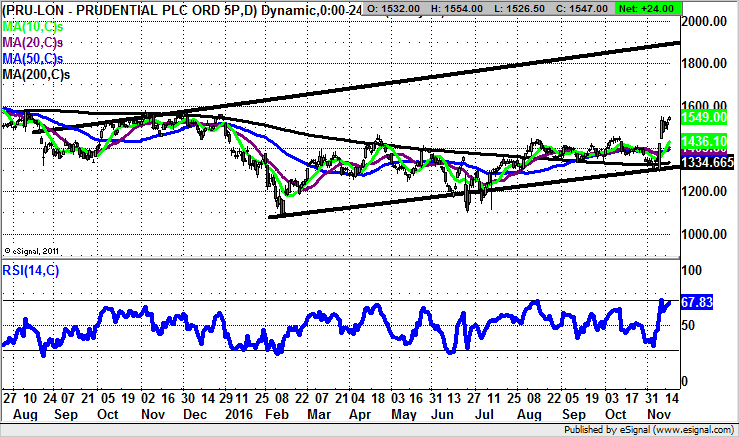

Prudential: Strong gap/flag combination targets 1,900p

I have to admit that Prudential (LON:PRU) does not tend to be the most exciting of companies on the stock market. But as many experienced investors will be aware, it is usually the “boring” companies which are the ones to back. One of the highlights of the stock market since the election of Donald Trump as US President has been the way traders and investors are scrambling to take the appropriate response. This has led to rather strange charting configurations, and sharp, volatile movements.

A good example of this comes from Prudential, where the insurer is trading in the wake of the latest nine months’ business update. Here we have been treated to a rise in Asia business by 34%, which is quite an achievement given the headwinds alleged to be blowing around the region, particularly in China. But it would appear the company is confident enough to raise its dividend, and do so by 5% a year from now on. This will clearly be a big positive for those looking to chase the stock higher over the near term.

Just why they may do so is suggested by the current configuration of the daily chart, where there has been an as yet unfilled gap to the upside into a bull flag. This should lead the shares – after the breakout eventually arrives – to the top of a rising trend channel from this time last year at 1,900p. The target is valid while there is no break back below the present position of the 10 day moving average at 1,436p.

Comments (0)