Zak’s Daily Round-Up: BARC, BRBY, LLOY, CAKE and R4E

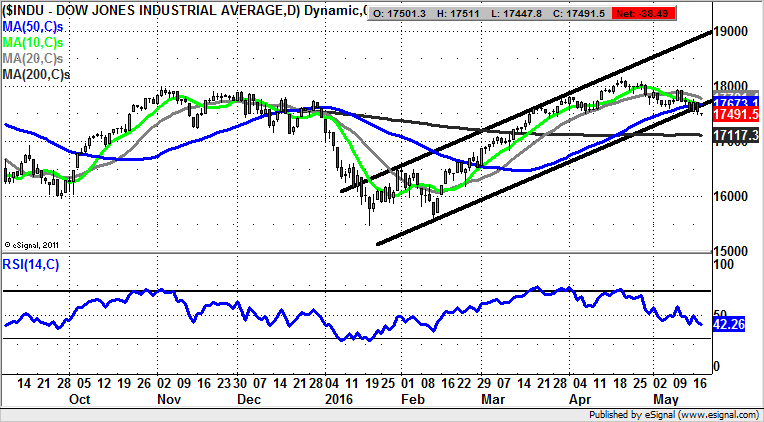

Market Direction: Dow, Key 17,500 Support under Threat

Barclays (BARC): Ultra Bullish Failed Gap Fill

It would appear that on a fundamental front we have the challenger banks and the challenged banks of which Barclays is apparently in the forefront. But it would appear that from a charting perspective the gloom and doom we have in terms of the sentiment here may be misplaced. This is because there has been a very strong pair of buy signals on a technical basis. The first is the overall inverted head & shoulders pattern which has been in place since the middle of February when the left shoulder was formed. Elsewhere, we have the highlight which is the aftermath of a gap to the upside last month. The floor of the gap lies at 156.75p, whereas the low for May to date has been 157.85p, a little higher but significant. This is known as a failed gap fill and is one of the strongest charting configurations in the book. Normally, a stock or market would seek out and find the floor of a gap as new support ahead of a new leg to the downside. In this case, despite rather weak stock market conditions the stock was unable to dig deep enough. This only happens in the strongest of setups, and allows us to assume that provided there is no end of day close back below the gap, we could be treated to significant upside. The favoured destination at this point is seen as being a retest of the April 182p intraday high. A weekly close back above this level suggests that the 200 day moving average at 208p could be the target 1-2 months after any April resistance clearance.

Burberry (BRBY): Sub 1,000p Target Possible

Whatever the fundamental position is, from a technical perspective it can be seen how the past couple of months have been a rather sad period for the stock. The demise started with the early March bull trap exhaustion gap through 1,400p. This was then followed by an as yet unfilled gap to the downside at the end of March and then perhaps best of all the April 13 island day reversal as a bull trap through the 200 day moving average now at 1,289p. The position now is that we are witnessing an understandable acceleration to the downside which has been in place since as long as October. The floor of the channel is currently running towards the 990p zone at the support line projection – a target which could be hit over the next 2-4 weeks even though the shares are currently deeply oversold with a RSI reading as low as 21/100. In fact, what this suggests is that one should be shorting the shares on any strength towards the 10 day line at 1,154p. At this stage only an end of day close back above the 10 day moving average is seen as delaying the downside scenario.

