Is the pound freefalling towards parity with U.S Dollar?

After today’s post-Brexit vote low for the Pound, it’s time for all the talking heads and financial journalists to describe the horrors of a weak currency. It is a pity the media is not exactly heavily populated by those who know what they are talking about, or are allowed to speak their mind…

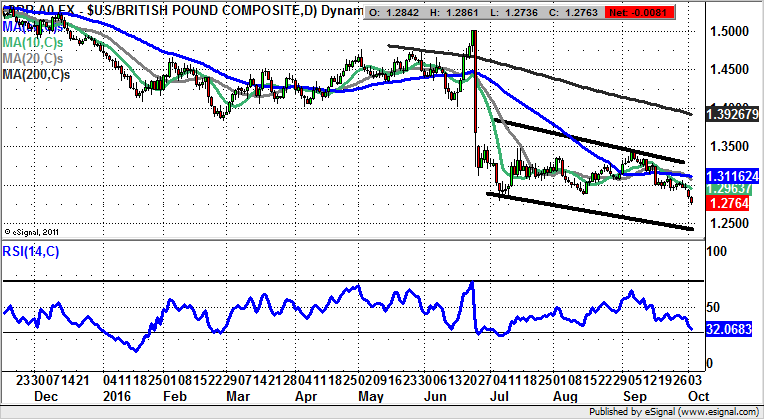

Sterling / Dollar: A Freefall Below $1.25?

One of the best outcomes since the end of June is that we are starting to see how life would have been had we never entered the European Economic Community in the 1970s. This by itself was of course a good idea, it was just the “ever closer union” and the free movement of people which did not work. With the FTSE 100 now heading for its highest ever level and Sterling falling to a 31 year low we find that the negatives of being in what is now the EU is that it has depressed the stock market by perhaps as much as 20% or even more, and caused Sterling to be overvalued. We are now faced with a question: what should our currency really be? Judging by the trajectory on the daily chart it would appear that the post Brexit decline and consolidation is merely a half way house to a larger decline. While we will only really know if the cross falls below the floor of a falling trend channel from July at $1.25, the risk is the fall from $1.50 to $1.28 could then be followed by a measured move down from say, $1.35 to sub $1.05. This may sound like an exaggeration or scaremongering. But a weekly close below the $1.2798 July floor could set the wheels in motion for a freefall towards parity. At this stage only a swift rebound back over $1.30 would really negate the downside scenario.

Comments (0)