Oxford Pharmascience: Break of 50 day line points towards 3p

Given that both my parents are doctors, I of course feel fully qualified to discuss the investment proposition at Oxford Pharmascience Group (LON:OXP).

I have a memory like a sieve when it comes to almost all fields of human endeavour (chart patterns are an exception), so it seems appropriate to write up my views in the wake of speaking to Marcelo Bravo, the founder and CEO of Oxford Pharmascience Group. Continuing on the theme of memory loss I would like to offer up the final fact Mr Bravo revealed in the interview, which centred on having some £22m in cash, versus a market capitalisation of around £23m.

This may sound like a rather stingy valuation, as well as not exactly giving the benefit of the doubt to the group’s mission to improve existing drugs and then make money by licensing the results. But at the same time in what is an asymmetric proposition, it would only take, let us say, one successful modification/improvement to an existing OTC drug to generate significant income.

Rather helpfully to the bull argument, the company is already in the process of interacting with the all important FDA in the US, so hopefully 2017 will be a breakthrough year for Oxford Pharmascience. Of particular note are the improved versions of Ibuprofen and Ketorolac.

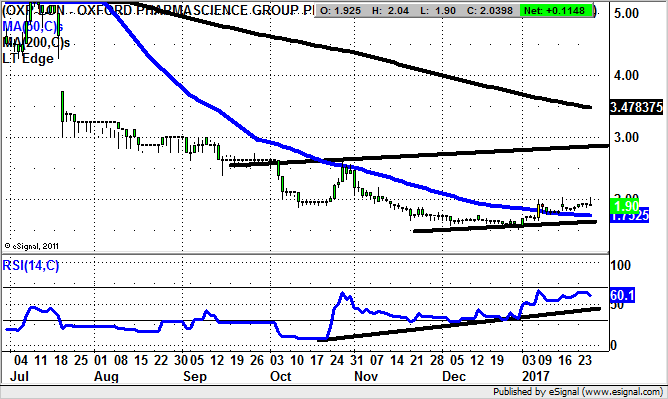

In terms of the charting position, on the daily timeframe the shares have broken – and have held above – the 50 day moving average at 1.75p. The hope now is that as little as a weekly close above near-term 2p resistance could lead as high as the main post-August resistance at 3p over the following 1-2 months.

Oxford Pharmascience

Zak, given that both your parents are doctors, you clearly failed to do the most obvious piece of due diligence. Did you ask them if there was a need for a new version of ibuprofen or the other pain killers? Given that millions of these tablets are taken daily around the world at 3p a tablet (in Boots/Sainsbury etc) suggests there is no need. OXP is barking up a tree. You should be asking yourself how much of the £22m the management will ‘p’ away before they realise this. Whichever broker brought this to market should be shot – wrong product, wrong strategy, grossly overvalued. In the last 20 years how many pharma product ‘life cycle extension’ companies have made any money for investors. Answer: None