Sovereign Mines of Africa (SMA): Bull flag points towards 1.2p

Focusing on the overall chart pattern can very often be the best way forward with regard to volatile small caps such as Sovereign Mines of Africa.

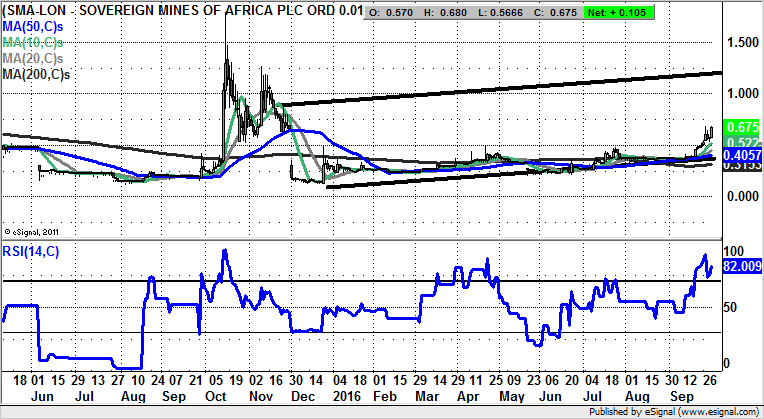

Sovereign Mines of Africa (SMA): Bull flag above previous resistance points towards 1.2p

While it may be something of an exaggeration to suggest that in terms of the price action Sovereign Mines of Africa has been something of a nightmare, it’s not that much of an exaggeration. The evidence is on the daily chart in the form of the sharp spike and decline for the shares in the autumn of last year. This kind of white knuckle ride is something which you only see in the most volatile of situations, but it may be true to say that once a shakeout of this variety is finally in the rear view mirror it is very often the case that an element of stability does return. Evidence for such a statement comes from the progress within a rising trend channel which can be drawn in from as long ago as December. The big breakthrough in recent sessions and the reason for all the relative excitement is not only the push above neckline resistance at 0.5p, but also the way a bull flag has formed above this resistance. The view now is that provided there is no break back below the 0.5p level the upside here could be as great as the late 2015 price channel top of 1.2p over the next 1-2 months.

Comments (0)