How to trade breakouts: buying into strength

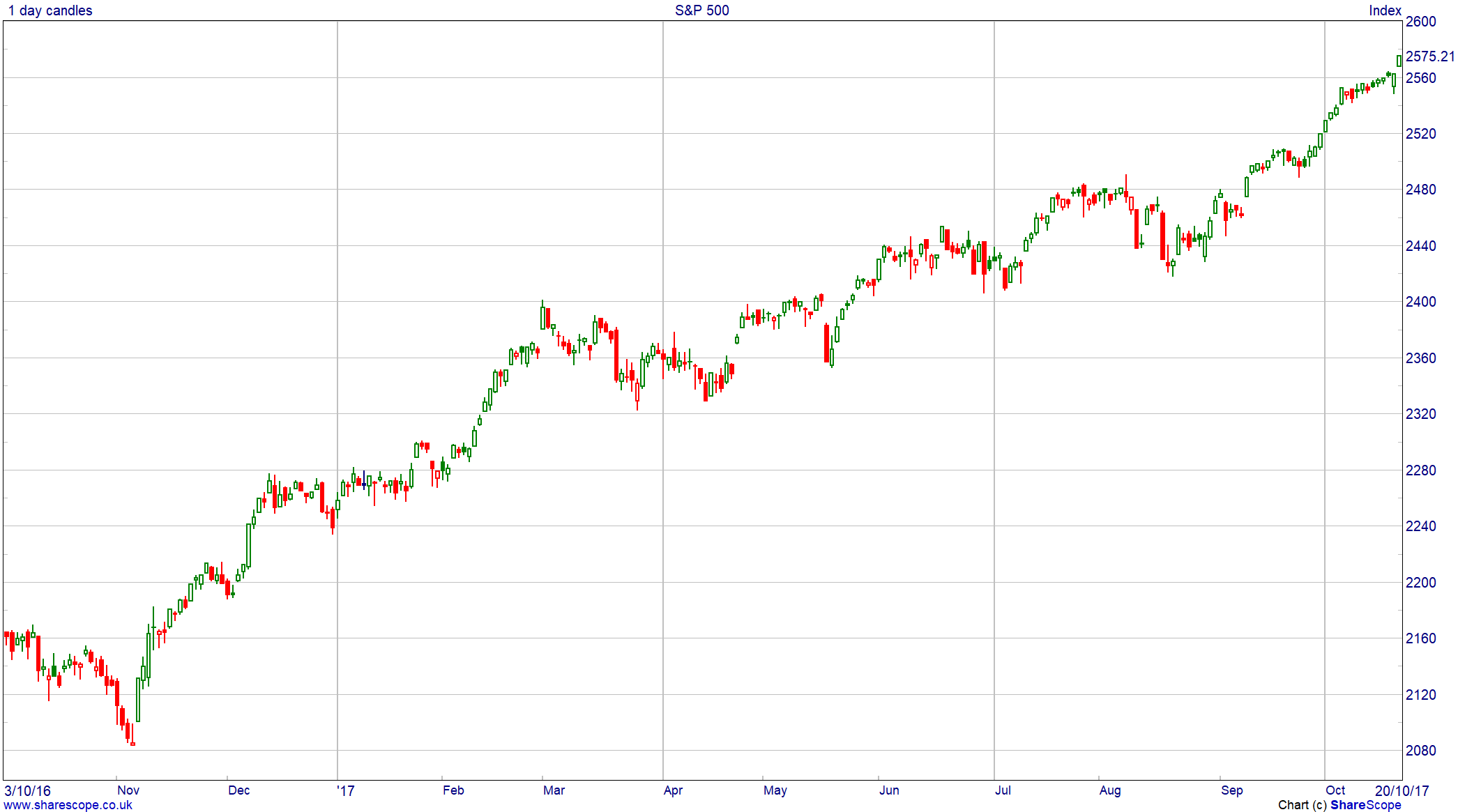

Last month saw some interesting statistics concerning the US stock market. Unless you have been living in a cave in recent years, you will be aware that the major US indices have continually pushed to fresh all-time highs. The latest leg higher within that multiyear trend started after the US election last year – markets confounded many by rising on the shock Donald Trump win. Since election day, the broader US index, the S&P 500, is up by around 20%.

S&P 500: Last 12 months

It can be psychologically very difficult for investors (and traders) to buy into strength in a rising market. Many will sit on the side-lines waiting for a pullback – looking for that strength to run out of steam, and the price to dip back in the hope of getting their chosen shares a little bit cheaper. This can be comforting – looking to buy a bargain – but can often leave many people watching and kicking themselves for missing out if a market really takes off, always regretting not just buying in the first place.

