Taking Stock

I’m moving soon so I’m having a bit of clean out. I think it’s far more tempting to keep financial stuff for years on end than most documents. If you’ve ever worked in corporate accounting, then there’s almost an unwritten rule to keep things for seven tax years. Actually for companies it is written! So I’ve tended to throw stuff out seven years after but for some reason keep all these old tip sheets and stuff like that.

I came across a folder with the Zurich Club written on the front. I took a trial in 1997. Interesting glancing through the monthly Communiques they used to send out by post. For younger readers, post is like email but often thought to be delivered by snails. Email certainly put the ‘go’ in ‘escargot’. One thing that caught my eye was their ‘Seven Super Star Stocks for Tomorrow’. Almost none of them exist any more, which tells you something straight away. To be fair ZC’s hands were tied to some extent, as it was quite difficult to short a majority of UK stocks for the private investor back then. So, inevitably they were only picking long positions, which is limiting at the best of times, and certainly doesn’t lend itself to anything more sophisticated than an educated punt for low cap stocks.

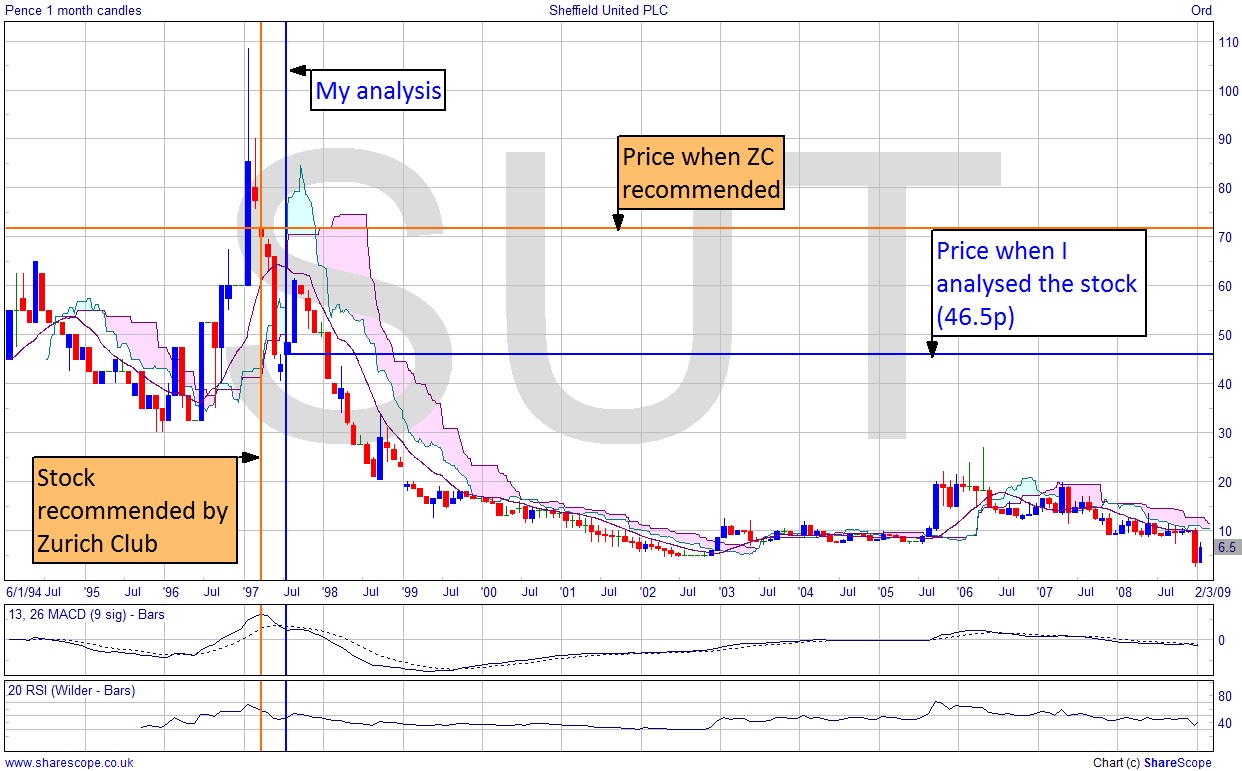

But what is interesting is that I’d made analytical notes on the sheet for each stock. One they recommended which is still trading was Sheffield United. Apparently, they were in Division 1 then and poised to move into the Premier League, according to ZC. They did get promoted (I know nothing about sport so this bit is from Wikipedia) in 2004 and even spent a season in the Premier League, but they’re back in Division 1 now (or whatever it’s called these days).

