Zak’s Daily Round-Up: CAPC, HSBA, RBS, BMR, DJI and SQZ

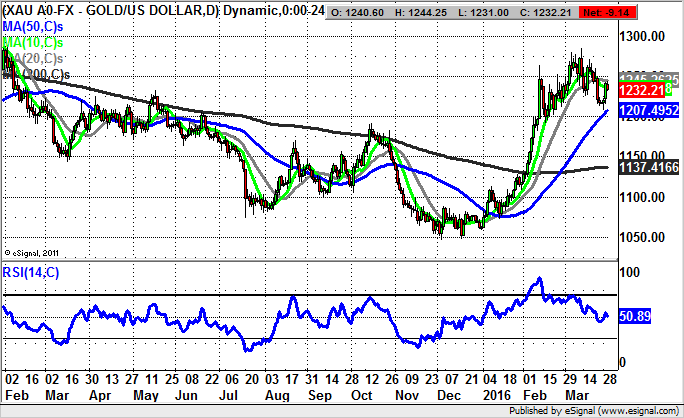

Market Direction: Gold, Bear Trap from below $1,220

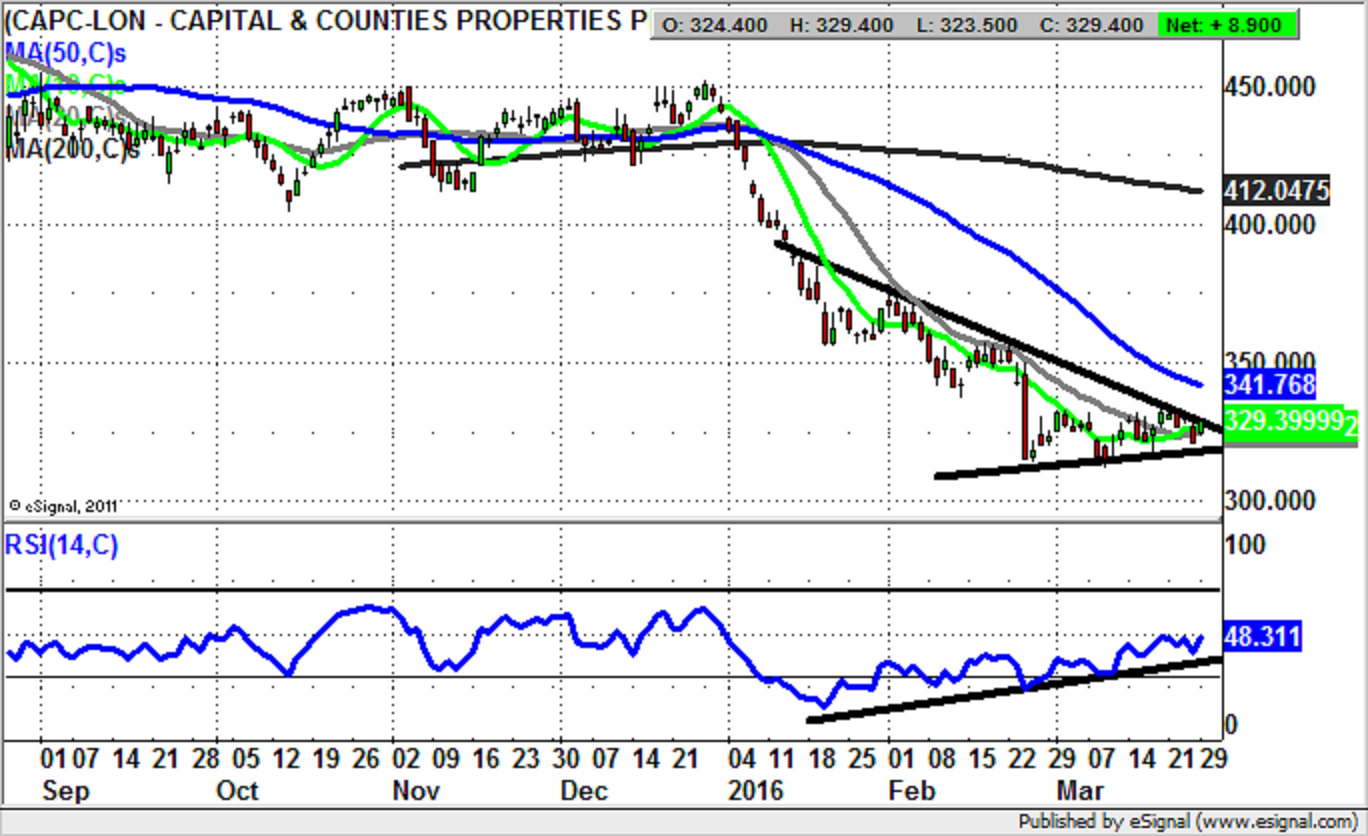

Capital & Counties (CAPC): Ongoing Consolidation

Capital & Counties is a stock which is not necessarily the first that comes to mind as a trading opportunity situation in either direction. However, it can be seen from the daily chart of this company how there has been a consolidation within a triangle formation after a sharp December breakdown. That was in itself a relatively straightforward and predictable occurrence after the rolling top reversal seen in the autumn of last year. During that September–December period there were multiple failures towards the 450p level, after which it was not much of a surprise that the shares gapped down to start this year, with the move underlined by a dead cross sell signal between the 50 day and 200 day moving averages soon after. Moving forward to where we are now at the end of March and it can be seen that there is a tentative basing in the 320p – 340p zone, either side of the 10 day moving average at 329p. But what is likely to be crucial is the way that we have a notional barrier at the 50 day moving average of 341p. At least while the stock remains below this technical feature we can probably still regard these shares as a sell into strength, even though the RSI oscillator has been rising quite healthily over the past few weeks. That said, the downside is now seen as being limited to the lows just below 320p established earlier this year.