The idea of buying into strength (or, alternatively, selling into weakness of course) is well documented within technical analysis and charting. There is the well-worn refrain – “the trend is your friend” – which is a reminder that market sentiment can trump everything (no pun intended….), and we should be looking to go with the line of least resistance. Part of trend-following does involve buying into the dips in a rising market should they occur. That is all well and good if they do come along – but once again in strong markets the dip buying chartist can still miss out if they never materialise.

Buying the break

Which brings us to the “breakout” approach. Put simply, this is going with the strength in the market, should a big level be broken. Let’s take a price level has been a problem for a while – for example, let’s use a share that can’t get through the 500p mark and keeps running out of steam every time it rallies towards this point. This is known as resistance – an area where sellers come back in and the broader view is that the share is overvalued. The share price rallies towards this area, but repeatedly runs into a wall of sellers and drifts back. But, one day, it trades through 500p. To many chartists this would suggest that market sentiment has changed. A level that in the past saw sellers with the dominant hand has been broken and now the share price is still viewed as reasonable value. This can be the first sign of a new trend about to start.

With stock markets so strong in recent years there are plenty of examples of this breakout trade, so here are a couple.

Carnival (LON:CCL)

Cruise ship business Carnival is a good example. For much of 2016 the share price trend was broadly sideways. Attempts on the £36 to £30 area would just bring out the sellers and the share price would not progress through here. But during November we saw the first chinks made in that barrier and in early 2017 the next leg higher really got underway.

It is never quite as clean cut as the textbooks suggest – but clearly sentiment was changing as that old barrier got probed – and eventually the new trend started.

Renishaw (LON:RSW)

The chart of FTSE250 business Renishaw is a more extreme example – although the basic principles still apply. It has had an incredibly strong trend over the last 12 months, with the odd pause along the way. These short sideways movements have created short-term resistance levels that, when broken, have signalled that the next stage of the trend higher is underway. At the moment that latest barrier is around the £50 mark.

A word of caution: manage the risk

But let’s not get too carried away thinking that following breakouts is a licence to print money. Nothing works all the time and there is such a thing as the “false breakout”. Of course, this only becomes obvious after the fact – hindsight investing is always the easiest! This is where a share breakout through a previous barrier and looks like it is starting a new trend, only to drop back into the range and go precisely nowhere – or even downwards. So, we still need some form of risk control to get us out of the breakouts that don’t work so they do not end up eating too much into the profits of those that do.

It does not have to be too complicated. A percentage-based stop loss is arguably as good as any method. If a share breaks, for example, the 500p level, you may decide a new trend is starting and buy in. Now, if a new trend is underway, the share really should not drop back too much. Something such as a 10% stop loss could work here – if the share price falls back to 450p, you decide it is a false break and exit for a manageable loss. Again, this is not some sort of magic system and you may well want to experiment with your own approach. But the idea is that the breakouts that don’t work out and incur a small loss should be covered and more by those where a significant new trend starts.

For more insight and analysis like this, CLICK HERE to read Master Investor Magazine for FREE.

There is another caveat that should be applied here. We have experienced incredibly strong trends, particularly when it comes to US shares. Just last month the investment bank Goldman Sachs pointed out that is has been more than 320 days since the US index had a drop of at least 5% from a recent high. This is a market that has just gone up with very little in the way of a meaningful correction. It’s a near perfect market backdrop for the breakout approach. Of course, these conditions could carry on for another 300 days – but it is always worth being aware of the sort of environment we have experienced in recent years and why this has favoured a simple trend following approach such as the breakout.

Charts of the Month

Given this month’s theme is breakouts, I thought it would be only fair to flag up a couple of charts of the month to keep an eye on. One of them is on the verge of a breakout and the other has already done it. The approaches are slightly different, but the outlook remains the same.

