Some Notes from Underground

I discuss Asiamet Resources (ARS), Solomon Gold (SOLG), and Kefi Minerals (KEFI)…

Share Spikes? Don’t get Skewered

Share spikes! They happen all the time, especially among small caps and miners. The first thing to say is that practically no-one ever gets out at the top. Generally only a very few trades (spurred by the foolish ‘last buyer’) go through followed instantly by a nimble-footed savvy sale and then rapidly by other profit takers. In all, the volume is usually tiny. Such spikes can’t be representative at all of a share’s behaviour.

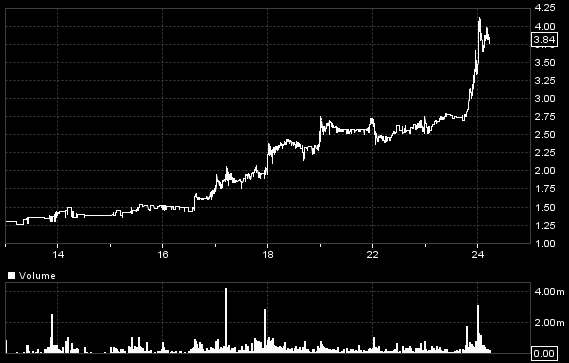

I discussed recent case in point Sirius Minerals (AIM:SSX) last week. This week we’ve seen Asiamet Resources ((AIM:ARS) I hope that mnemonic doesn’t turn out to be apt) jump 160% so far in a week, to 3.8p (the last spike was 4.3p 18 months ago), with the first PEA for its Beruang Kanan Main (“BKM’) copper deposit on Kalimantan Island in Indonesia – which is expanding rapidly in size as exploration drilling continues – expected any time soon. Maybe investors have been influenced by ProActive Investors’ quoting the CEO as ‘expecting the PEA to show “valuations at many multiples” of current share price’.

Asiamet Resources – week to March 24th 2016

But does he mean “share price”? Or does he actually mean “market capitalisation”? Many companies use the term “many times”, but they can be weasel words (“company maker” is another one) if, as has been the case with so many of the miners I’ve discussed that, while expansion in size or value to match that of its asset often does come about, it is usually by way of an increase in shares in issue and not by any increase in the share price. Instead, all too often for many junior miners I’ve discussed, a drastically falling share price accompanies a drastic increase in issued shares. (See the latest, below, on serial offender Kefi Minerals (KEFI).)

The fact is that no company can know by what means the market will adjust its capitalisation to match any increase in its ‘value’. It depends on the state of the market at the time of the necessary capital raises, whether the shares it has to issue to bring about that increase in value will be at a high or a low price.

Anyway, back to ARS, because it illustrates another twist in the junior miner valuation minefield I’ve been trying to help conduct readers through. Its latest resource statement for BKM reads “at a 0.5% copper reporting cut-off, Inferred and Indicated resources total 584 Mlbs”. At the present $2.3/lb copper price that gives an ‘in-ground’ value of $1.34bn. Taking 1% of that which (for the moment) I’ve argued is how the stock market will value it gives $13.4m, or £9.5m. Asiamet’s 619m fully diluted shares at today’s 3.85p are valued at £23.8m.

But that’s not all. Any mine will be a shallow open pit. Mining at the 0.7% copper grade ought to be fairly low cost, so it would be fair to attribute a higher ‘in-ground’ valuation than 1%. But how high?

And what about that ‘cut-off’ grade? It is the grade below which it won’t be economical to mine, so all ore below that grade is omitted from the calculation. If the assumed cut-off is 0.2% instead of 0.5%, the resource would jump by 52% to 888Mlb, and if it is assumed to be 0.7% it would fall to 304Mlb – i.e. a three-fold difference in the ‘resource’ – so which figure do we take? Details in the technical report show that a 0.2% grade cut-off is the preferred ‘base case’ – i.e. considered to be reliable after a preliminary look at the mining plan, except that the copper price assumed in the calculation is $3/lb instead of $2.3/lb as of now. That will increase the required economical grade, and therefore the ‘base’ case would tend more towards 0.5%, which gives the $1.34bn ‘in-ground’ value that I think should be used.

