Versarien: Golden cross and bull flag breakout target 32p

Versarien (LON:VRS) is a standout stock, perhaps as much for the name as for what the company does. The present charting setup is also noteworthy.

I have to admit to having something of a soft spot for cutting edge tech companies, both of the gadget variety and, in the case of Versarien, materials as well. This group has already made a name for itself as a global chemicals distributor, but it could very well be that the latest moves with its new graphene brand Nanene may be a game changing event.

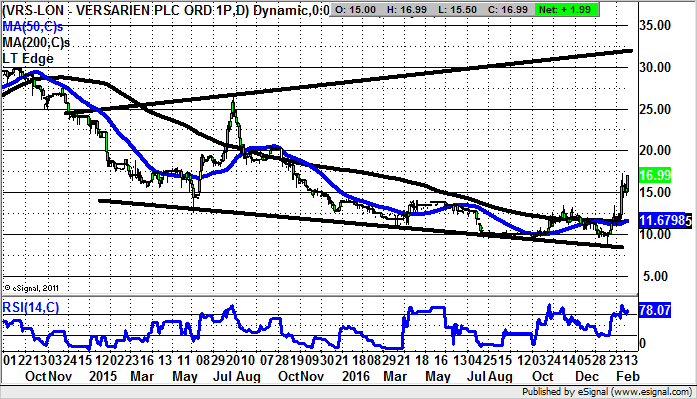

This point is highlighted by the present configuration of the daily chart where we see a golden cross buy signal between the 50 day and 200 day moving averages, one which was triggered earlier this month. What can also be seen is that there has been a decent bull flag consolidation in recent days, with the price holding well above the former January resistance at 13.5p.

While this is the case one would be looking for a significant upside move. Just how high this could stretch is suggested by the resistance line of a late 2014 broadening triangle which is currently pointing at 32p. The timeframe on such a move is regarded as being the next 3-4 months, with the Landsdowne Chemicals distribution deal underpinning this idea on a fundamental basis.

Only well below the 50 day and 200 day moving average zone at 11.66p would even begin to delay or question the upside argument.

Comments (0)