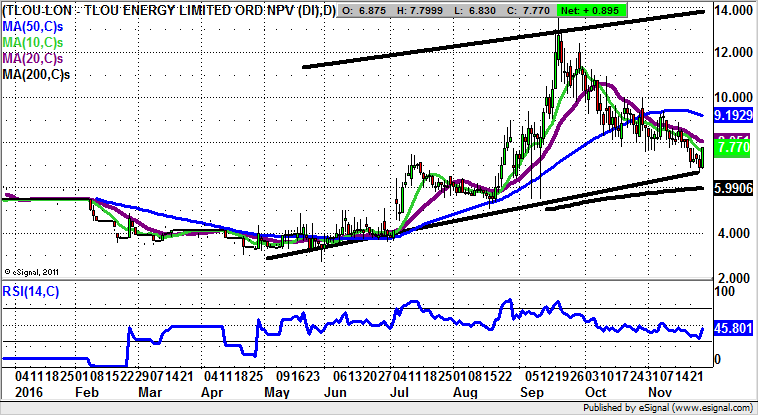

Tlou Energy: Rebound at trendline support

Tlou Energy (LON:TLOU) has been typical of many of the private-investor favourite stocks which have turned up this year, and generally impressed. Of course, it is in the nature of the game that in the small caps space we are vulnerable to disappointment, and in some cases tragedy. But Tlou Energy looks to be one of the happier situations today.

In the recent past the highlights have been the oversubscribed equity placement at the beginning of September. This was followed by the Botswana Government backing the company’s methane project plans later in the month.

From a charting perspective we have what can so far be described as a classic setup. This has consisted of an as yet unfilled gap to the upside through the 50 day moving average at the start of July, an event quickly followed by a golden cross buy signal between the 50 and 200 day moving averages.

The view now is that provided there is no end of day close back below the 200 day line at 5.99p we should be treated to a retest of the best levels of the year in the 13p area. The timeframe on such a move is regarded as being the next 1-2 months, particularly if the May support line at 6.5p remains intact over the next couple of weeks.

Comments (0)