Zak’s Daily Round-Up

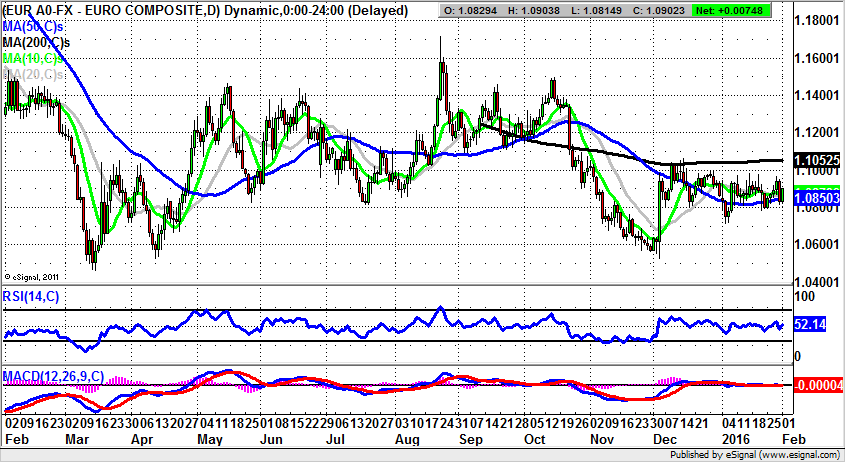

Market Direction: $1.08 – $1.10 Range Remains on Euro / Dollar

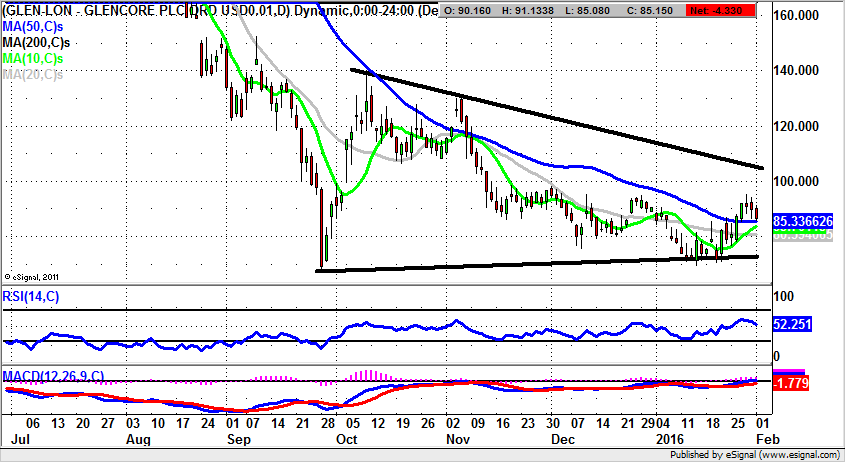

Glencore (GLEN): 50 Day Line Reversal Zone

It has to be admitted that I am not the world’s greatest fan of Glencore. The whole stock market history of the company is not exactly one that warms the heart (or, indeed, the bank balance). The present situation on the daily chart reminds us of the thrills and spills that long suffering shareholders have had to endure over recent months and years. In fact, it may be said that given the fundamentals / headlines surrounding the group, the price action to start 2016 has not actually been quite as bad as one might have expected. I for one was looking for a sub 50p destination by now. Instead, the market would appear to have bought into the debt reduction story, down from as much as $30bn. This is just as well given the way that even after the changes the market cap and the debt levels are effectively equal, which is not something that exactly makes you feel we are looking at a must-have portfolio play. From a technical perspective the setup here is that we are looking at the shares having a tendency to fail at and just above the 50 day moving average now at 85.33p since the beginning of October. This makes the preferred trade looking to short the stock on the latest strength above this feature, with only a break of the October resistance line at 105p really questioning the idea of any rallies here not being shorting opportunities. The target below 105p is a retest of the 2016 intraday support to date at 69p over the next 4-6 weeks.

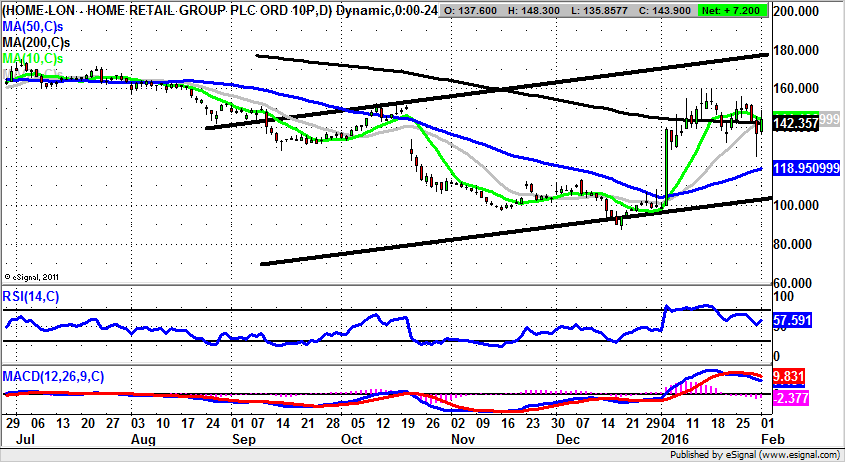

Home Retail Group (HOME): Technicals Back a Successful Bid?