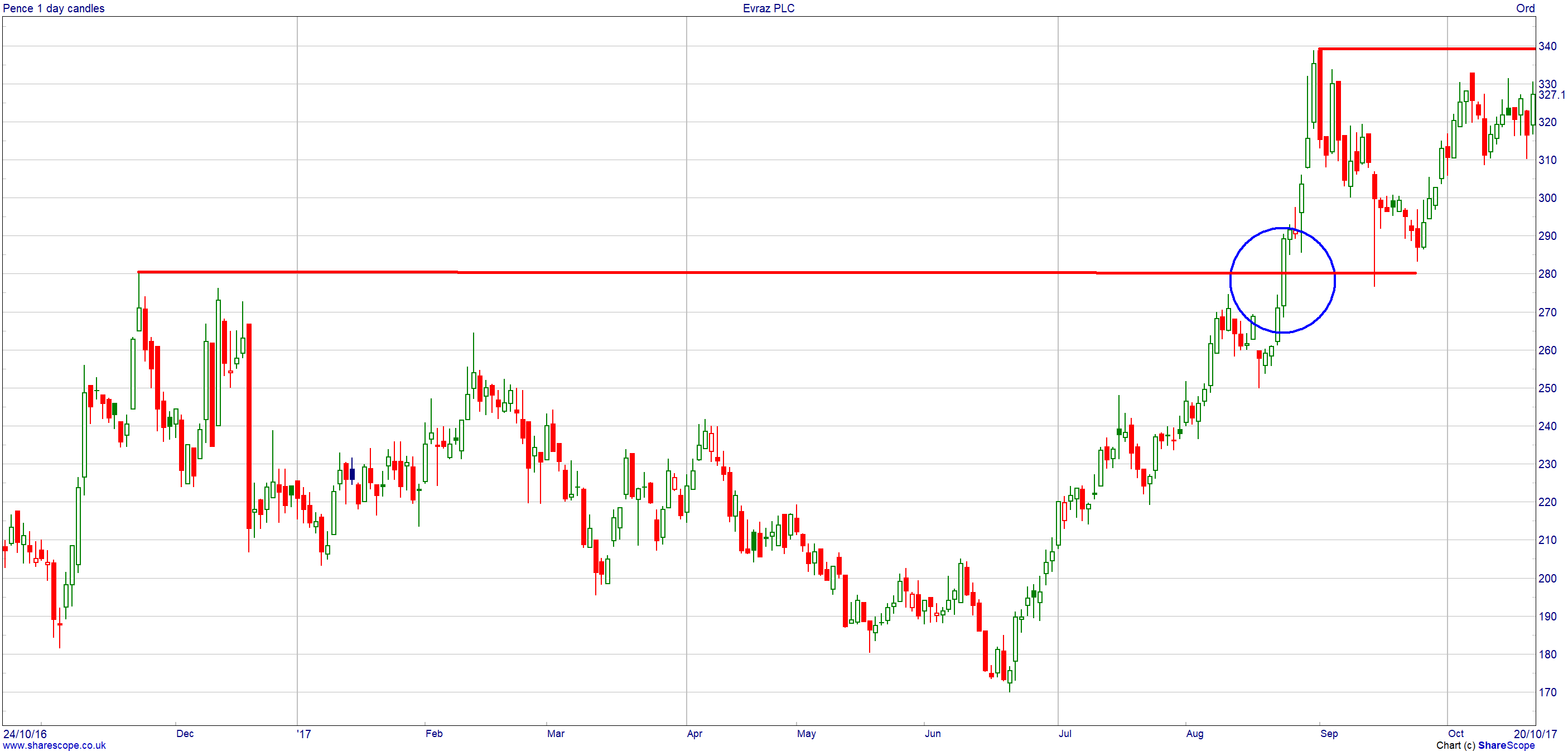

Evraz (LON:EVR)

This FTSE 250 mining company has had a great run over the last four months, which has seen the share price gain around 70%. Now of course for many, this sort of gain may lead them to assume they have missed the boat – but don’t forget we are looking to buy into strength. There was a good example of a breakout along the way of this sharp rise higher. You can see from the chart that the end of 2016 saw the price run out of steam ahead of the 280p mark. The sellers came in and pushed the price back towards 170p. But then sentiment shifted, and the price recovered.

In August of this year the share price was back up at that 280p previous problem area. There was a wobble for about a week where it looked like the sellers had the upper hand once more – but then that changed, the level was broken and the price moved more than 20% higher in fairly short order.

This has left another level to watch for the next breakout – if it happens. The 340p zone is now the area where so far at least the sellers have had the upper hand. Strength through here would suggest that the next leg higher is underway once more – so that is the breakout level to watch. As usual there are a couple of ways of playing any break here: either buying in as soon as the level is breached, or more conservatively waiting to see how the market performs after the breakout. A slide back and then some strength back above the 340p could be used to increase the chances of this being a valid break.

