Tesla and Some News You Can Trade

Normally I avoid using news as an entry signal. I’ve written in this very blog about how most news isn’t even news: it’s noise. Company announcements, many government figures – they’re all released, often with careful timing, in order to achieve an objective. They’re basically infomercials. The other problem is that, given it’s in the news, everybody knows about it. However, once in a while an announcement comes that is probably ahead of the curve. Tesla Motors Inc (NASDAQ:TSLA) has started taking orders for their new model. Lots of orders! No I mean really lots and lots of orders! As I write apparently $275m in new orders.

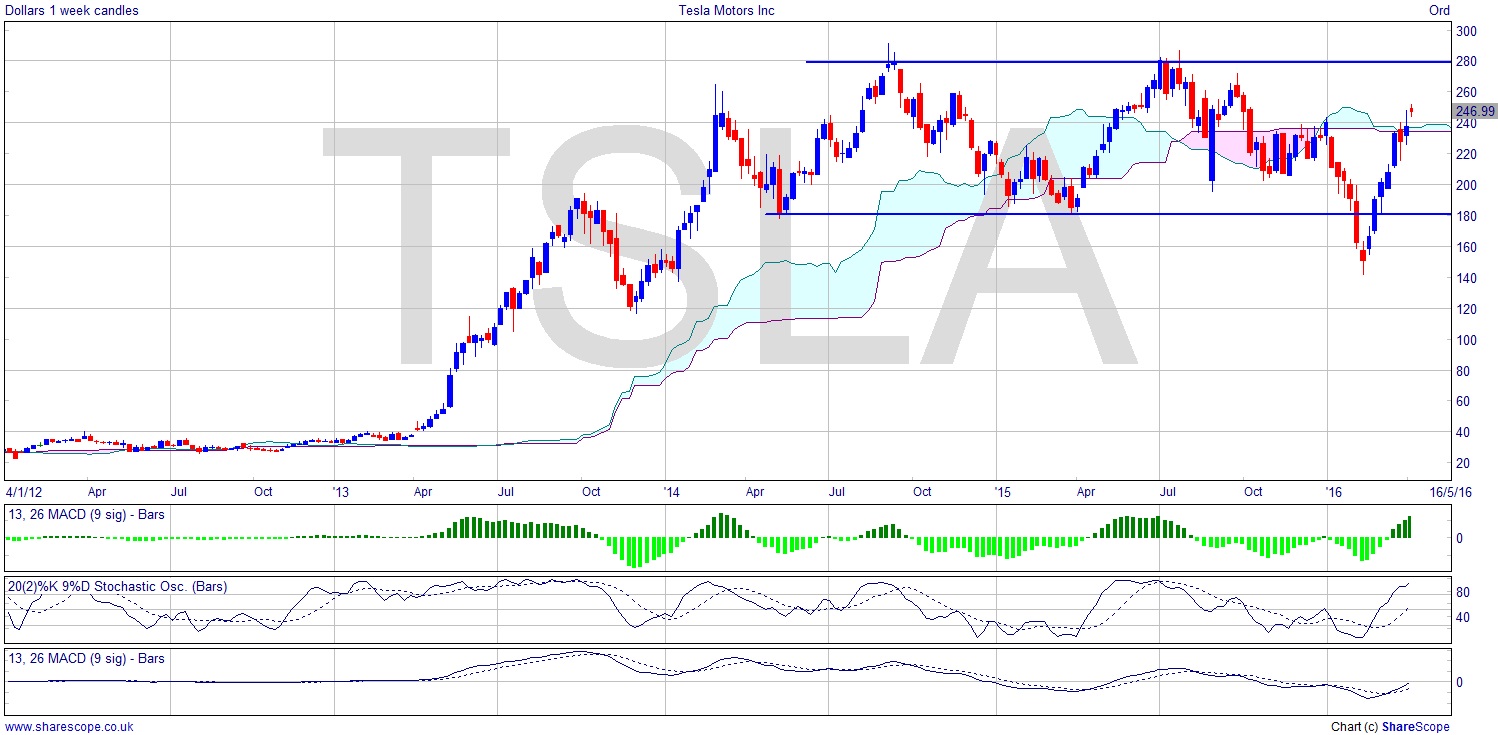

The question we now face is whether or not that is factored into the price. I say it can’t be. And even if it is, the Tesla chart still supports a potentially big move up. You can see on this weekly chart that in 2013 the price took a hike up and hasn’t really achieved a great deal since. OK, there could be a host of problems with the new Tesla. Product recalls and so forth. But that probably wouldn’t happen straight away, giving us a window even if things do go tits up.

