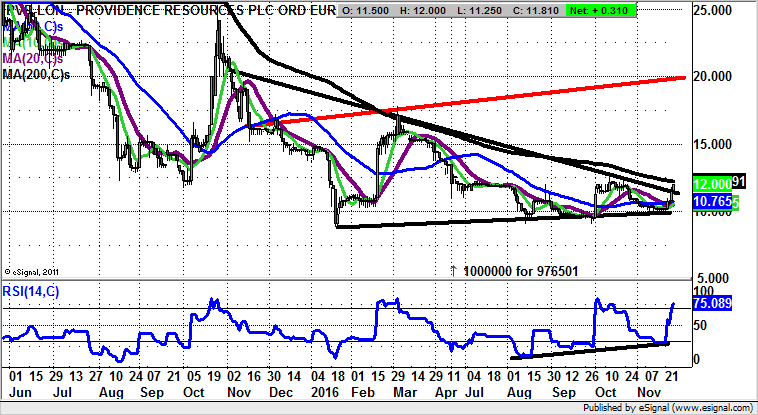

Providence Resources: Triangle break targets 20p plus

There is nothing as frustrating, but ultimately rewarding, as calling the end of an extended bear run in a small cap stock. Providence Resources (LON:PVR) is the situation where we may finally see a decent rally.

It has been a long wait for fans of Providence Resources, and one which may have felt all the longer given the way the stock has fallen heavily from the “glory day” when it was trading well above 100p just two years ago.

On the fundamental front though, everything hinges on the prospect of the company announcing it has found a drilling contractor to get started off the West coast of Ireland in June. This may feel like there is going to be a long wait, but it can be seen how there has been a technical breakthrough on the daily chart.

It has come in the form of a break of the big triangle formation which can be drawn in from as long ago as this time last year. The resistance line of this triangle runs at 11p, with the message at the moment being that in the wake of a likely weekly close above this level we could be treated to a relatively powerful move higher.

Just how high the stock could fly is currently suggested by the red resistance line projection heading for 20p plus. The hope now is that we could see 20p over the next 1-2 months – well before the drilling gets started. At this stage only well below the floor of the triangle at 10p on a weekly close would upset the turnaround argument.

Comments (0)