It is usually not a good idea to chart a company which is in play as a bid situation. But of course, the uncertainty and the degree of difficulty make such contenders all the more appealing. This is certainly the case with Home Retail Group, where it appears that everything is in place to regard this as a deal waiting to happen with Sainsbury (SBRY). As always, the only problem is the price. This is mooted to be towards 160p plus, which makes the present share price zone a relatively appealing one. What can be said at this stage is that one would be looking to buy into weakness on the basis that the Argos owner will be taken over. The technical buy trigger looks to be the 200 day moving average at 142p. As little as a likely end of day close above this feature today should be enough to imply a best case scenario target as high as the top of a rising trend channel from September as high as 175p. The fact that the RSI, now at 57, has also just bounced off the neutral 50 level is added in as a leading indicator buy signal for the upside argument. At this stage, only a move back below the 50 day moving average at 118.95p would really be an outright negative for the technicals of Home Retail Group.

Small Caps Focus

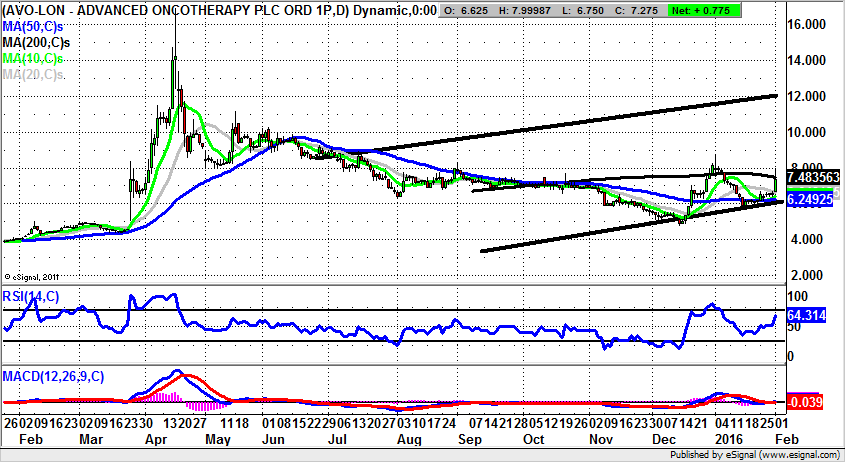

Advanced Oncotherapy (AVO): Above 50 Day Line Points to 12p

Although the overall picture on the daily chart of Advanced Oncotherapy shows this to have been a successful bull situation for the past year, it has still been a little painful for the bulls to cope with the decline from the April 2015 spike through 16p. However, it should be acknowledged that the consolidation we have witnessed since the spring has been orderly, and has generally occuppied a 6-8p range. This has particularly been the case since as long ago as the middle of July. The position currently is that the shares are trading in the aftermath of a rebound off both the floor of a rising trend channel which can be drawn from as long ago as July, and the 50 day moving average at 6.24p. The assumption to make currently is that, provided there is no end of day close back below the 50 day line and 2015 support ine, we should be treated to further signficant recovery moves. This would be the case particularly if there was a swift break back above the 200 day moving average, now falling at 7.48p. On this basis it would be possible that the 1-2 months timeframe target here is regarded as being the summer 2015 resistance line projection at 12p, especially on a quick 200 day line clearance, and at least while the 50 day line is held by shares of Advanced Oncotherapy.

Gulf Keystone (GKP): Surprising Intermediate Strength

It is now approaching three years since I first suggested there was a risk of Gulf Keystone shares heading as low as 10p. This was not a popular call, especially given the way that at the time the stock was trading around the 180p mark. Indeed, soon after I was on the receiving end of let us say, rather negative comments on the Bulletin Boards and beyond. What was perhaps the most interesting aspect here though, is the way that the shares not only bottomed out at 10.25p – very close to the big sell call, but that they took so long to do so. This was even though we have seen a geopolitical nightmare emerge in the zone that Gulf Keystone operates, and of course a massive Crude Oil collapse. All of these developments make it all the more interesting that the share price is heading north to start this week. The key driver here from a technical perspective looks to be the January bear trap reversal from below the initial 11p floor, and perhaps most importantly, the multi tested support line in the RSI window, which could be a leading indicator on at least an intermediate rally. Indeed, the view at this stage is that, provided there is no end of day close back below the 10 day moving average at 12.19p, the former August support through 20p could be seen even if the shares head back down sharply after that.

Comments (0)