Are stock markets set for further gains?

With many markets setting fresh all-time highs, chartist David Jones thinks we can expect more of the same in 2021.

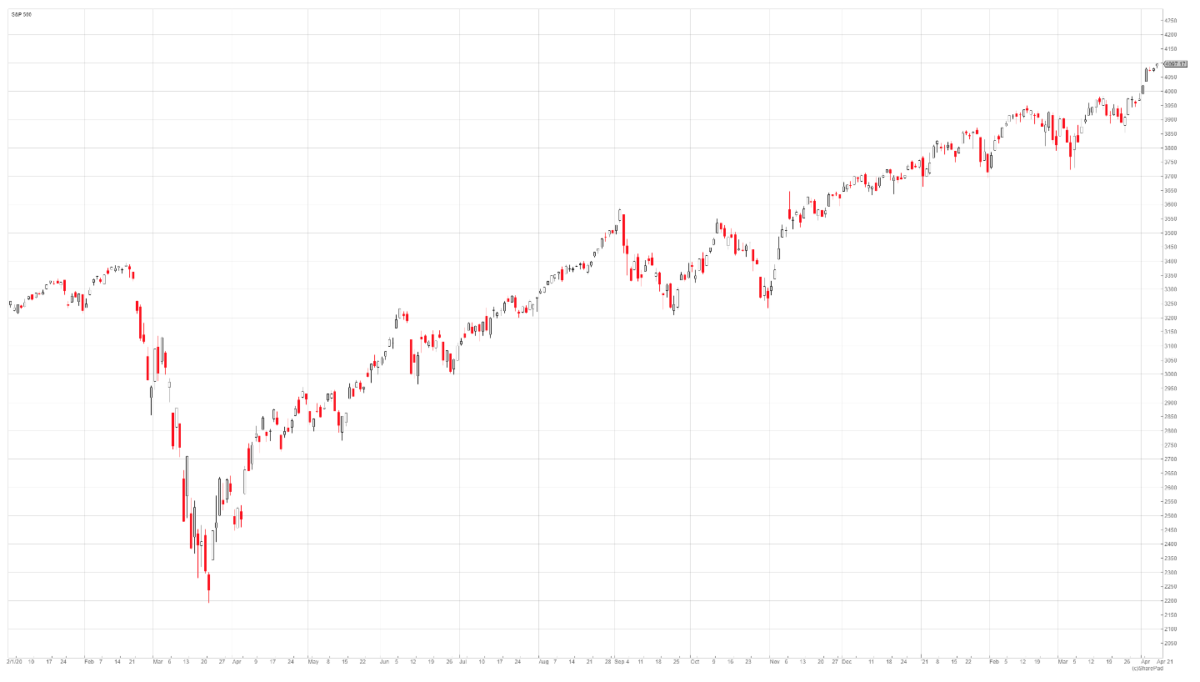

As the famous saying goes, “markets can stay irrational for longer than you can stay solvent”. It is often aimed at those betting against a soaring market where they are using the argument that it can’t possibly go any higher as it is so obviously overvalued. The last 12 months are another great lesson in the perils of going against the herd. In March last year, markets crashed. The broad S&P500 index lost a third of its value in only slightly more than a month from the end of February. Some have referred to this – with the benefit of hindsight – as the shortest bear market in history. Since then, the recovery has roared away, with many markets setting fresh all-time highs. I think we can expect more of the same in 2021 but, whatever happens, there are a few ways of trading your view of stock markets.

Global pandemic shakes markets (for all of five weeks…)

In February last year the S&P500 hit another fresh all-time high. Volatility was low, stocks were grinding their way steadily higher. There was news of a virus in China, and Italy was locked down, but investors were not too concerned. And then of course that all changed. As the virus and lockdowns spread around the world, market sentiment completely changed and global equities plunged.

The extent and swiftness of the fall in the S&P index is clear to see. Falls like this make for dramatic headlines, as bad news gets clicks. But look at what happened by the end of August 2020, at the right-hand edge of the chart. Five months after hitting the bottom in March, the index had moved out to a fresh all-time high. The shortest bear market in history was really over! Since then, the index has moved almost another 20% higher.

Should we be worried about stocks at elevated levels?

I think the obvious answer to that question is yes we probably should be. But having an opinion that perhaps stock markets have got ahead of themselves, and then trying to make money from trading those markets is often not compatible. Anyone trying to time the tops in rallies over the last 12 months and make money short-selling has either been very lucky or, more likely, lost money. Remember: the market can remain irrational longer than you can stay solvent.

