Market slump: take your pick as to why

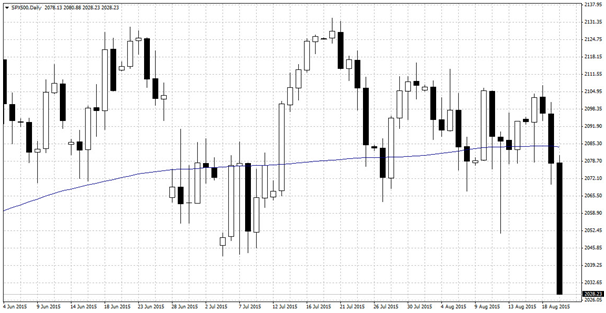

As of Thursday evening, the S&P 500 is reeling from a heavy session that saw the benchmark index hit a six month low and turn negative for 2015.

S&P 500 Daily Chart

You can take your pick as to the reason for the decline – Here are just some of them.

The first and most widely distributed reason for the sell-off is a fear that China’s slow down will have a ripple effect across the world. With eye watering annual growth rates, the Chinese economy has been fuelling growth in many areas, not least in commodities and demand for luxury items such as smart phones. 2015 has seen the worm turn however, with drastic measures introduced to devalue the yuan in a bid to remain competitive. It’s no coincidence that another reason mooted for Thursday’s decline is the fall in Apple’s smartphone sales to China, resulting in a 2% decline.

Another curious reason for the decline is the ongoing concerns over Greek stability. Europe appears to be inching towards an accord, with the Bundestag voting to approve the latest deal. This was until Greek PM Tsipras resigned, triggering snap elections. This activity is curious because throughout the Greek crisis, the euro has had a life of its own while the S&P 500 has had a greater correlation with negative European headlines.

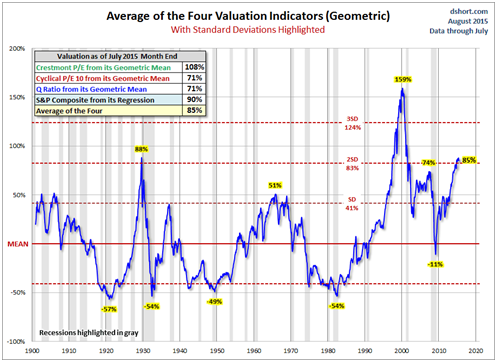

The final and perhaps more telling reason is that stock markets have been expensive for some time. It was a case of when not if markets suffered a decline.

Dshort.com run an excellent monthly summary of current market valuations.

Source: http://www.advisorperspectives.com/dshort/updates/Market-Valuation-Overview.php

This summary compares four well established market valuation metrics, with the stark finding conclusion that stocks are at historically expensive levels only exceeded by the 1930s and the tech bubble. Stock markets can certainly stay expensive for years before correcting, just as the housing market did, but at least we can say that equities were ripe for a pull back.

So what would make a good bet now?

Sadly it’s the case of finding the least bad option. Any commodity heavy currency such as the Australian dollar is best avoided right now, while the US dollar has its own troubles.

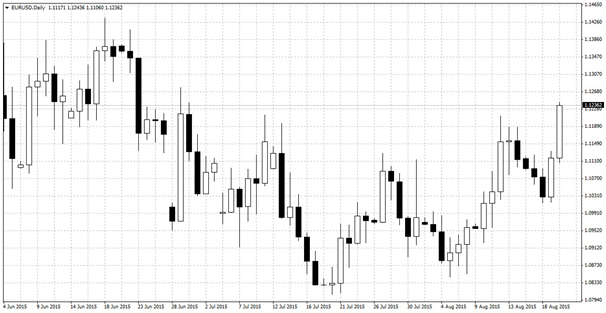

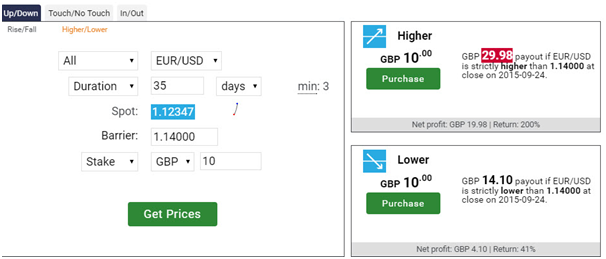

The best of a bad bunch right now might actually be the euro. 2014 saw some sustained selling pressure for the single currency, but the euro has avoided any dramatic collapses throughout the turmoil of 2015. Whether true or not, it seems the market perception is that the euro is insulated against Greece. European interest rates are going nowhere in the short or medium term, but at the same time, US rate rises might just be nudging a few months into the future.

EUR/USD Daily Chart

The euro has shown it can fly in the face of genuine economic and political concerns and this could be enough to support it over the next month or so.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)