Is Gold a Good Insurance Asset?

Unlike the foreign exchange markets, where traders expect their bets to move vividly when the Fed puts an extra comma on its policy statement; unlike the equity markets, where traders expect price panic when Merkel sneezes; unlike commodities markets, where traders expect Armageddon when rainfall increases by one drop per year; in the gold market, the Fed could print money uninterruptedly for an entire year and gold would retain its real value with steadfast loyalty. Precious metals in general and gold in particular have been marked by a wave of boredom; a zombified state under which price action is dull, no matter how strong the incentives for price movement are.

Price action and volatility are the most important ingredients of a market. With millions of traders interacting at each fraction of second by adding buy and sell orders in reaction to the flow of news, one expects the markets to move in the direction of those news and that move to suffer irregularities. That’s healthy! When that doesn’t happen, something is wrong and traders are ignoring fundamentals and hence contributing to a disconnect between prices and intrinsic values.

Discounting the expected future cash flows to come up with a single number that expresses the price of an asset isn’t an easy task, and thus it is one that encompasses a large degree of disagreement at every single moment. That is a very good justification for volatility. In the particular case of gold, it is difficult to identify the factors that affect the market and even when that is possible, it is difficult to give proper weights to each of the identified factors. Accordingly, gold prices show large volatility… But not anymore, it seems!

Just after the Lehman collapse, at a time the Fed cut its key interest rate and initiated an asset purchase programme aimed at increasing the stock of money in the US economy, gold started rising quite rapidly. With interest rates decreasing and expected to remain lower for longer, the opportunity cost of holding gold decreased. At the same time, with the US economy experiencing a financial calamity, gold seemed like a safe haven. But a few years later, at a time when the world economy is still not growing more than modestly and interest rates are still on a downtrend, gold has entered a bearish period. The yellow metal has declined 26.7% during the last three years while the S&P 500 has risen 51.7%.

On one hand, one could argue that with gold being a safe haven and with the S&P having performed so well, one should not be surprised with the decline of gold. A rise in the S&P 500 should reflect improved economic prospects and thus increase the odds of interest rate hikes and decrease the appeal of gold. Investors are by then willing to take on more risk and gold loses its appeal.

But, on the other hand, with many central banks around the world still printing money and many of them constantly delaying their first interest rate hikes, one wouldn’t expect equity indices to do so well or gold to do so bad. After all, many of the risks are still on the table, and with the stock of money rising faster than the supply of gold (mostly unchanged), the relative price of money in terms of gold should have decreased – that is the gold price should have risen. But the opposite has happened.

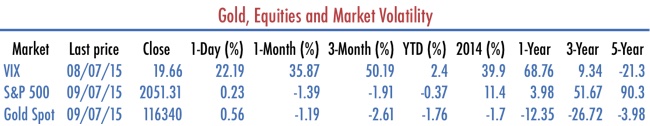

Another point one should make here concerns volatility. The VIX, or fear index as it is commonly referred to, should be negatively correlated with gold. When fear increases, the demand for risky assets decreases and demand moves in favour of safe havens, like gold. But that has not been the case.

The above table shows that volatility is rising. During the last three months, the VIX rose 50%. But, in the same period, the S&P 500 declined only 1.9% while gold also declined by 2.6%. In 2014, the increase in volatility was already noticeable with the VIX rising almost 40%. Still, gold declined 1.7%. For the last 365 days, the VIX is up 68.9% and gold is down 12.3%. Such a level of co-movement is not common. One would expect gold to be favoured by the increase in volatility, in particular because we know the latest geo-political developments have been particularly negative and have uncertain consequences for the future. The Greek debt crisis is one big example of this turmoil, which should have encouraged the gold trade.

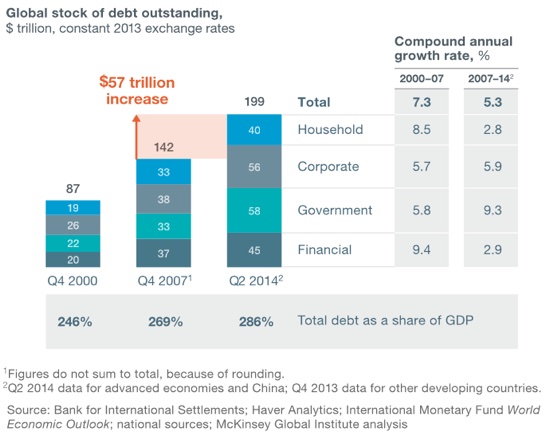

We can also look at the matter from another perspective: debt. One way or another, debt is a claim on future paper money payments. When debt is rising, there are only three ways of paying it. The first is the healthy way. If the level of economic output grows faster than debt, a country may very well pay the existing debt and reduce its level. Debt would have been directed to growth. The second is by repudiating the debt. When it comes the time to pay, a country just repudiates the debt and doesn’t pay it. The third is by printing money. Let’s say that growth happens to be less than expected. The only way to repay the existing debt is by printing more money. This means that when debt rises faster than GDP, the most likely consequence would be a rise in inflation through money printing.

A recent study by McKinsey shows that global debt has increased by $57 trillion since the Great Recession, outpacing world GDP growth. Total debt-to-GDP increased from 269% to 286%. While households have decreased the pace at which their debt is growing, corporations and governments are leveraging their initial positions. With government debt rising at a pace of 9.3% per year, one can only expect governments to either repudiate their debts or keep their money printers occupied for longer, which should favour gold.

The above reasoning doesn’t explain the current pattern gold is following. The metal has been losing value and is ever more confined to a narrow range. The evidence coming from physical precious metals markets creates even more noise, as demand has been increasing. An example of this is the announcement made by the US Mint just a few days ago that it was sold out of the American Eagle One silver coin.

With gold prices coming from the trade of futures on paper gold, where open interest is several dozen times higher than the physical gold available to honour those contracts, one could be forgiven for scratching one’s head. If everyone were to decide to take delivery (and provided that there is no gold available to honour it), the price could only boom… But that hasn’t happened so far.

Futures on gold are mostly used for speculation on price direction. Many believe this market is being manipulated to avoid a price rise. Many big banks hold short positions in COMEX gold futures that they claim are hedges for OTC long positions they own. Unfortunately that is impossible to know for sure, as there is a lack of regulation for OTC derivatives markets and financial regulators are unable to investigate the truthfulness (or lack thereof) of the claim. While it may seem like a conspiracy theory, there are reasons to believe something isn’t working properly in the gold market; hence traders should avoid it, at least as a traditional means of acquiring portfolio insurance.

HSBC, Goldman Sachs, Barclays and Deutsche Bank have all been sued in the past by investors and jewellers over claims they conspired to manipulate precious metals prices for years. It may be true, it may be false… one thing is sure: gold lost its usual traction.

Comments (0)