Zak’s Daily Round-Up

Market Position: Below 5,900 Risks 5,600 on FTSE 100

Hargreaves Lansdown (HL.): Withstanding Bear Forces

It would appear that there are some things in life that are certain. Death and taxes – the latter even for Google – and for financial services provider Hargreaves Lansdown, the ability to withstand the vagaries of both bull and bear markets. The reason for this may be rather more obvious than it seems. If the group was merely a stock broker, then the slings and arrows of the FTSE 100 and AIM market over the past year could have provided some unwelcome developments on the fundamental front. However, the group is so focused on the fund management area, as well as a plethora of financial products that, it appears, are well insulated against current troubled geopolitical times. In addition it is evident that there is significant brand loyalty to this high end service provider, with clients clearly not being too fussed about paying extra where necessary for such treatment. This idea is backed by the present configuration of the daily chart, where it can be seen how the stock has been in a largely upward trajectory since the autumn of 2014. The floor of the channel currently runs level with the 1,225p zone, and it is evident that, even in the wake of the latest gap to the downside below the 200 day moving average at 1,283p, there has been a decent new higher low put in at 1,245p. While there is the risk that this low may only be in place temporarily, at least while there is no end of day close back below the 2014 uptrend line, the shares could rebound back towards the 50 day moving average at 1,408p by the end of this month. Only cautious traders would wait on an end of day close back above the 200 day line at 1,283p before going long.

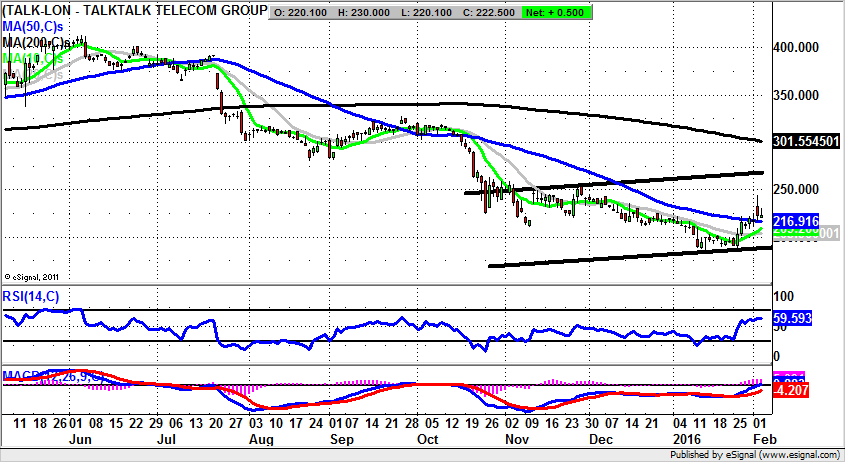

TalkTalk (TALK): Karma on the Share Price

It is difficult to avoid making the odd snide comment with regard to TalkTalk, given the legendary customer care, and presumably the way that, for many, “once a customer, always a customer” is the watchword. This, for one reason or the other, is whether the customer in question actually wants to continue to be one or not – allegedly. At least in the instance of Zak Mir Senior, who is 84, I am relatively sure he does not have the means with which to terminate his broadband service, but then again, at that stage in life one likes to stick with what is familiar. Of course, it can be seen from the daily chart of the telecoms services provider and customer service specialist that the period since the summer of 2015 and the hacking experience has not been a good one. Tens of thousands of customers have been lost, some possibly never to return. The share price situation currently shows how a combination of hacking and the stock market downturn has taken its toll, but that at least in the past few sessions we have seen a token attempt at recovery above the 50 day moving average at 216p. The message at the moment is therefore while there is no end of day close back below the 50 day line we could see further attempts by shares of TalkTalk to reclaim the post October resistance zone at 250p. However, back below the 50 day line, especially before the end of this week, could mean the stock is heading back to the worst levels of the past year below 190p, even if the shares recover after that.

