Should you take heed of RBS’s market warning?

RBS has issued a warning that the coming year is not about return on capital, but return of capital. Should you listen to a bank that so monumentally cocked up that they are now really Royal Bank of England, having been bailed out by the government? There were very serious errors of judgement as they failed to control risk back before the credit crisis. BBC Scotland made a fascinating documentary about the massive failings at RBS.

The problem with a really long bull market, as I’ve said before, is that everyone now has a prediction of when and how it will fail, and of course someone will be spot on, and probably be right for the wrong reason. It starts to get like monkeys and typewriters, although I imagine they’ve been quite busy writing the Top 40, the new Star Wars movie, and getting quite upset that Animal Rights Group lost the copyright case over the monkey photo, creating a legal precedent that monkeys have no rights after all.

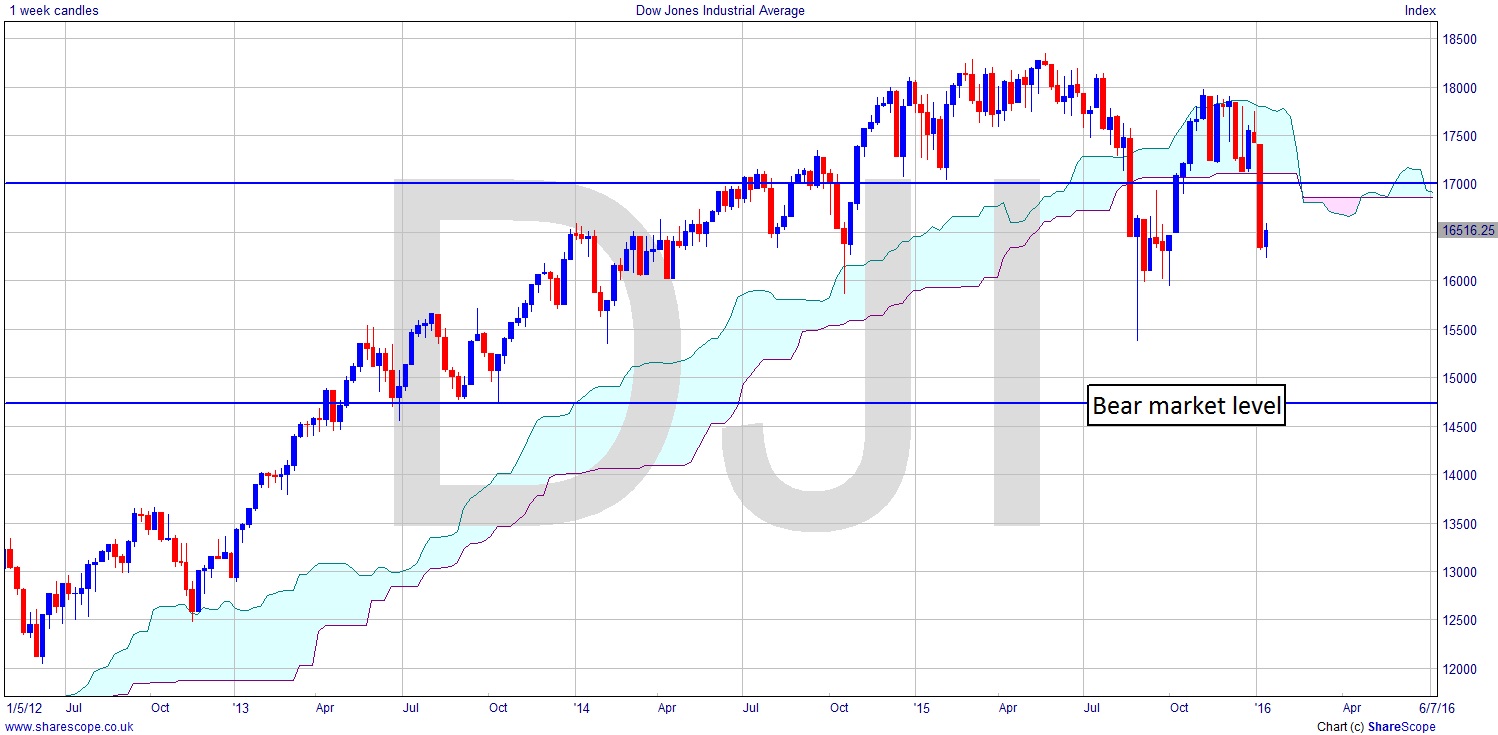

The Dow Jones is so far off a bear market at the moment that we would need to see some decent downside for the bull market to end. It has more than another 11% to fall before it touches the level required for a technical bull market – 80% of the bull market high. Of course it’s possible, but the reasons why the market is where it is, and the issues it faces, are more useful than scare-mongering. In any case we should be completely calm in trading at all times, and RBS sounds more neurotic than a Woody Allen film character.

This whole bull market is based on a number of unusual elements. We’ve had an enormous amount of QE at the beginning of the market, both here in Europe and in the US. That immediately results in the market having to rise simply to correct its value relative to the extra money floating around. We’ve also had very low interest rates, but at the same time a real inflation rate which is higher than the headline rates published by the statistical departments of governments. Companies have been maintaining dividends without justifiable profits more recently, and the whole shebang is based on numbers and bits of paper, not real growth underpinning the rise in the market.