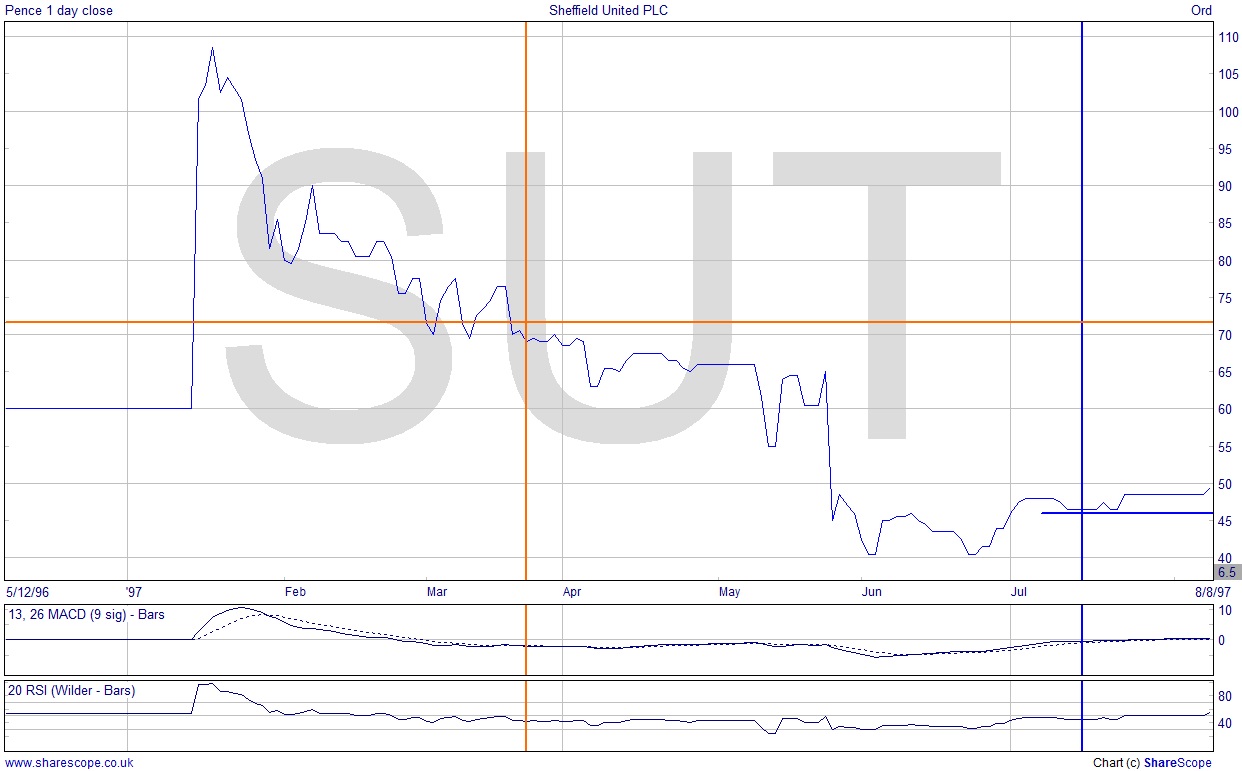

ZC’s ‘key facts’ were a share price of 55p, range of 55-111.5p and that was it. No entry price, target or anything like that. Simpler times they were! I noted that they had been 110p in Jan ’97 and when I analysed them in July ’97 they were at 46.5. People used to be quite happy with tipster hubris as a buying signal back then, and I wonder how many dived in without doing any TA, which was really called ‘Chartism’ back then and very much a fringe thing at the time. I noted “look for real signal”. There’s a daily chart of closing prices although I would have had HLC charts at the time. The orange lines cross at the price and rough date ZC made the recommendation, the blue when I analysed the stock.

It’s a good thing to see what you did in the past in order to know how right (or wrong) you’re getting it. I kept this stock on my watchlist for a while, and then dismissed it as a waste of space. What happened next? Did I miss out on a really good deal? Or was my analysis correct and I avoided losses by not taking someone else’s word for it and doing the work myself?

I think it’s fairly clear that it was not going to give the ‘real signal’ I was looking for. Apart from a fairly unremarkable flourish when Sheffield, aka the Blades (apparently), were promoted, it’s been a poor show for eighteen years now. The stock is as low as it’s been. If you’re really interested in making some money from Sheffield United then get a job selling pies on the terrace.

In the very first issue of Master Investor Magazine I wrote about owning your own trades in my Final Word column. This is a classic example of doing just that. What ever happened to the Zurich Club?

Comments (0)