Small Caps

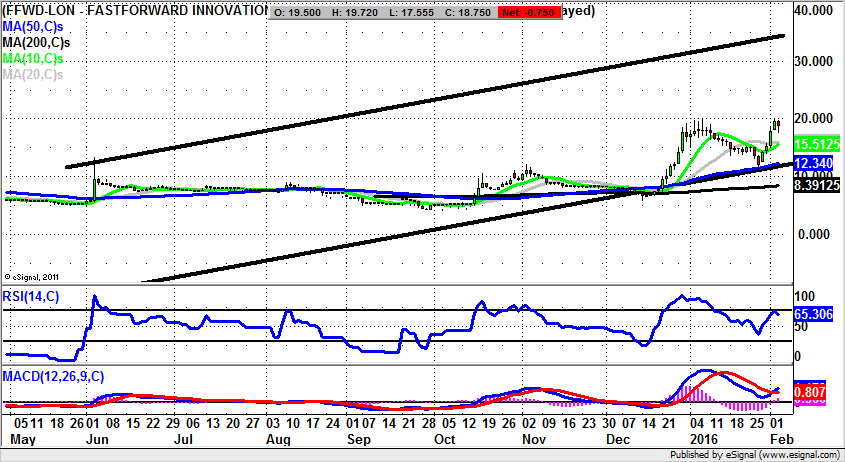

FastForward Innovations (FFWD): Above 20p Points as High as 35p

Earlier this week I had the pleasure and honour of attending a presentation by FastForward Innovations. Clearly, for someone possibly celebrating his 50th birthday later this year, much of what the company is involved in is rocket science. But at least it can be said that the premise of the group is that it allows private investors entry into Silicon Valley type start ups at the ground floor, much in the way that all of those mysterious venture capitalist do – you have a decent idea of what this is all about. As far as the technical / trading angle here is concerned, we have a situation where the stock was first identified as a short-term technical situation towards the floor of the original 2015 trading range at 4p. At that time the notional upside was towards 10p – a decent return. In fact, what we have seen to start this year is the way that the 10p zone former resistance has now come in as new support. The new resistance is the initial January peak through 20p. The view at this stage is that, provided there is no end of day close back below the 20 day moving average at 15.88p, we could see a significant new leg to the upside. The favoured destination at this point is a meeting with the top of a rising June price channel with its resistance line projection heading for 35p. The timeframe on such a move is seen as being the next 1-2 months.

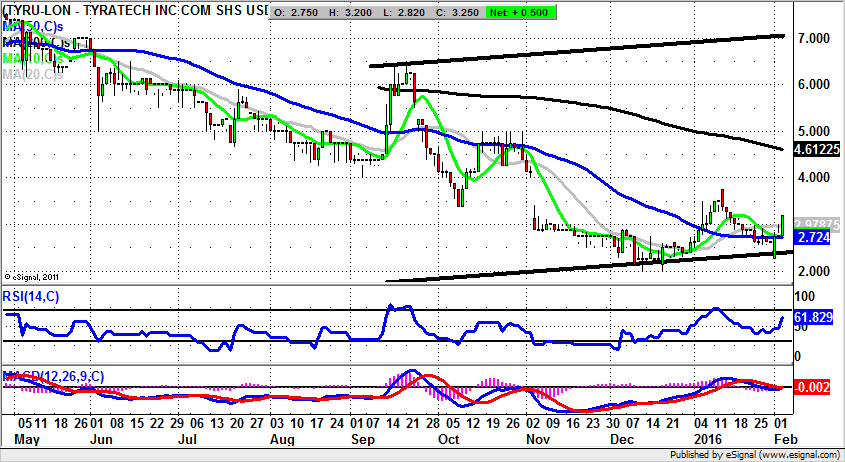

Tyratech (TYRU): Range Floor towards 2p

Given the way that by rights Tyratech’s headlice treatment, Vamousse, should be a game changing, money spinning product on the shelves in Boots and Walmart, it has been and remains somewhat disappointing to see the stock remain in the doldrums. However, the daily chart is starting to provide us with the first indication of a lasting recovery being on its way, even if this turns out to be one which is slow to appear at first. But at least we do have a higher February floor above 2p versus December, with the message now being that provided there is no weekly close back below 2p the bulls could be back in the game. The favoured scenario now is that as little as a clearance of the January peak at 3.7p on a weekly close basis could lead shares of Tyratech back up to the top of a rising trend channel from September at 7p over the following 2-3 months.

Comments (0)