The warning signs are there for a market top. One of these is increased public participation. Given that the wider general public is usually wrong at major turning points, the influx of a new army of retail traders – particularly in the US – should be cause for concern. Constantly rising markets makes everyone look like an investing genius. For those of us of a certain age, there are parallels to be drawn with the dot-com bubble in the late 1990s. But that carried on for much longer than many thought possible – and cynical investors who stayed out of the mania, as everything was so overvalued based on traditional models, were derided as dinosaurs.

So, I don’t think we are in a new paradigm of ever-increasing equity prices – although the central banks’ policy on near-zero interest rates is doing its best to keep that going. At some point we are going to get another bear market – it just doesn’t look like it at the moment. Having an opinion on whether the market is cheap or expensive is not the same as making money from trading it.

How to trade stock market indices

The mechanics of trading stock market indices using spread betting could not be more straightforward. Movements in global indices are quoted in points; when spread betting you buy or sell so many “pounds per point”. Let’s use the FTSE100 as an example.

In mid-February the FTSE was trading at 6,485 and our trader decides the market is going to go higher. Using spread betting, the trader buys £5 per point at 6,485 (there would be a small bid/offer spread that also needs to be taken into account). Jump forward to now and the FTSE is trading at 6,920. The market has moved 435 points in the trader’s favour (6,920 – 6,485). The trader bought £5 per point, so the trade is showing an open profit of £2,175. As spread betting uses leverage, there would be some daily financing costs incurred on the position but with interest rates so low currently these are very small.

Of course, it needs to be said that if the trader had got market direction wrong and let the market drop 435 points, then the position would currently have a £2,175 loss. It always pays to have a stop-loss strategy when trading markets where sentiment can change unexpectedly – i.e. all markets!

A strategy for trading stock indices

I will start by trying to dispel a myth about trading. It does not have to be ultra-short-term in nature. The example above in the FTSE100 shows a trade running for almost two months. In my own trading, the trades that go the right way and deliver the big profits usually run for weeks and months. The ones that go wrong tend not to last that long before being cut for a loss.

Although the popular image of a trader is someone surrounded with lots of screens, jumping in and out of markets many times during the day I would suggest the least stressful approach for many of us is to look to hold a trade for the bigger swing. There is a lot of “noise” that goes on throughout the trading day in markets – taking a step back and looking at a slightly bigger picture can filter this out and lead to a calmer and more disciplined approach for trading.

There is no magic system for trading stock market indices – like any market they go up, down and sideways. But given that we do have something of a strong trend at the moment, the obvious thing to do is either buy the dip or buy the strength. Eagle-eyed readers will notice I have not suggested trying to pick the top and sell-short. Why would you want to do that? At some point, these markets are going to turn but it has not happened yet. When trading, we want to go with the line of least resistance – with the line of broader market sentiment in the time frame we are trading. And for stock markets, that is still up for now.

I have highlighted three major lows on the S&P500 so far this year. When trading within an uptrend, these major turning points can be very useful when it comes to risk management and setting stop losses.

Managing the risk with a stop-loss

If we are looking to buy the dip then it may sound obvious, but we need to wait for the dip to occur. One way of trading this approach is to wait for the sell-off to happen, then monitor the market performance on a daily basis. When a day occurs that takes out the high of the previous down day then this can be one sign that the rally is about to resume. By definition, if the rally is restarting, it should not take out the low reached in the most recent sell-off. This is where the stop-loss goes – somewhere beyond that most recent major low. This is an approach that would have worked on the areas highlighted on the chart above.

I find trading breakouts a little harder than buying the dip – but they can end up being profitable trades. The S&P500 broke out at the end of March 2021 and is trading at fresh all-time highs once more. I do not believe there is a way of knowing whether the breakout is going to be the sign of further gains to come – or is actually a false breakout. I think you can only know this after the fact, which is no good when looking to trade these sorts of moves. One approach for stop-losses is to put your stop slightly lower than the break-out point. If the market pulls back into the recent range before the break, then perhaps it is better to exit the position for a manageable loss and look for a better entry point on a dip-buy.

No-one knows the future. All we can do as traders is play the probabilities and manage the risk. With the US index setting fresh all-time highs at the time of writing, the sensible bet for my own trading is to expect this to carry on higher. Until it doesn’t. I also use stop losses to manage the risk in case the market does really start to turn.

Comments (0)