Zak’s Daily Round-Up: ABF, DC., ITV, ABDP, AST and HZM

Market Direction: Dollar / Yen above 110.50 Targets 114

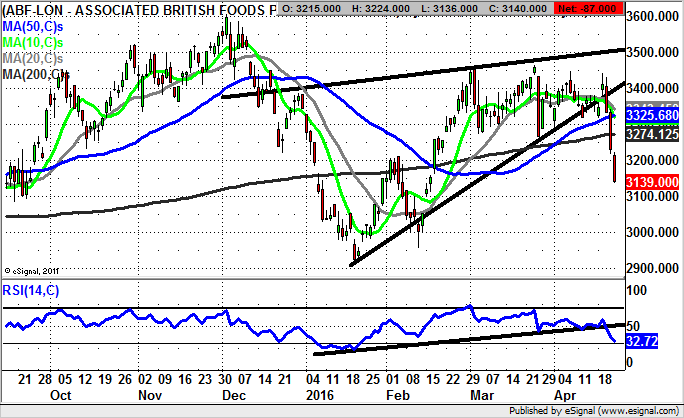

AB Foods (ABF): Risk of fall to February Gap Floor

One of the more painful times in the technical cycle is when we are at a long dated trend from which the rug is pulled. This is what we appear to be looking at for AB Foods over the past couple of sessions. The reason for the disappointment is the way that the Primark owner has just broken down despite the golden cross buy signal between the 50 day and 200 day moving averages at the start of the month. True, it is usually the case that such signals are lagging and appear within the more mature phases of a rally. The key in the near term is whether the shares will deliver a weekly close back below the 200 day moving average, now at 3,273p. If this is the case one would fear that there could be a journey back down to the floor of a February gap at 3,053p. The way that there has been a break of the uptrend line in the RSI window from January in the RSI window clearly acts as a leading indicator on the downside argument, and is particularly ominous given the way we are trading in the aftermath of four failures above 3,400p since the beginning of last month.

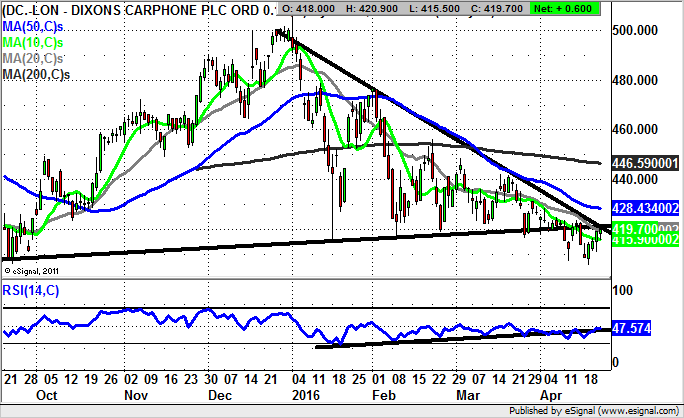

Dixons Carphone (DC.): 420p Resistance Line

I remain somewhat puzzled by the way that retailers like Dixons Carphone have managed to face off the controversy regarding their Duty Free offerings at airports, and how much they passed on VAT savings to customers. It may perhaps be that the recent decline of shares in Dixons reflects such concerns. However, it can be seen that in the wake of the decline from over 500p at the start of the year there has been an almost 20% drop in the stock. But it could very well be that the overall stock-market rebound could draw an end to the decline. This would especially be the case if we were treated to a break back above the late December resistance line / 20 day moving average at 420p over the next few days. If this is the case one would be looking for at least an intermediate rally for the shares towards the main post February resistance feature at the 200 day moving average, now running at 446p. The timeframe on a journey from 420p to 446p is seen as being 2-4 weeks from an end of day close above the 420p level.

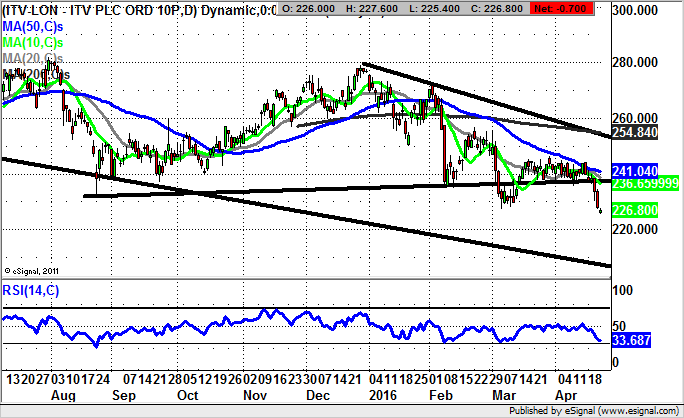

ITV (ITV): 210p Support Line Target

It would appear that ITV shares have gone from being a potential takeover target, to one doing the taking over. This is said in the wake of speculation of a possible of deal to acquire Peppa Pig owner Entertainment One (ETO). Such a move would clearly dilute shares of ITV and this explains the latest dip for the stock. What is expected now is that while there is no end of day close back above the 235p February support, the support line projection target from April is as low as 210p over the next 4-6 weeks.

