Will the Markets Repeat The 1975 Referendum?

There is some debate about who said it, according to Wikipedia, but whether it was George Santayana or Edmund Burke, or even BBC1’s comedy schedulers, the quote “those who fail to learn from history are doomed to repeat it” gives the impression that repeating it is a bad thing. As traders and investors the one thing we really do want is history repeating itself.

As a result I am looking back at the 1975 EEC Refendum, carefully timed to be after we’d actually joined the Common Market so that the soft option would be maintaining our membership. In fact the ‘Yes’ to staying in vote was overwhelming at 67.23% of the 65% turnout. In fact only two counties in the UK voted against staying in, and they were the Shetlands, which came in under 50% for ‘Yes’, and the Western Isles, where only around a quarter of those who voted wanted to stay in.

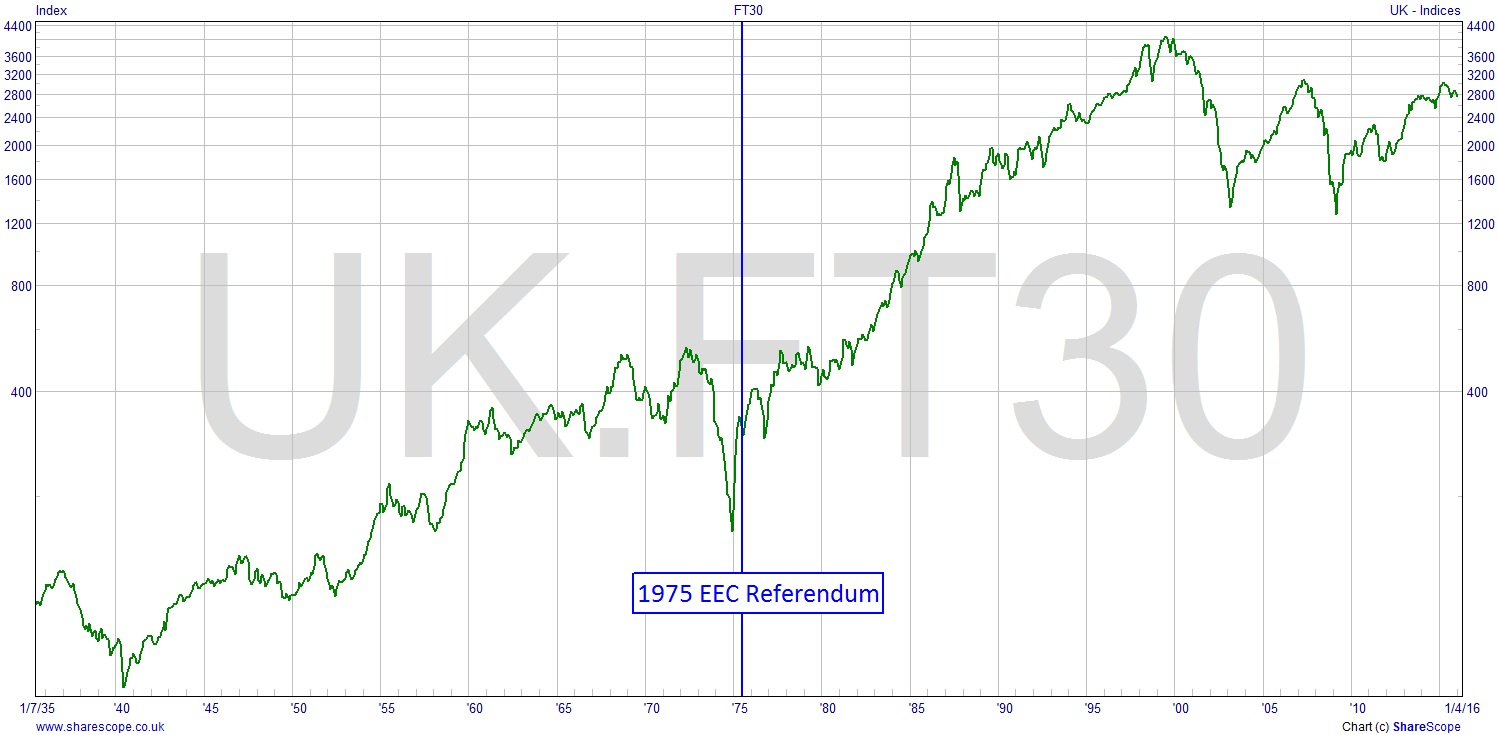

Finding information on the UK market before the 80s is not as easy as with the US, but I’ve found some. The FT30, which is a genuine asset to have on ShareScope, goes right back to 1935. It’s just monthly closing data, but it’s still of use.

