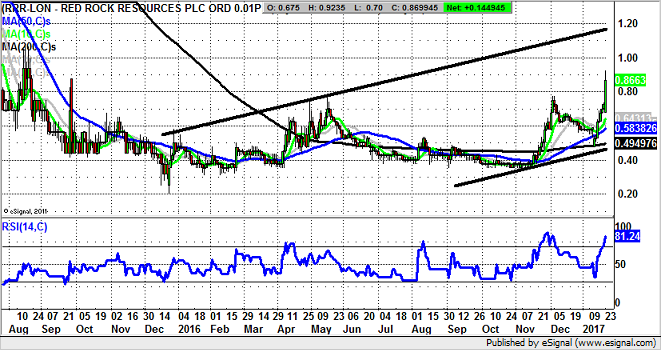

Red Rock Resources: Upside now towards 1.2p

I have had a long standing technical target of 1.1p on Red Rock Resources (LON:RRR). The latest newsflow makes this appear all the more realistic near term.

Having fully nailed down the name of the Executive Chairman of Red Rock Resources really seems to have helped out on the technical analysis of the stock for some reason! What is also interesting from Andrew Bell’s company today is the way we have been treated to double newsflow this morning.

The first snippet regarded Australian group Jupiter Mines, where details of its planned $55m distribution were revealed. Here the share to Red Rock Resources is to amount to some $655,000. Perhaps even better is the way that the buyback value of Red Rock’s holding is £8.83m versus the current book value of £1.5m. Needless to say, this is rather good news.

The other news of the day which was perhaps not quite so uplifting was that Red Rock is to go for arbitration regarding the El Limon gold assets sale in Columbia. But nevertheless, this company is one of the dishes of the day as far as the small caps arena is concerned.

What can be seen on the daily chart is the way there has been an acceleration to the upside in the wake of the recent rebound off the 200 day moving average, now at 0.49p. The expected destination over the next 1-2 months is as high as the top of a rising trend channel from December 2015 with its resistance line projection pointing as high as 1.2p.

Comments (0)