Small Caps Focus

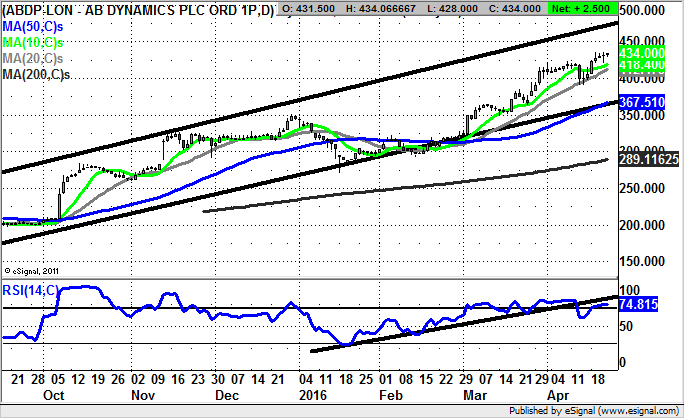

AB Dynamics (ABDP): 480p Resistance Line Projection

By definition, the world and of course the stock market is not overwhelmed by ultra trending positive situations like AB Dynamics. However, it can be seen on the daily chart here how the shares have remained above the 200 day moving average, now at 288p, since as long ago as the beginning of last year. Indeed, the position now is that we are seeing near-term support coming in towards the 20 day moving average at 409p. All of this leads us to anticipate that provided there is no end of day close back below the 20 day line, we could still be treated to decent further upside. The favoured destination is the top of a rising trend channel which has been in place since the end of July. This has its resistance line projection as high as 480p, a destination which is expected to be hit as soon as the end of next month.

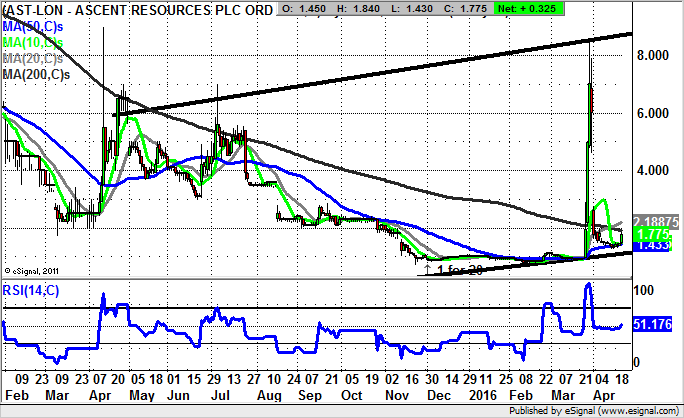

Ascent Resources (AST): 200 Day Line Clearance Leads to 2.75p

Ascent Resources is one of those classic situations where we have a battle between the fundamentals and the technicals, and one which verges on a binary issue. As far as the technicals are concerned we are looking at a position where an end of day close back above the 200 day moving average at 1.9p could unleash decent upside. This is currently seen as being towards the bottom of this month’s gap to the downside at 2.75p. Such a target is valid while there is no end of day close back below the 50 day moving average at 1.45p. The ideal scenario is that the stock will head quite directly to the upside after its latest 200 day line break, rather than test for support once again at the 50 day line.

Horizonte Minerals (HZM): One Year Price Channel Pointing at 4p

Horizonte Minerals was recently the beneficiary of the meltdown for mining sector giant Glencore, gaining a key asset at a bargain basement price. The penny seems to be dropping in this respect as far as the share price of Horizonte is concerned, with the sharp break of the 200 day moving average now at 1.85p earlier this month. Indeed, the message at the moment is that provided there is no end of day close back below the 200 day line, we should have the chance of a top of March rising trend channel target as high as 4p over the next 1-2 months. At this stage only an end of day close back below the 20 day moving average at 2.14p would even begin to delay the upside scenario. Cautious traders can wait on an end of day close above the 10 day moving average, now at 2.45p, as their momentum buy trigger, given the latest knock back for the shares from the 2.50p zone.

Comments (0)