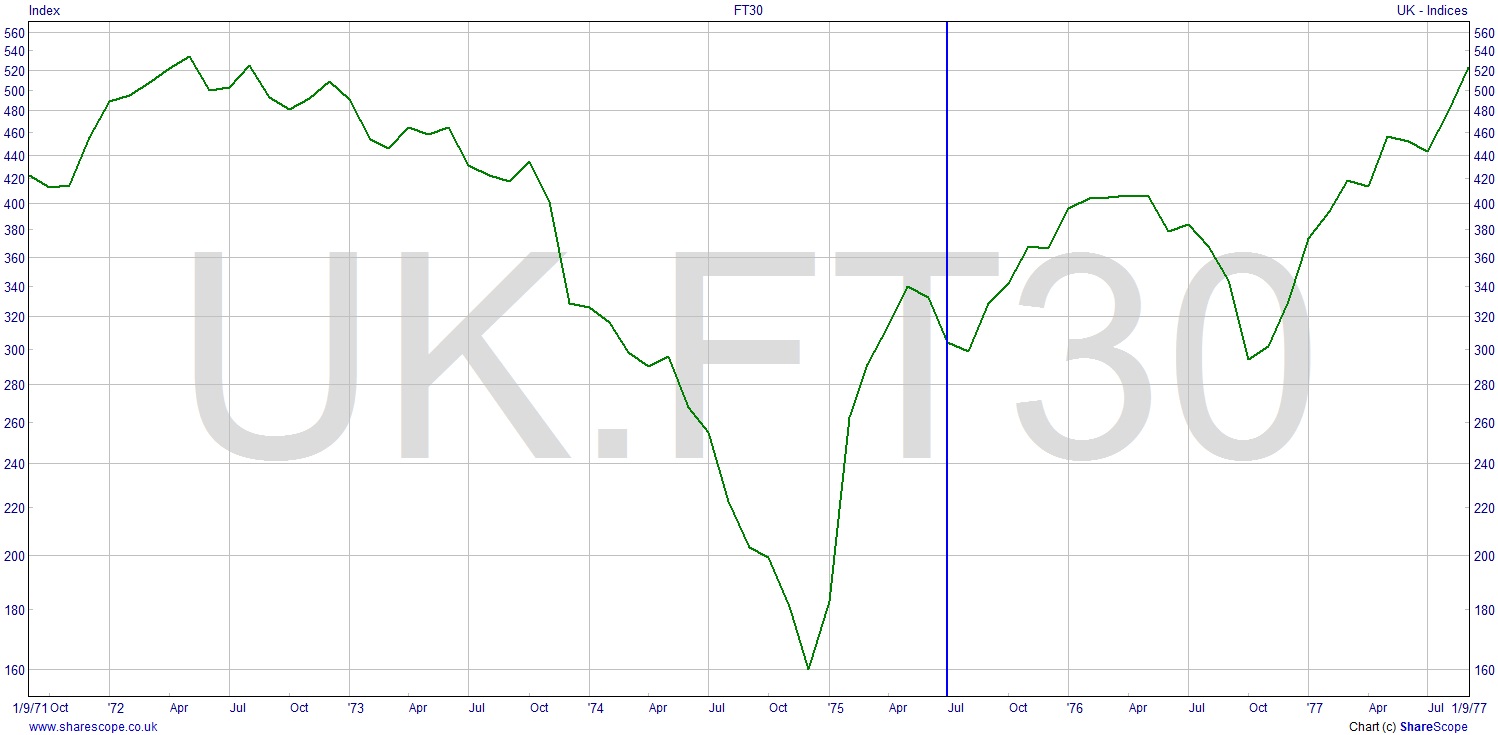

One thing we know about markets is they dislike uncertainty. You can see that by the months leading up to the 1975 referendum the country was coming out of the recession and leaving behind the 3-day week and power-cuts. However there is a clear blip in the market rally leading up to the referendum, which was on 5th June 1975.

Timing is everything, and I doubt very much there would be a referendum at all if the result wasn’t already a foregone conclusion. Obviously the Scottish Independence vote was a political cock-up, so don’t expect them to make that big a mistake again. Cameron has negotiated some sort of proposal with Brussels that there now isn’t time to suck and see. So there won’t be time to prove it doesn’t work, or doesn’t deliver. Ergo: ‘yes’ to staying in. Goodbye to UKIP, another, albeit small, political vacuum that will take a few General Elections to fill, maintaining the one-party system nicely.