There’s a quite clear range of price congestion since ’14 between about $180 and $280. The Yanks do like their really expensive shares. After a fakeout earlier this year when the price dropped below $180 we’ve seen a recovery, and there’s no better entry signal than a failed breakout. Having just moved above the cloud, we have an opportunity for early entry to the measured move upwards, which could see prices reach $420. In any case once it’s above the ATH just shy of $300 there is obviously no resistance above.

I wonder if Tesla might not become one of the new stars of the NASDAQ. This Model 3 is meant to be an affordable version allowing more regular people, as they call them in America, to enter the market. We have the luxury in this country that we can trade the price through a spread bet or CFD and not worry about currency at all. I wrote about Cable recently on the blog and you can determine from that whether you want to be exposed to the vagaries of uncertainty here one day, and uncertainty in the US the next, and so on. Either way, with the various tools we have at our disposal in the UK for trading, we can pretty much target risk with great accuracy.

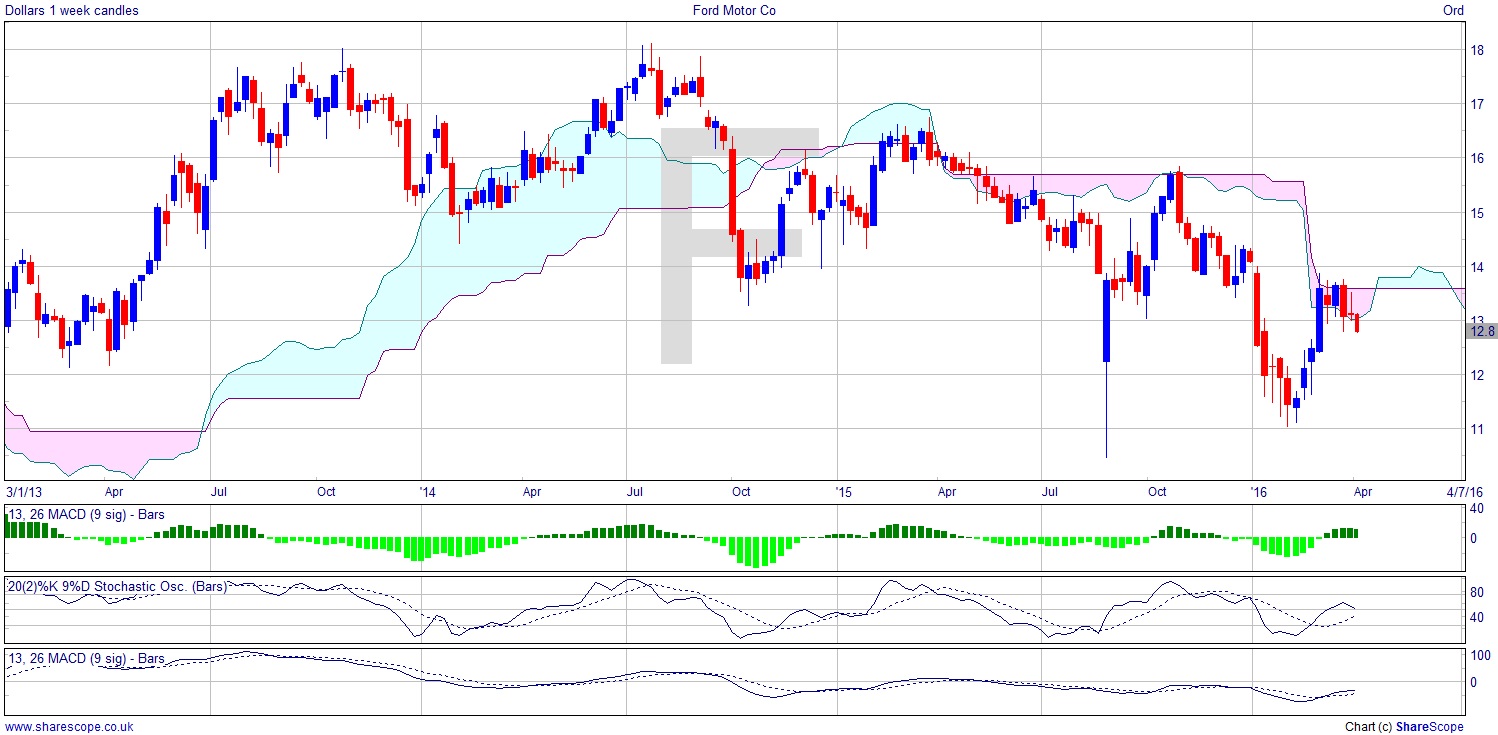

A classic way of hedging the Tesla trade though would be to go long Tesla and short Ford Motor Co (NYSE:F). That’s a pretty unhealthy looking chart, and you’d be trading the difference between the two, subject to beta. Sizing the two parts though may be awkward due to the massive differential in price, as Ford is only around $13. However that would eliminate any market risk and sector risk.

Comments (0)