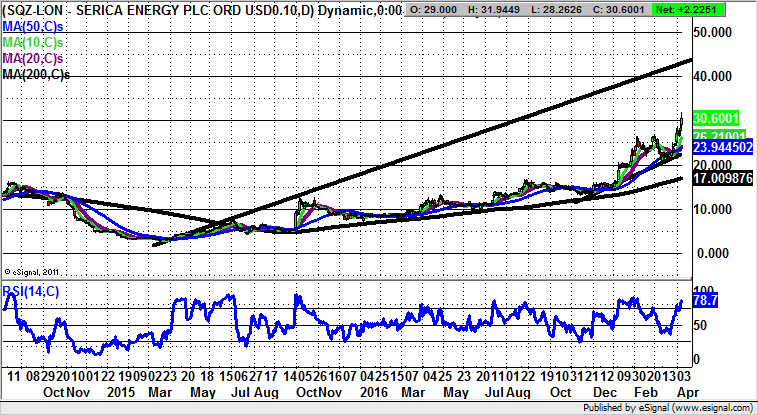

Serica Energy: Technical target up to 45p from 35p

Serica Energy has been on the radar as a “special” North Sea exploration minnow, with the big USP being its cash pile.

Sometimes the technicals and fundamentals of a company appear to exist totally separately. Even in the most technical of situations – with say, a deeply embedded uptrend or downtrend, there is generally a nod to trading updates, and of course any other surprise announcement. In the case of North Sea focused Serica Energy (SQZ) it is clear there has been a logjam of expectation in recent weeks and months, with the share price dithering in the low 20p ranges.

This hiatus looks to have been ended by the revelations this week from the company’s 2016 results. Those who are fans of cashflow will have been delighted to learn than money in the bank is set to rise from $13m up to nearly $26m by the end of this quarter. This is clearly a massive jump, and all things being equal should allow the shares to head significantly higher – a process already underway.

In terms of what the scenario may be, initial March resistance at 27p looks set to become support as the break higher occurs. The favoured destination here on the upside is seen as being towards 45p, which is the top of a rising trend channel that can be drawn on the daily chart from as long ago as Q1 2015. At the current rate of progression one would be looking for the stock to hit its expected destination as soon as the next 1 – 2 months.

Comments (0)