HSBC (HSBA): Mid Move Consolidation Ahead of Fresh Falls

It would be pleasant to think that after the extended battering shares of HSBC have been taking over the recent past, we may be due for a period of stability or even outperformance. Unfortunately, as things stand this does not appear to be the case. For instance, March to date has delivered a rare island day reversal for the stock in which there was a failure to breach the 50 day moving average now at 455p. That upside block whereby a stock or market gaps up and then gaps down the next day has caused the shares to ricochet off the top of a falling trend channel which has been in place from as long ago as November. The implication is that provided there is no end of day close back above the 50 day line one would be looking to a journey to the floor of the late November channel as low as 370p. The timeframe on such a move is seen as being the next 1-2 months. In the meantime any strength towards the 450p zone is regarded as a shorting opportunity.

RBS (RBS): Below 50 Day Line Targets 210p

Clearly, on a fundamental basis it could be quite a while before we see any meaningful recovery at RBS – a process which is already over seven years in progress. This sad state of affairs for both shareholders and taxpayers is illustrated on the daily chart where we see the shares declining within a symmetrical triangle with its support line heading as low as 210p. The expectation over the next 2-4 weeks is for the shares to head as low as this number, even if there is then a recovery and the pattern we are witnessing currently is actually a bullish falling wedge.