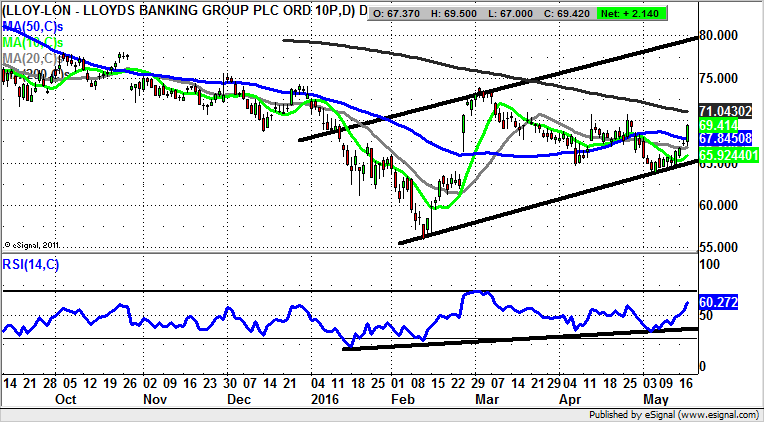

Lloyds Banking (LLOY): 2016 Rising Trend Channel

So it would appear that we are back on track with the Lloyds Banking share sale, where we buy again what was once ours, then was not, and now is again – or something along those lines. The bribe earlier this year was a £2bn special dividend which caused a rally to, surprise, surprise, 73p – the Government’s breakeven level. Interestingly enough now, it can be seen how there has been a decent progression here over the past few months after the bribe was delivered in February. The charting manifestation was a gap through the 50 day moving average, now at 67p. The floor of the gap was left at 63.59p and has so far not been filled – a very bullish development. The assumption to make now is that provided there is no end of day close back below the floor of the rising January trend channel at 65p, we could be treated to further significant upside. The favoured destination at this point is seen as being as high as the January resistance line projection at 80p.

Small Caps

Patisserie Holdings (CAKE): May Bear Trap Rebound

It would appear that there is a definite backbone to the fundamentals of cake shop Patisserie Valerie, not a place that a sugar avoider such as myself frequents, but I can understand how most normal people would find the outlets irresistible. Looking at the daily chart, currently it can be seen how there has been a sharp May one day intraday bear trap rebound from below the former November support at 304p. The assumption to make now is that as little as an end of day close back above the 200 day moving average at 350p could be enough to deliver a new intermediate rally. The favoured destination at this point is regarded as being post February resistance at 400p. The timeframe for all of this is as soon as the end of next month. At this stage only back below the 10 day moving average at 337p would even begin to delay the upside scenario.

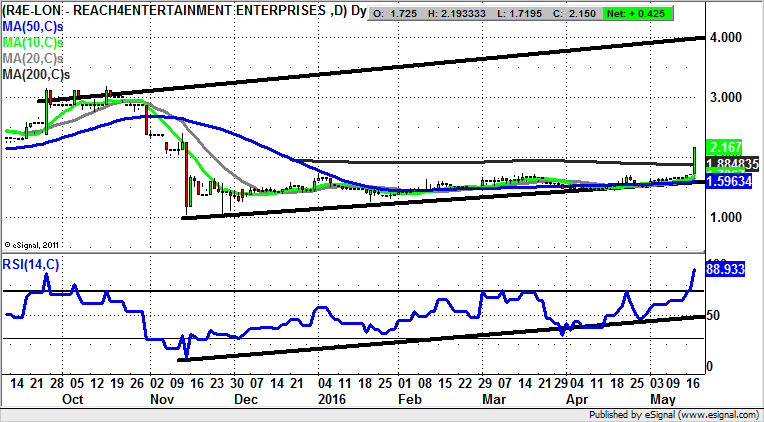

Reach4Entertainment (R4E): 200 Day Line Breakthrough

It would appear that celebrations are in order as far as the Reach4Entertainment technicals are concerned. This is because the shares are trading in the wake of a clearance of the 200 day moving average, now trading at 1.88p. The importance of this stems from the way that for technicians the boundary between regarding a stock as bullish or bearish is the 200 day line. On this basis it can be said that provided there is no end of day close back below the 200 day moving average over the next few sessions, we would be reasonably confident of further perhaps sizeable upside. The favoured destination at this point is the top of a rising trend channel in place on the daily chart from as long ago as September last year. This has its resistance line projection heading as high as 4p, a level which could be on tap as soon as the end of next month.

Comments (0)