Something for the Weekend – German Economic Decline

I have a lot of ideas for pieces, and in many cases they don’t turn into full articles, and get buried in digital dust. I came across this next paragraph of an idea the other day. I quite like it but never fleshed it out and the moment has gone to some extent perhaps.

Scotland is the root of all evil. It’s not obviously. And what is evil anyway? One man’s evil is a dyslexic’s live. The point is had Scotland voted for independence, far from creating a separatist environment it would have created a devolutionist environment. Smaller subdivisions within the greater whole. Calabria would probably have succeeded in independence, yet still part of a greater whole. What Brexit has done is precisely to create a separatist environment. Fragmentation is the way forward. But it is, and will be, only political fragmentation. Trade won’t fragment.

If the growth years of the EEC and then EU, i.e. the 70s to the noughties, were about finding common ground between European nations, then this next generation is presumably about finding the differences. Bizarrely the thing that ails Europe so much today is failed integration in multicultural societies, the one thing we most have in common.

So whilst the zeitgeist is now separatism, if not isolationism, trade nonetheless rules. Germany is seeing a decline in industrial output and a huge year on year drop of 10% in exports. Is that down to Brexit? That would only make sense inasmuch as the pound is weaker and we are one of the main German export markets. But I already showed that a weaker pound and other phenomena attributed to Brexit were in fact continuing trends and long overdue correction in my Final Word piece in August’s Master Investor Magazine. Perhaps Carney deliberately lowered interest rates to help force the Germans into giving us a favourable trade deal post Article 50. It seems this was hardly necessary.

All of this points to a contraction in the German economy, hardly surprising as they’re stumping up loads of money for their flawed decision to allow migrants to settle in Germany, effectively sentencing them to work as black market slave labour (thousands have gone off the radar already, more to follow).

Merkel has surely already lost the election next year, and like most European countries now, they are likely to be dressing to the right rather than the left.

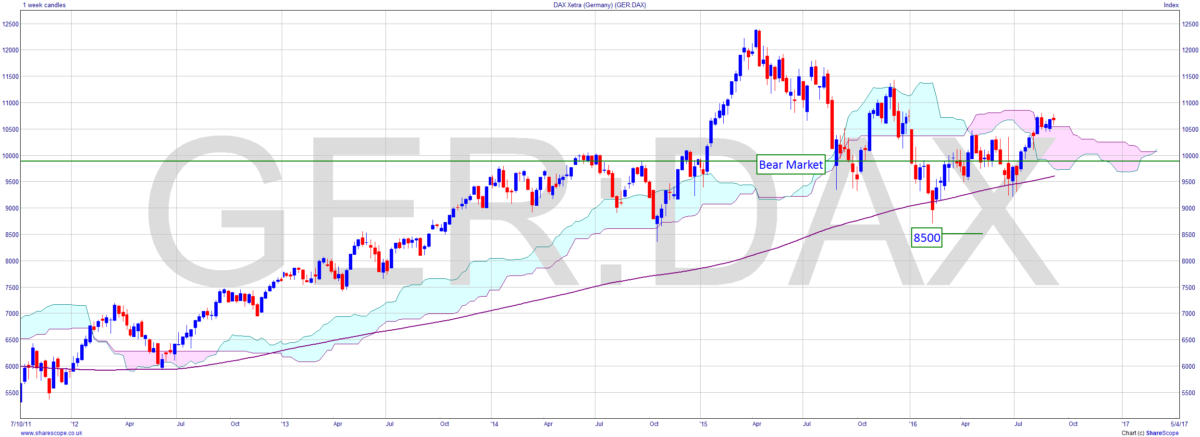

So what about the DAX then?

Well we can see that on the weekly chart it’s popping up out of the cloud, which is quite bullish. However it’s still a few lower highs away from the ATH of last year. There’s a reverse head and shoulders there over the last 12 months, again a bullish signal. But with a backdrop of falling exports and productivity I don’t particularly like them apples. So it’s a bit of a mixed signal, and like many stocks at the moment not one we can dive into. But it is a huge watchlist candidate. It’s been dipping in and out of Bear Market territory. But markets can’t genuinely flourish without economic activity. And that doesn’t appear to be in evidence. GDP and such indicators are leading. Usually by around six months. So we can reasonably expect, whatever happens in the meantime, for the market to be falling at in spring ‘17. If these economic numbers continue a downward trend then it’s all over bar the shouting.

Deutschland, Deutschland, über alles, alles, alles, who the fuck is alles?

Comments (0)