So, whilst some companies are doing well, the market level is really a false reflection of the growth of the economy. I say growth, but really if real inflation has been running even just a bit higher than the published figures, then we have been in technical recession ever since 2008. The latter is rather more accurate. So with the markets valued on no real growth it’s not a big surprise if they are a bit wobbly. After all, markets fall because they’re over-priced.

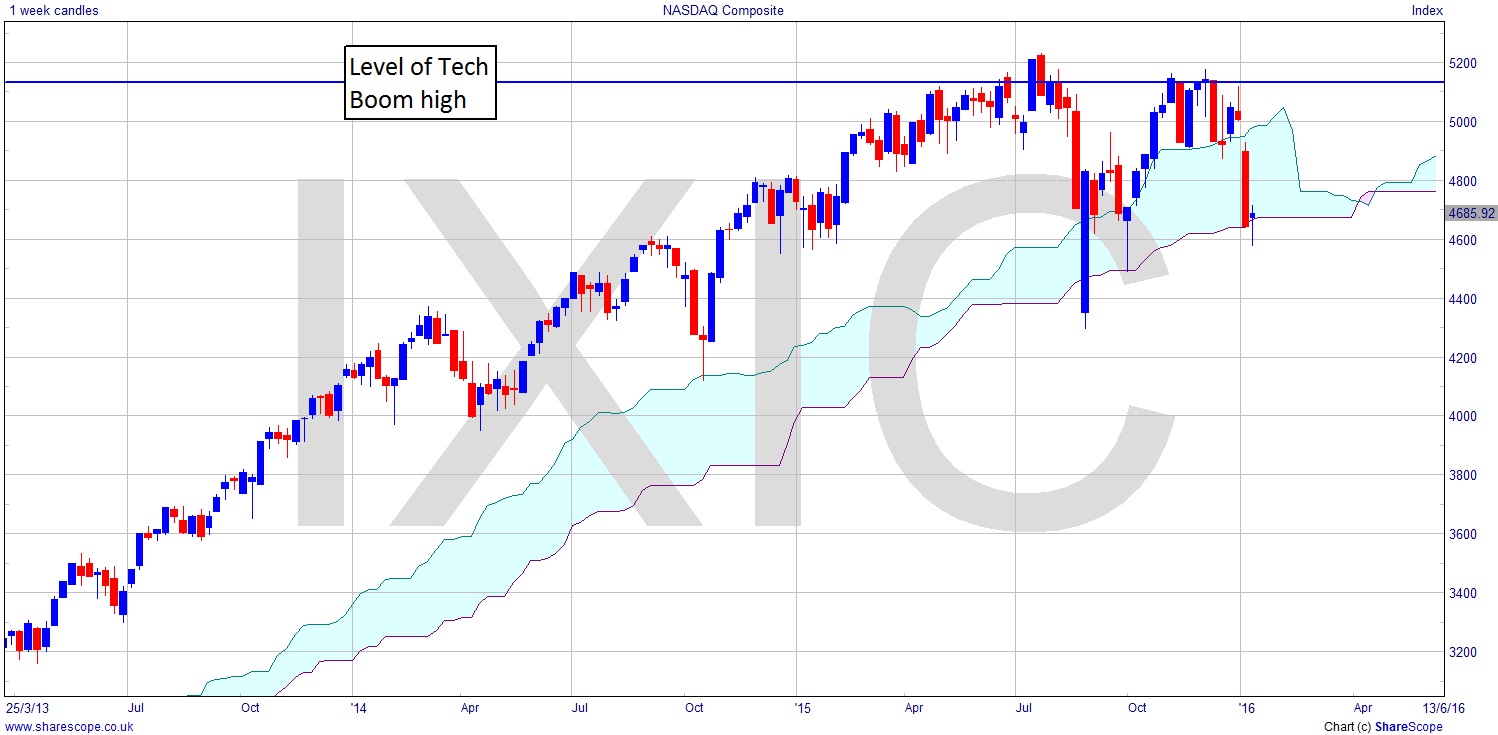

More interesting than the H+S on the Dow which I’ve looked at before, I go once again to the NASDAQ, which is the leading indicator in the US, due to the nature of the tech stocks it is largely comprised of being asset light and expectation high. The NASDAQ has indeed started to look less attractive since I wrote about it on 22nd Dec last.

You can see on the weekly chart here that it’s only just holding onto the bottom of that cloud, and what happens now on this chart will most likely dictate how the year will play out. Compare with the Dow, which still has a way to fall before we see any real change. That low last autumn is over 1,000 points below its current price. I’ll be keeping the NASDAQ at the top of my list for now.

Some might say that it’s a bit irresponsible of RBS to issue such a warning. Game theory will play out here. If they say something, then it will have an effect on everyone else, and move the very goalposts they were basing their missive on. If the big investment banks, like Goldman and suchlike, think that RBS don’t know what they’re doing, then they’ll just sit tight and wait for prices to fall and buy cheap. Or maybe they’ll agree with RBS simply to make prices fall even further so they can buy cheap. We know that ratings agencies have in the past been reticent to downgrade good customers, thus making their work useless. Now we have an investment bank making a recommendation, it’s hard to imagine they don’t have an agenda.

Comments (0)