daily chart since September, with the floor of the channel currently running at the 50 day moving average at 497p. This feature can be regarded as the end of day close stop loss on the buy argument, although longer term investors may wish to use the 200 day moving average at 476p as their particular money management point. The reward in either instance is the top of last year’s price channel currently pointing as high as 570p. The time frame on such a move is expected to be over the next 1-2 months. But perhaps from a technical perspective it may be said that the most intriguing aspect here is the way one can draw an extended resistance line in the RSI window from the end of November. The idea from a technician’s perspective is that when/if the resistance line breaks we shall have something of a log jam effect, and an acceleration to the upside for BAE shares. This may explain the persistent interest in the stock price at the moment. Indeed, cautious bulls may wish to see an end of day close for the RSI clear of say 57/100, before taking the plunge on the long side.

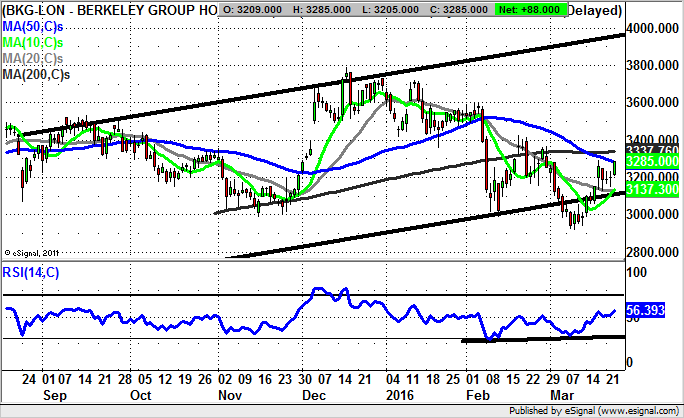

Berkeley Group (BKG): Above 3,100p Suggests 3,600p Initially

The question of whether the housebuilders will continue to flourish over the near term seems to be one which most people agree on in the affirmative. However, the issue of whether the current valuations of leading plays such as Berkeley Group are fair or excessive is rather more contentious. However, it does help that for this particular stock we are trading in the aftermath of quite a chunky decline from near 3,800p in December to below 3,000p to start this month. Indeed, the recovery we have seen so far this month from below 3,000p has been a clear bear trap rebound from under post November support at 2,985p. The view now is therefore that at least while the stock remains above the floor of the rising trend channel from the September/10 day moving average at 3,137p, one would be looking for further significant upside. The favoured initial destination at this point is seen as being the former February peak at 3,603p, a process which should be accelerated by a quick clearance of the 200 day moving average now at 3,337p over the next few sessions. The RSI rebound above the neutral 50 level to 56 is a leading indicator on potential upside, and should reassure most traders that Berkeley Group is ready to rehabilitate its bull run.

Small Caps Focus

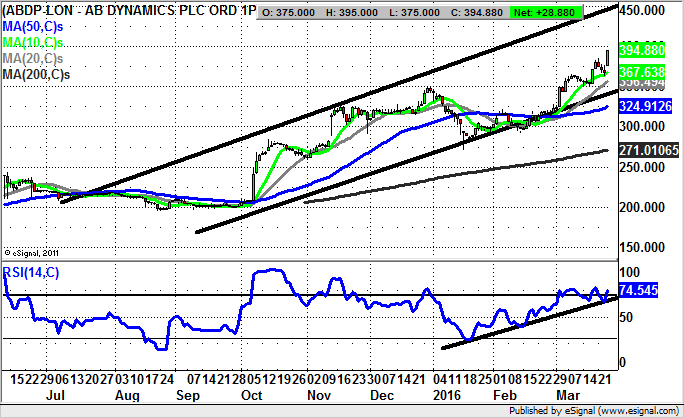

AB Dynamics (ABDP): Breakout towards 455p

It may be interesting to note that among the small caps it is usually the penny stocks which have the share price trajectory of AB Dynamics currently. This consists of a blockbusting bull run breakout which has been in place since early October. The vehicle for the ascent has been a rising trend channel which one can draw from as long ago as July. This has its floor level with the present position of the 20 day moving average at 356p, which suggests that at least while there is no end of day close back below the 20 day line we should continue to see an acceleration to the upside here. The favoured destination over the next 4-6 weeks is seen as being as high as the 2015 resistance line projection currently pointing as high as 455p. In the meantime, any dip back towards the area of the last March resistance at 385p is regarded as a buying opportunity, especially as it would cool off the present overbought RSI reading at 74/100.

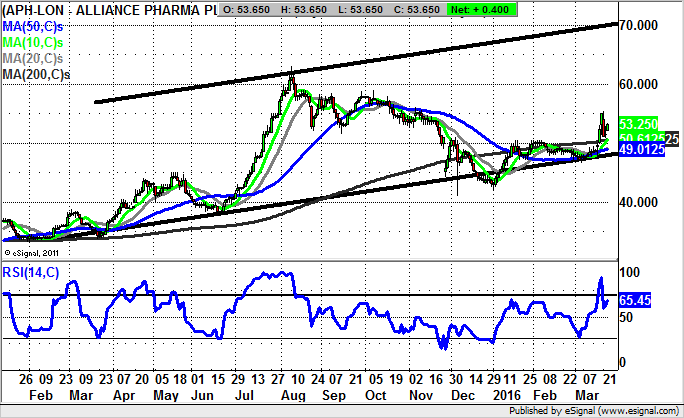

Alliance Pharma (APH): Gap through 200 Day Line Targets 70p

On the face of it some might think that Alliance Pharma is not the most exciting prospect on the stock market. But closer inspection of the recent price action would suggest otherwise. The reason for coming to such a conclusion is because we have all the near-term moving averages rising, and have just been treated to a gap to the upside. This has been delivered through the 200 day moving average at 50.6p over the past week. The additional bonus is the way that since the 200 day line was broken a very bullish looking flag consolidation has formed. This should be enough to take the stock up towards the top of a wide rising trend channel, which has been in place since as long ago as this time last year. The top of the channel has its resistance line projection pointing as high as 70p. The timeframe on such a move is regarded as being the next 1-2 months. Only cautious traders would wait on a clearance of the post November resistance at 55p before pressing the buy button.

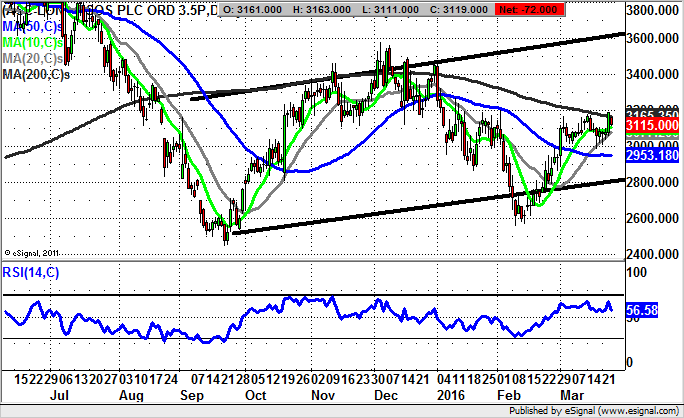

ASOS (ASC): Above 200 Day Line Targets 3,500p Plus

Given the way that even companies who could previously walk on water in the retail space, like Next (NXT), are having their issues at the moment, it is perhaps not too surprising that the likes of ASOS are seeing their shares in consolidation mode. Nevertheless, after the latest extended basing towards 2,500p since the autumn we are looking to the 200 day moving average at 3,165p as a momentum buy trigger. Above this on an end of day close stop loss basis targets a return to the former December resistance at 3,500p plus.

Comments (0)