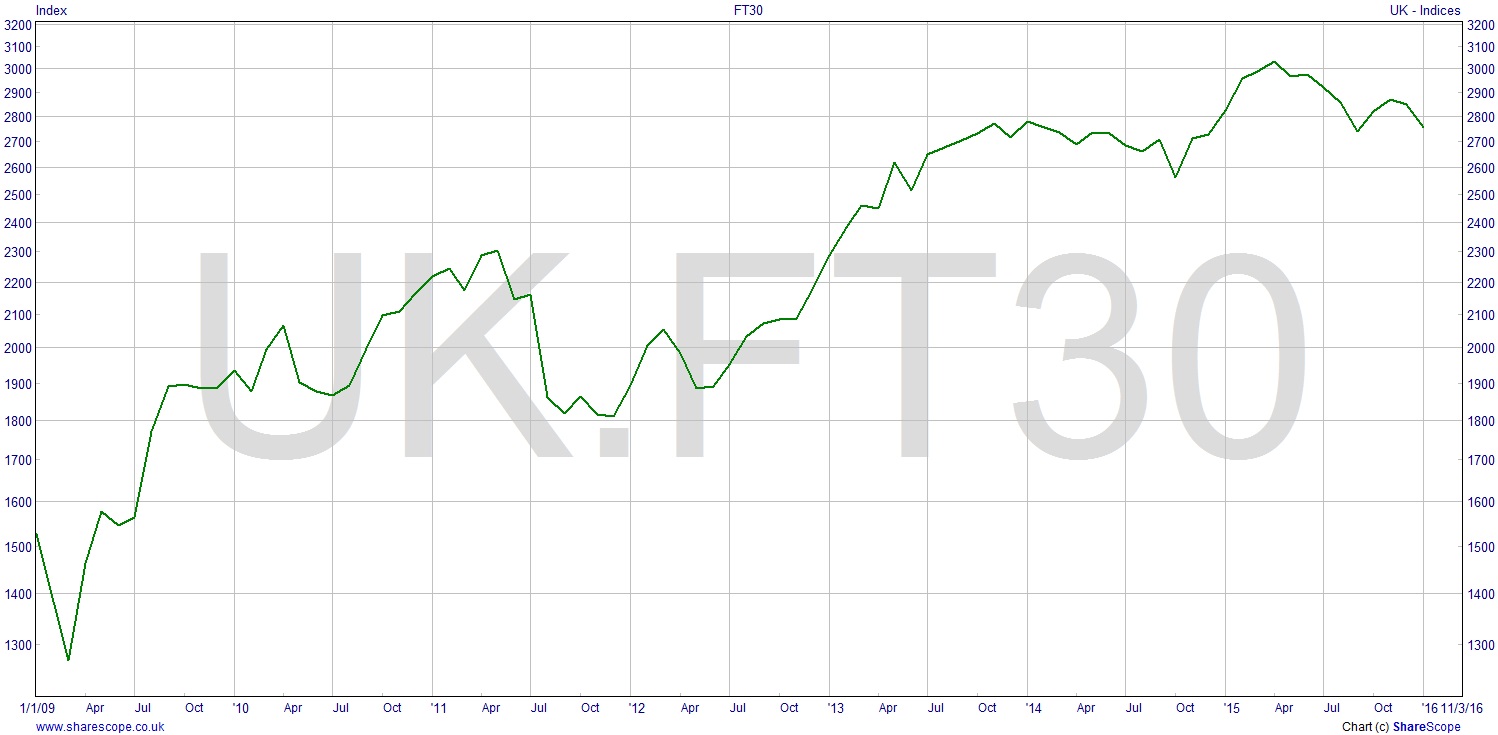

The thing about the FT30 is that it doesn’t change its constituents like the FTSE100 does, based on performance in terms of market cap. In fact the only way to ‘leave’ the FT30 is bankruptcy or merger. Consequently it’s more diverse in terms of sectors, and shows better any weakness in the markets. As is clear, we are still barely at the level of 2007 and way short of the pre-2000 ATH. There could be a H+S forming now, and with uncertainty we could perhaps see a really nice drop. There’s a full list of constituents of the FT30 on the FT.com website if you fancy preying on the weak.

The FT30, as I’ve said in previous articles, can be seen as a leading indicator of bearishness in the FTSE100. With us so close to a Bear Market we could get the trigger from not just the referendum, but also the huge problems caused by the renewed flow of thousands more migrants, which is now fragmenting the EU itself. Watch out for the support at around 2550. Obviously we’ve only a few bites of the cherry here since the chart is monthly closing, but you can find the daily data in the FT and on the FT.com site (you may need to register).

Comments (0)