However, even that is not all. A ‘resource’ actually has no value at all. It is merely a measure of all the ore in the ground. The only part of it of any value will be ‘the mineable reserve’ – i.e. that part of the ore that will be worth more than the cost of getting it out and processing it. And that depends on other assumptions that only the mining engineers will know when they produce their more detailed plans and economic analyses. Usually the ‘reserve’ is between 1/2 and 2/3 of the ‘resource’. So, even if we accord a 3% valuation (recent transactions for small goldies have been less than 3% of the gold price) to ARS’s ‘in-ground’ copper ‘resource’ at the 0.5% cut-off’s 594Mlbs, an appropriate market value for its shares would be £9.5m x 3 x 2/3 = £19m.

But it is the PEA which will count more among the knowledgeable, rather than ‘in-ground’ guesses, and they will take more notice of the significant figure at this stage which is the capital cost in relation to ARS’s market cap. With a shallow open pit, the capex might be quite low, while the IRR (which will dictate the ease of bank funding) should be quite high.

We’ll have to wait and see. No doubt the ‘spike’ when it comes (yesterday, in a VoxMarkets podcast, the CEO was pushing ARS through an organisation called ‘Share Pickers’ – who have had to ask him what a PEA is, and what ‘monetising’ means) might be rather higher than the as-I-write 3.8p. But don’t be part of the ill-informed and get skewered – if only because miners at Asiamet’s stage will take advantage of a share spike to come to investors for more cash. ARS does have some other assets in copper and gold, potentially larger but at an earlier stage, and while the enthusiasts will throw these into the pot to justify the value they think they see, at this stage it is only BKM which the professionals will consider – and they will eventually control how this current share spike lives and dies.

Talking of share spikes, Solomon Gold (SOLG) experienced the mother of such back in 2010, as its then exploration in the Solomon Islands looked (momentarily) like delivering the goods. But that was also in the run up to the short-lived mining rally in early 2011. The spike in the shares over just a few days took them from the low 30s to over 80p where they hung for a day or two with a more than 100m trading volume before collapsing down to the 40s – which were never to be seen again.

Now, their current strength at 4p looks healthier, having traded at good volumes on a 2.5p base. I’m no chartist, but going by the price/volume relationship in the accompanying chart, if they break above 4.5p I would have thought the next stop is in the 7.5p area. Needless to say, however, that historic 80p (to which some hopefuls on the bulletin boards wistfully look back) is completely out of the question at this early stage, if only because there are many more shares in issue. And SOLG will miss a trick if it doesn’t take advantage and come to shareholders for the funds to pay for drilling. Some observers hope this will be avoided if a white knight exploration partner with deep pockets comes aboard. Whether the resulting dilution is better for existing shareholders than would be a share placing depends on the numbers. In either case, however, I think dilution in whatever form will be a reasonable price to pay for the additional value that the drilling it will pay for looks like creating.

Solomon Gold – Share price/volume relationship 2 yrs to March 2016

But what to say about Kefi Minerals? Having led investors to believe – less than three months ago – there would be no more share dilution before funding for its Tulu Kafi Mine is fully sorted sometime around July, what does it do? It comes up with another, fairly whopping, 20% addition to issued shares at a paltry 3.5p (admittedly not at a discount), which explains why my suggestion on 5th February that Kefi might, at last, be ready to spark into life hasn’t happened yet. Investors were obviously right to be cautious. A leopard doesn’t change its spots after all. But Oracle Fund Management has coughed up to maintain its stake. So maybe the share price engine will get going eventually.

The placing, by only one of its two brokers, Brandon Hill (who gets free warrants), leads us to suppose that other joint broker Beaufort – having so recently hosted the presentation hinting at no further dilution – had the conscience to bow out – or maybe they couldn’t manage it. Take your pick.

Needless to say, my valuation per share now reduces by 17%, self-inflicted by the management, although compensated by a 30% increase in the residual NPV stemming from the lucky $150 rise in the gold price.

Comments (0)