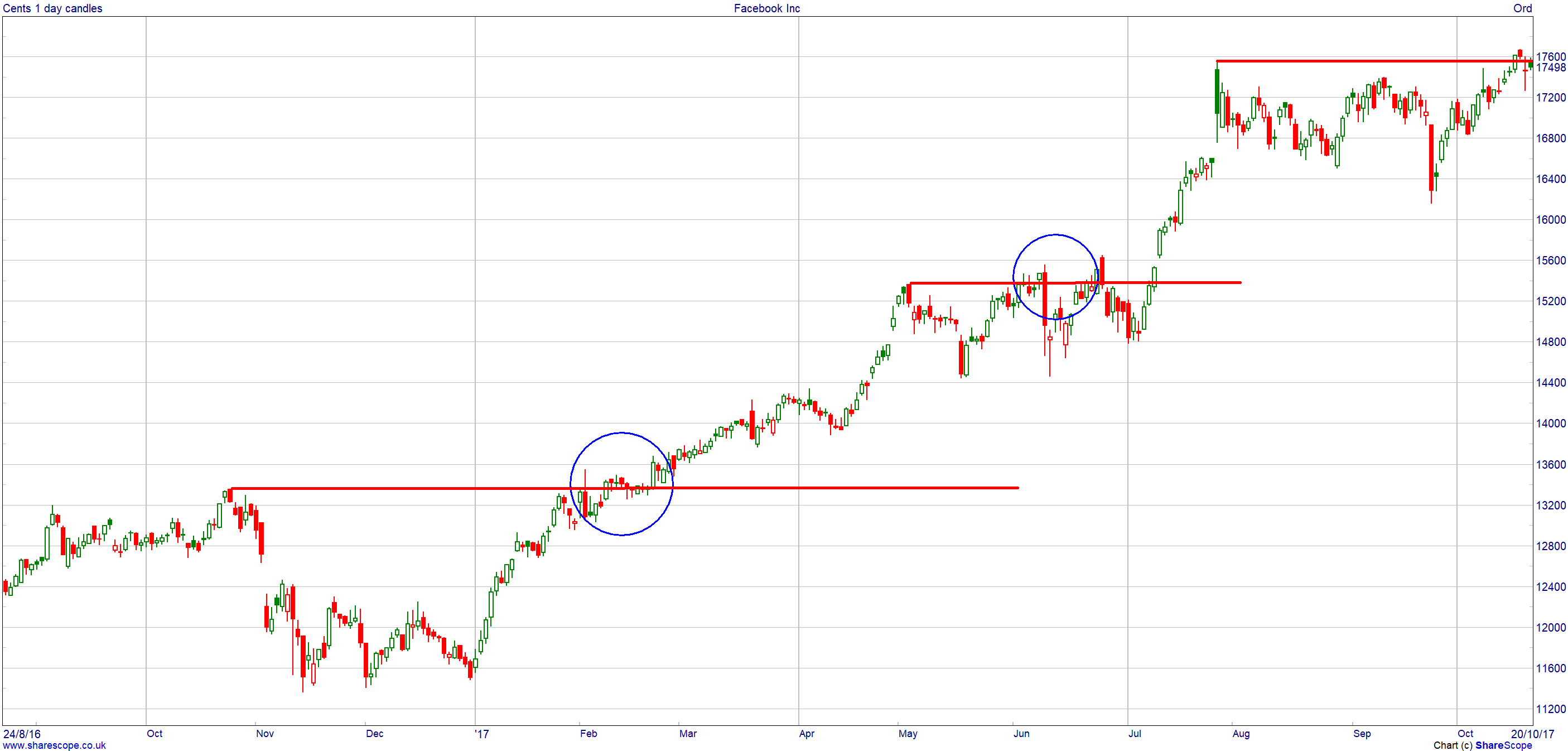

Facebook (NASDAQ:FB)

We turn to the US for our second share to watch. After a difficult time following the initial float back in 2012, the share price of Facebook has been a major outperformer in recent years. Just in the last 12 months there have been two clear breakouts on the chart that have seen even more ground covered – and during last month the share price once gain started to probe through the previous high in the $175 area.

It has spent a couple of days above this area, making fresh all-time highs before dropping back. We don’t yet know if this is going to be a failed breakout, but going with the strength in recent years, many would see this dip back as another buying opportunity. The old support comes in around the $160 level so I think it’s only if it starts to slip below here does it start to look as if that trend is losing some real momentum. For now, a resumption of strength could be all the confirmation some need to start to expect fresh highs once more from this social media business.

Comments (0)