Small Caps Focus

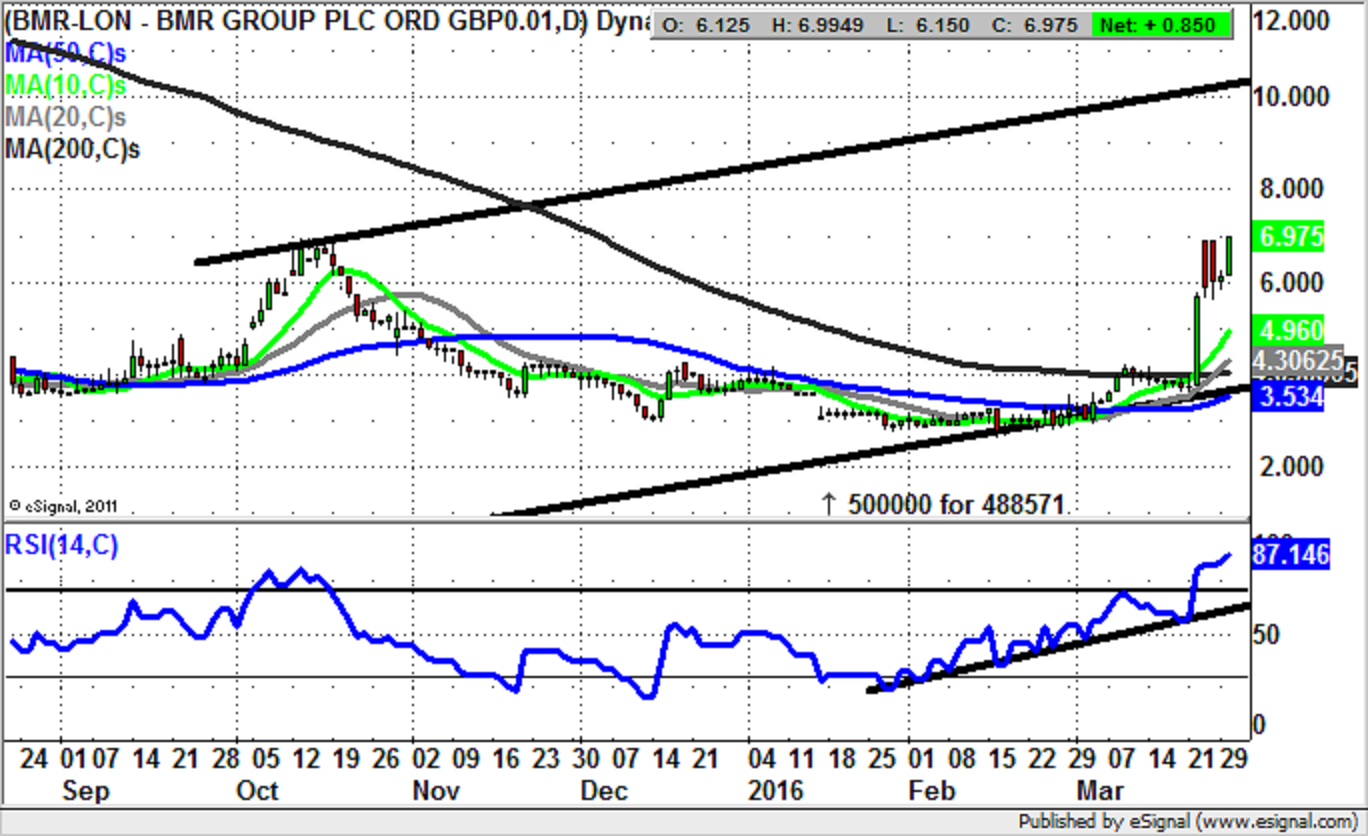

BMR Group (BMR): Bull Flag Breakout Targets 10p

As far as the recent price action of BMR Group is concerned, it would appear that we are looking at a situation where there is a classic bull flag breakout occurring on the snapshot of the daily chart. The good news as far as such setups are concerned is that they are very often mid move consolidations, something which implies that even though we have already seen significant gains here over the near term, there could be more to come. Just how high BMR Group shares could fly on an end of day close above the initial 6.9p March peak is suggested by the top of an October rising trend channel with its resistance line projection currently pointing as high as 10p plus. The timeframe on such a move is regarded as being the next 1-2 months or less.

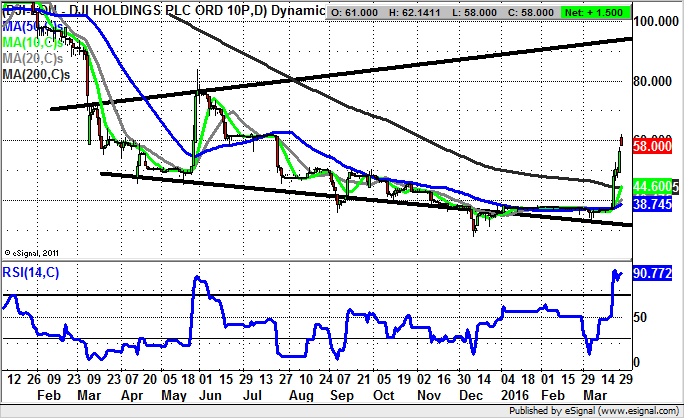

DJI Holdings (DJI): Broadening Triangle Points to 90p Plus

Of course, as many followers of minnows (and perhaps of the financial markets in general) will know, the trend may be your friend but it takes some courage to go long after an extended move. This point is currently being underlined on the daily chart of DJI Holdings where we have seen the stock more than double since December and go into a much overbought state at RSI 90 / 100. However, it can also be seen that with the clearance of the former post August resistance at 50p we have a point to which the stock can and probably will retrace given how overbought it is with the RSI at 90 plus. The message at the moment is that provided there is no end of day close back below 50p over the next couple of weeks one would be looking to a target here as high as 90p over the next 3-4 months – at the top of a broadening triangle from this time last year.

Serica Holdings (SQZ): 2015 Price Channel Targets 16p

It can be said of Serica Holdings over much of the past year that the progress to the upside many may have expected has not materialised. This is particularly disappointing given the way that September / October witnessed a near vertical move to the upside. But at least with the latest clearance of the initial March resistance at 10p, the mid move consolidation of recent months seems to be complete. Therefore while above the 50 day moving average at 8.73p / 2015 uptrend line, one would be looking for a three-month target as high as 16p. Any dips towards 10p are currently regarded as a buying opportunity, especially as they would improve the risk/reward of going long.

Comments (0)